(Bloomberg) -- Japanese stocks rallied after their plunge into a bear market during the previous day's trading brought them down to key technical levels.

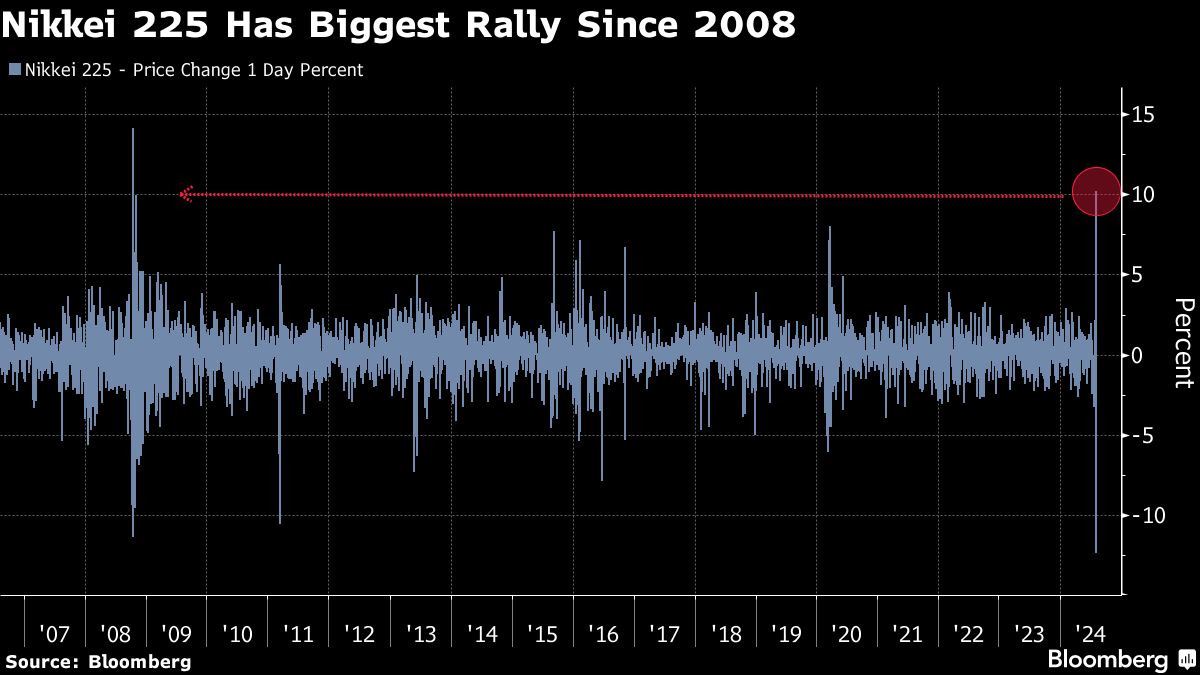

The Nikkei 225 Stock Average and Topix rebounded more than 9%, the most since October 2008, as exporters such as tech companies and automakers surged after the yen slumped about 1% against the dollar.

Banks gained 3.9%, with yields on 10-year government bonds jumping 14 basis points as a debt auction met the weakest demand since 2003. All 33 of the Topix's industry gauges climbed.

Whipsaw moves set off a circuit breaker for Nikkei futures, while the gauge's implied volatility pulled back from its highest level since 2008. Benchmarks tumbled 12% on Monday in a broad flight from risk amid a stronger yen, tighter monetary policy and concern over the US economy's outlook.

“Panic selling may have run its course,” said Hideyuki Ishiguro, chief strategist at Nomura Asset Management Co. “Still, price movements today will probably be like a roller coaster ride because of rising anxiety in the global market.”

Yesterday's selloff drove Japan's key share indexes down more than 20% from their record highs hit last month, pulling them into a bear market. Officials from Japan's Ministry of Finance, the Bank of Japan and the Financial Services Agency were scheduled to hold a three-way meeting to discuss international markets, according to a notice from the BOJ.

Charts signaled the market was ripe for a rebound. The Toraku ratio — which tracks the proportion of stocks that rose and fell over the past 25 days — has fallen to its lowest since October 2023 and is approaching the level of 70 that some traders take as a turnaround signal.

“We're not seeing a risk-on rally as such, but a healthy correction after an unhealthy selloff, triggered by investors stampeding for a tiny exit,” said Matt Simpson, a senior market strategist at City Index Inc.

A stronger-than-expected July ISM services figure in the US on Monday may have offered “some calm amid hard landing jitters,” said Jun Rong Yeap, a market strategist at IG Asia Pte. Speculation about a looming US recession was partly behind the three-day rout in global equity markets.

But even with the recent rebound, Japanese stocks will likely stay at bear market levels in the short term as investors remain on edge.

“As the magnitude of the drop in Japanese stocks yesterday turned out to be much more than Europe and the US, market participants now recognize that the correction was excessive,” said Tomo Kinoshita, global market strategist at Invesco Asset Management Japan. “However, this does not mean that the market correction is over. Weak economic indicators in the US could still bring further selloff in the US and the rest of the world, including Asia.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.