(Bloomberg) -- Japanese sovereign bond yields are surging to the highest levels in more than a decade amid signs the central bank is ready to reduce debt purchases to ease pressure on the ailing yen.

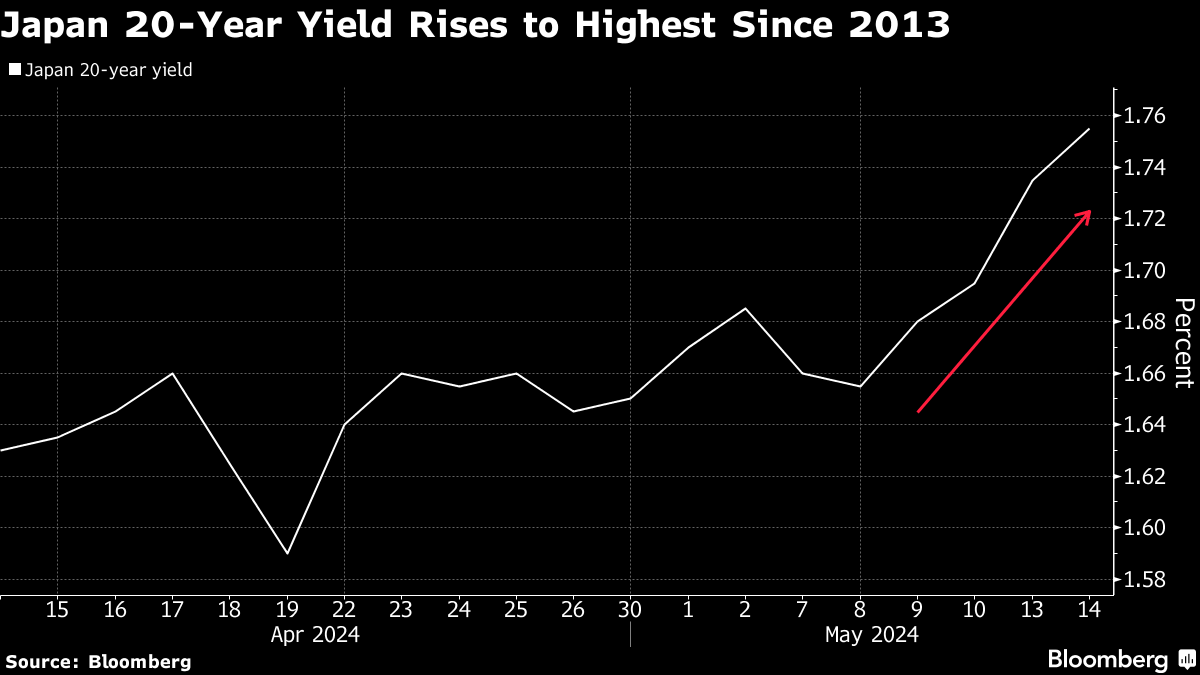

The yield 20-year sovereign debt rose 3.5 basis points to 1.77%, the most since 2013, while that on 30-year bonds reached its highest since at least 2011. The benchmark 10-year Japanese government bond yield increased two basis points to 0.96%, just shy of the peak level in more than a decade.

The Bank of Japan on Monday offered to buy a smaller amount of bonds, raising speculation it will accelerate the pace of monetary policy normalization to support the currency. This turns the focus to an auction of five-year notes today for more signs of rising yields.

“There's uncertainty in the market about whether yesterday's cut in the bond-buying amount was a one-off,” said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management Co. “The amount could be decreased at any time, and as early as Friday, which puts upward pressure on yields.”

Japanese bond yields have been pushed upward by rising US yields and lingering speculation the central bank will deliver an additional interest-rate hike sooner rather than later. The wide yield gap between Japan and the rest of the world, especially the US, has been fueling the yen's depreciation.

The yen weakened slightly to 156.45 against the dollar, falling for a third straight day.

Read more: BOJ Cuts Bond Buying in Regular Operation as Yen Stays Weak

--With assistance from Naoto Hosoda.

(Updates with quote in fourth paragraph, yen reaction in sixth paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.