Shares of ITC Ltd. fell during early trade on Friday after its profit missed analysts' estimates. The standalone net profit of India's largest cigarette maker stood at Rs 4,917 crore in the quarter-ended June, as against Rs 4,903 crore a year ago, according to an exchange filing. That compares to the Rs 5,160 crore consensus estimate of analysts tracked by Bloomberg.

ITC's performance was impacted by paperboards and the fast-moving consumer goods business, despite a challenging macroeconomic environment and high competitive intensity in certain categories. Private consumption expenditure remains relatively subdued, the company said.

Although ITC's cigarette revenue was in line with expectations and profitability was ahead of estimates, the drag on net profitability was led by weakness in its agribusiness, Citi Research said.

ITC Q1 Results: Key Highlights (Standalone, YoY)

Revenue up 7.2% to Rs 17,000 crore. (Bloomberg estimate: Rs 17,158 crore).

Ebitda up 0.7% to Rs 6,295 crore. (Bloomberg estimate: Rs 6,497.37 crore).

Margin at 37% versus 39.5% (Bloomberg estimate: 38%).

Net profit rose 0.28% to Rs 4,917 crore. (Bloomberg estimate: Rs 5,160 crore)

Here's a look at what brokerages had to say on ITC's first-quarter Results:

Citi On ITC

The brokerage maintained 'buy' with a target price of Rs 515 per share, implying an upside of 4% from the previous close.

ITC reported a mixed performance in the first quarter, with headline margins missing estimates.

Gradual volume recovery in cigarettes.

Growth acceleration in other FMCGs is expected.

Rural demand trends are improving, given moderate inflation.

Better terms of trade for farmers and expectations of a normal monsoon to aid growth.

Peg ITC at ~20–25% premium to the stock's last 5-year historical trading averages.

Believes the reasonable low double-digit earnings growth, similar to peers, justifies the valuations.

Emkay On ITC

Emkay retains 'add' with a target price of Rs 520 per share, implying a 5% upside from the previous close.

Expect the stock to stay rangebound.

A steady cigarette tax setting bodes well for legal industry volume recovery.

Sees ITC's businesses align well with economic growth.

The brokerage awaits the next leaf tobacco cycle and the cyclical recovery in other businesses.

Leaf tobacco inflation is likely to have a higher impact in the coming quarters.

Lifts valuation from 18 times to 20 times.

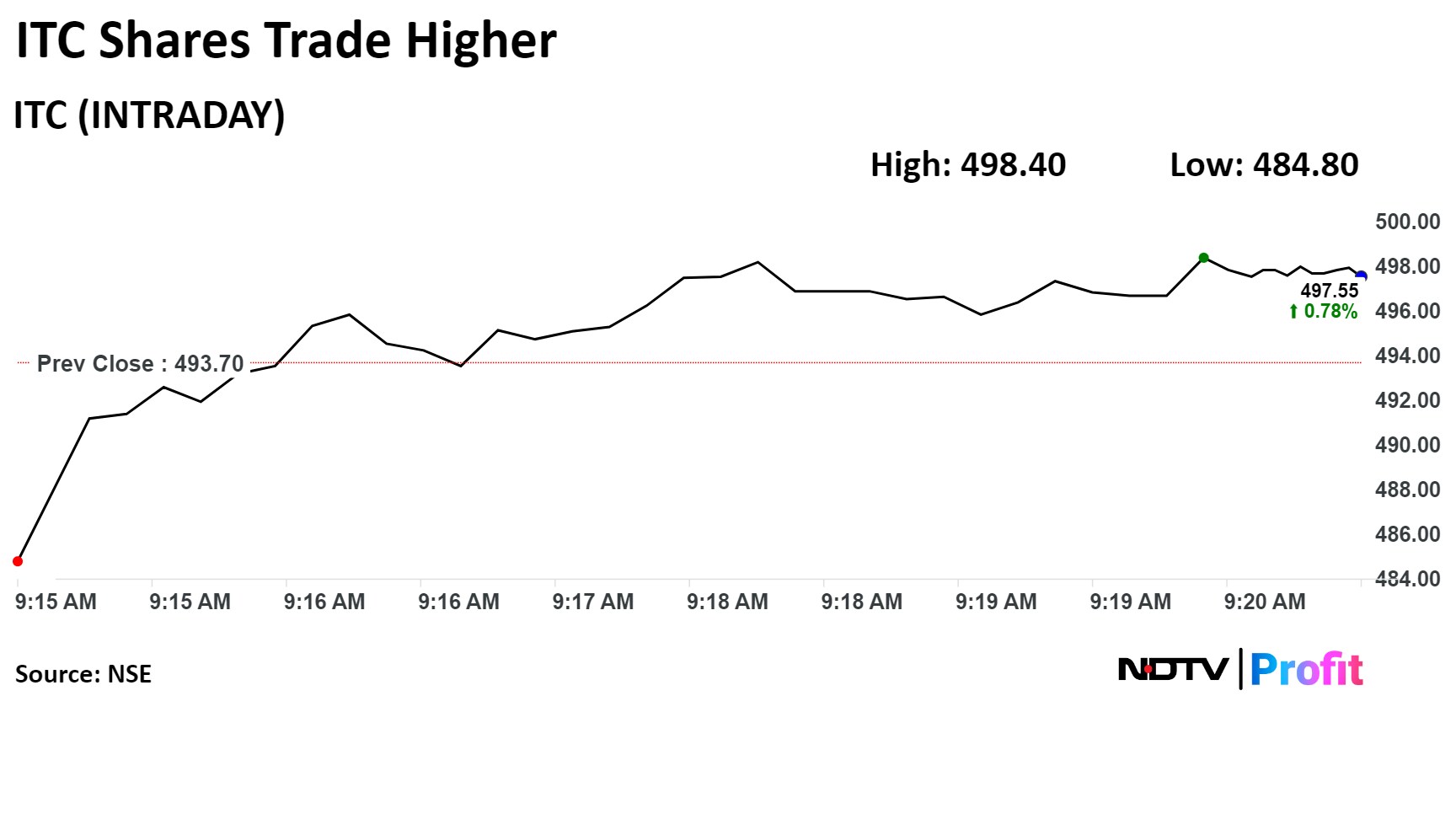

Shares of ITC fell as much as 1.80% during the day to Rs 484.80 apiece on the NSE. It was trading 0.03% higher at Rs 493.85 apiece, compared to an 0.79% decline in the benchmark Nifty 50 as of 09:35 a.m.

The stock has risen 8.07% in the last 12 months and 7.77% on a year-to-date basis. The total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 69.40.

Thirty five out of the 39 analysts tracking ITC Ltd. have a 'buy' rating on the stock, two recommend a 'hold', and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.