(Bloomberg) -- Stocks started 2024 with a limp. But that could change this week as earnings season kicks off and companies start announcing their plans for share repurchases, something investors hope will help the market keep last year's rally running.

Bulls may need the support, as hedge funds and retail investors are tilted defensively following the strong end to the year, with worries around the timing of the Federal Reserve's rate cuts adding to the caution.

“I'm bullish on stocks in 2024, but it's going to be a wild ride in the coming months since institutions are bearish,” said Brian Reynolds, chief market strategist at Reynolds Strategy, who correctly called the bear market during the 2008 global financial crisis. “Once the selling runs its course, companies will buy back their shares to push stocks back up.”

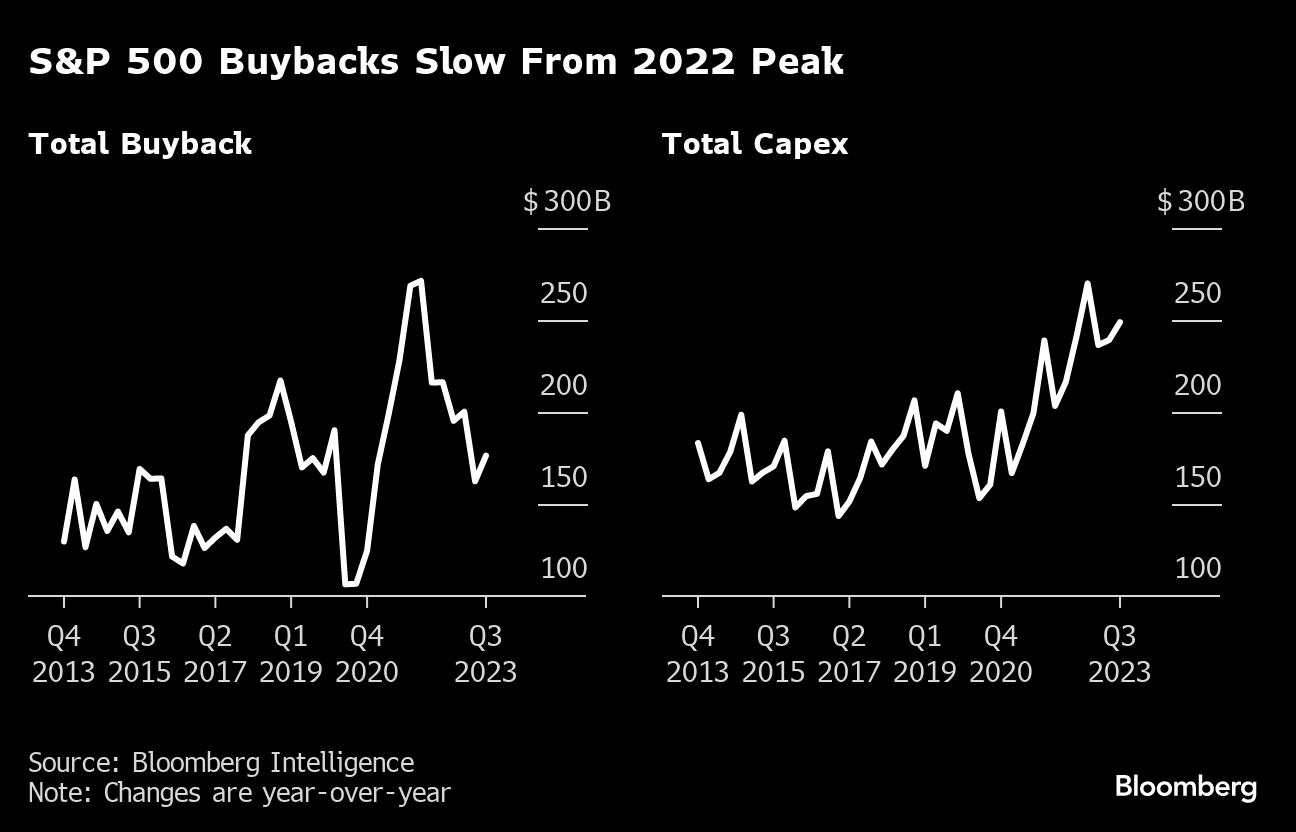

US corporations have been reluctant to repurchase their shares as the Federal Reserve pushed interest rates higher to fight inflation, which raised borrowing costs. Buybacks have fallen for five straight quarters after hitting a record in 2022, according to Bloomberg Intelligence. But with the Fed potentially getting ready to cut rates and earnings growth forecast to improve, investors expect more companies to deploy their newly available capital in the stock market.

