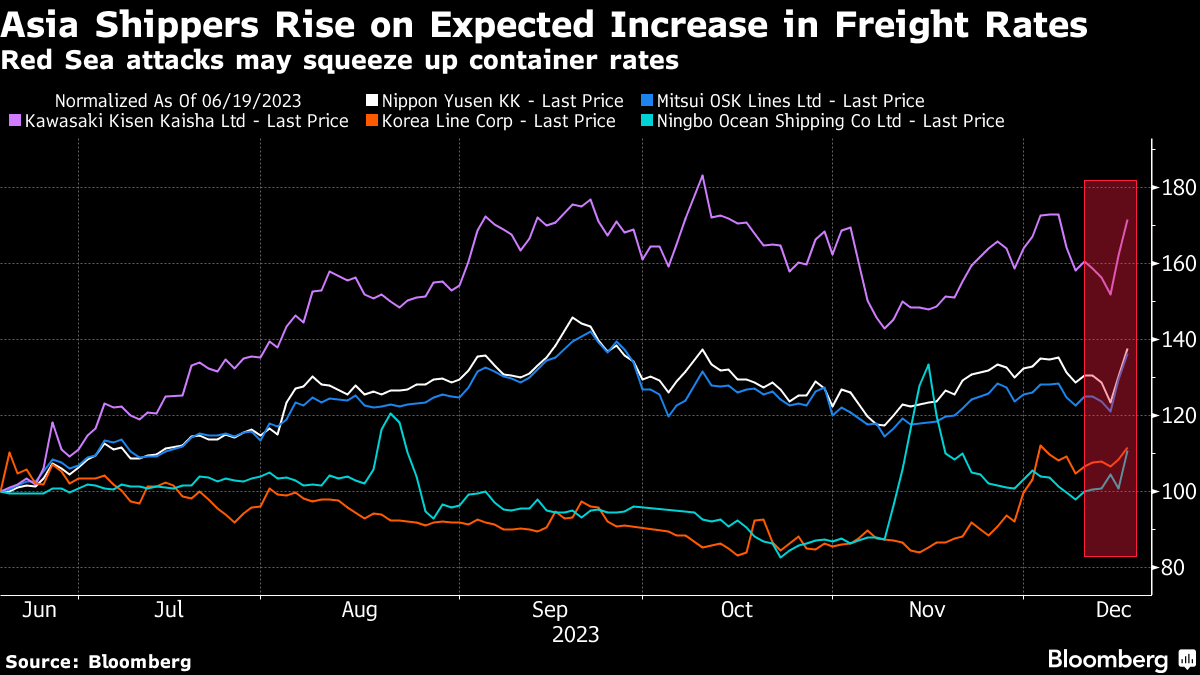

(Bloomberg) -- Shipping stocks in Asia soared on expectations that disruptions to Red Sea routes due to militant attacks will push up freight rates.

A gauge of Japan's shippers rose as much as 5.8%, the only industry sector that gained while the broader Topix Index fell 1.6%. South Korea's Korea Line Corp. and China's Ningbo Ocean Shipping Co. both rose as much as 10%.

The threats to shippers around Egypt's Suez Canal may pressure freight rates from Asia to Europe or to the US East Coast as ships take alternative, longer routes, according to Bloomberg Intelligence senior analyst Lee Klaskow. If all trades via Suez are re-routed, there will be about a 6% effective supply reduction in the container industry on an annualized basis, Citigroup Inc. analysts including Kaseedit Choonnawat estimated in a report.

“Given ships need to detour and the news would raise freight rates, it is positive to shipping stocks,” said Shawn Oh, an equity trader at NH Investment & Securities Co. in Seoul.

Nippon Yusen KK was the top performer in Japan's Topix index as it rose as much as 6.6%, the most in five months, while its peers Mitsui OSK Lines Ltd. gained 5.6% and Kawasaki Kisen Kaisha Ltd. advanced 6.5%. In China, firms including Nanjing Tanker Corp., China Merchants Energy Shipping Co. and Cosco Shipping Energy Transportation Co. all rose 8% or more at their peak on Monday.

A.P. Moller-Maersk A/S, the world's second-largest owner of container ships, told its vessels in the Red Sea area to pause their journeys, following recent attacks on merchant ships by Houthi militants off the coast of Yemen.

Re-routing Suez transits for Asia-Europe trades to around Cape of Good Hope would add 10 to 14 days of travel, the Citi analysts wrote.

The alternative routes would help absorb shippers' excess capacity, which is expected to rise through 2025, according to BI's Klaskow.

--With assistance from Naoto Hosoda and Kelly Li.

(Adds Bloomberg Intelligence and Citigroup analysis from third paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.