Oct. 7 marks one year since the eruption of a war between Israel and Hamas, the Palestinian militant group backed by Iran. Commodity prices, which are the most reactive to geopolitical conflicts, have moved significantly over the past 12 months.

Gold and crude oil, the most traded commodities, advanced in opposite directions over the last year. While the price of gold shot up meteorically amid global headwinds, oil has logged a year-on-year decline as a slump in global demand countered the supply concerns triggered by the tensions in the Middle East.

Gold Up Nearly 45%

Gold gained momentum over the past 12 months, rising by 44.8% or $820 per ounce.

Spot gold was valued at $1,810.51 an ounce on Oct. 7, 2023, and a year later, it is trading at around $2,653.

One of the key reasons fuelling the gold demand was "safe-haven buying amid ongoing tensions in the Middle East," said Kaynat Chainwala, AVP of commodities research at Kotak Securities Ltd.

However, the rally was also driven by a combination of other factors, including expectations of a decline in US interest rates, robust central bank purchases, and strong demand from exchange-traded funds, she told NDTV Profit.

"Since July 2024, gold has seen consistent monthly gains, reaching record highs in the last week of September following the much-anticipated pivot by the Federal Reserve, which began with a significant 50 basis point rate cut," the analyst added.

COMEX gold price peaked to a record high of $2,694.89 per ounce in September-end. (Image source: Bloomberg)

Brent Crude Down 6%

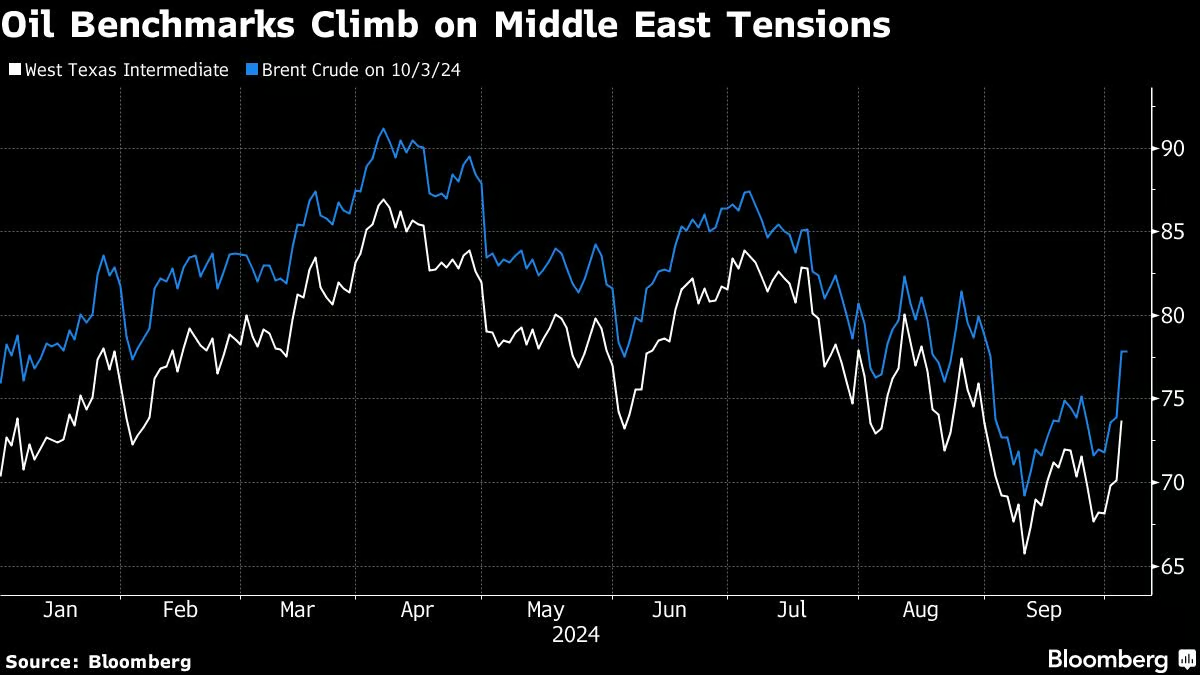

Brent, the global crude oil benchmark, has slipped by 6.14% or $5.2 per barrel, over the past year. Brent's futures were valued at $90.89 a barrel when the war broke out, and they were trading at around $79 per barrel at 09:10 a.m. GMT on Monday.

The US West Texas Intermediate, which is the American benchmark crude, has slipped by around 8.5% or $7, over the last 12 months. It was trading at $75.78 a barrel at 09:18 a.m. GMT on Monday.

In the days following the eruption of war, oil prices had surged to a high of $93 per barrel. This was also driven by attacks on oil containers linked to Israel and its allies by Yemen's Houthi militants in the Red Sea.

However, the prices have sharply corrected over the past several months, largely due to a slump in global demand.

"The decline can be attributed to several factors, including the absence of significant supply disruptions stemming from the ongoing conflict, a boost in non-OPEC oil supply, and increasingly pessimistic demand forecasts from key markets like the United States, Europe, and China. Additionally, a seasonal lull in demand further pressured prices downward," Chainwala said.

In late September 2024, WTI prices plunged to a 14-month low of $66.95 per barrel, further weighed down by expectations of increased output from Saudi Arabia and Libya, she pointed out.

A look at how Brent and WTI prices have moved in 2024 so far (Source: Bloomberg)

Looking Ahead

The Middle East tensions are in a new orbit, and how the situation will evolve over the next few weeks will remain keenly watched, said Kranthi Bathini, director, WealthMills Securities Pvt.

"Because of the current tensions in the Middle East, crude oil is moving upwards. Any increase in crude oil will have a negative impact on the Indian economy, as India has been a net importer of crude oil. This is going to create pressure on the current account deficit in the short-to-medium term," Bathini said.

Notably, WTI prices breached the crucial $75 per barrel mark last week. This was "fuelled by fears that Israel might target Iranian oil rigs in retaliation for missile launches, raising alarms about possible disruptions to oil supplies, particularly through the vital Strait of Hormuz," C. Chainwala said.

The Strait of Hormuz, which separates Iran from the Arabian peninsula, accounts for one-fifth of the world's total petroleum supplies, according to the data shared last year by the US Energy Information Administration.

Any possible attack on Iran by Israel could lead to the disruption of oil flows through the Strait of Hormuz, analysts pointed out. Among those who use the strait to supply oil are Organisation of Petroleum Exporting Countries members, including Saudi Arabia, the United Arab Emirates, Kuwait and Iraq.

Any targeted strike by Israel "could potentially impact oil production and transportation in the region, further driving up prices and exacerbating market uncertainty," Chainwala said.

The flare-up of tensions in the Middle East would also further boost the appeal for gold, as the metal often attracts investors seeking safe-haven assets in times of political and economic uncertainty, she said.

However, gold may continue to trade in a narrow range as caution prevails ahead of the release of inflation data in the US, Chainwala said. "If progress towards the Federal Reserve's 2% inflation target continues, some Fed officials might consider pausing rate cuts, which could exert downward pressure on gold prices in the near term."

"Aside from geopolitical factors, most indicators point to a short-term decline. So once those tensions ease, we may see a decrease in gold as well as oil prices," said Rahul Kalantri, vice president, commodities at Mehta Equities Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.