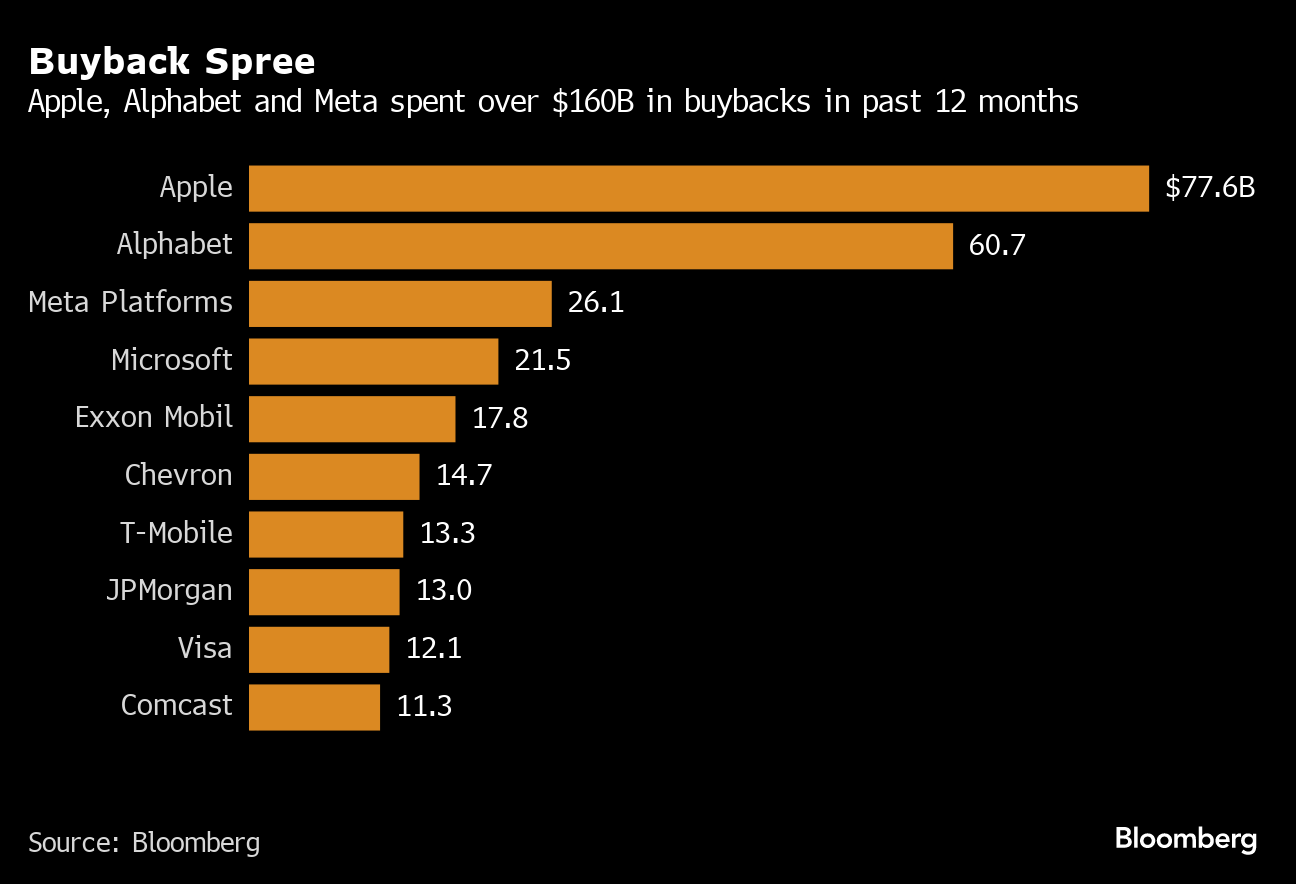

The fate of the stock market doesn't rest entirely on buybacks, however at nearly a trillion dollars a year, they represent one of the biggest buying forces around. S&P 500 companies spent nearly $800 billion on buybacks in the past year, down almost 20% from the same period the year before, according to data compiled by Bloomberg.

S&P 500 firms are expected to spend at least $840 billion toward buybacks in 2024, according to preliminary data from S&P Dow Jones Indices, which uses a different methodology than Bloomberg. The 12-month expenditure through September of $787 billion was down nearly 20% from a year prior, S&P Dow Jones Indices said. The record was $923 billion in 2022.

Overall, total corporate buybacks fell 18% in the third quarter compared with the year prior, according to Wendy Soong, a senior analyst at Bloomberg Intelligence. More than 40 S&P 500 companies announced buybacks in the fourth quarter worth a total of $163 billion, nearly a third less than a year ago in dollar value.

Those companies include Cigna Group and Adobe Inc., both of which have cash on hand after planned corporate takeovers collapsed.

Market Timing

The tricky part in all this for executives and investors will be finding the right time — both when to buy back the shares and when to expect them to pop. The key may lie in the Fed's plans for rate cuts, which officials have signaled might not occur until mid-2024 or even later. That could prevent companies from borrowing money for repurchases until later this year or early 2025, according to Michael Sheldon, chief investment officer at RDM Financial Group.

Still, buybacks appear ready to make a comeback. Capital spending as a share of sales has recovered to the pre-pandemic five-year average, partly due to surging allocations by the so-called Magnificent Seven tech giants, led by Apple Inc. Despite the company's challenges in China, its repurchase plans mean its shares continue to have upside potential after their nearly 50% gain in 2023, said Nancy Tengler, chief executive officer at Laffer Tengler Investments Inc.

“Buybacks are a way to solve problems for companies when their profit growth slows,” said Tengler. “We aren't buying Apple for the fundamentals. We buy it because the company will put a floor on the stock every single time it falls.”

Other companies are getting that message as well. Take Broadridge Financial Solutions Inc., the Lake Success, New York-based provider of investor communications and technology products, with a market capitalization of over $23 billion. It plans to spend about $500 million on buybacks during its current fiscal year.

“I expect our shareholder returns will be more weighted toward buybacks as there isn't a lot to buy in terms of M&A,” Chief Financial Officer Edmund Reese said in an interview. “Buybacks help the stock.”

--With assistance from Tom Contiliano and Nina Trentmann.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.