Nippon Life Hits All-Time High After IndusInd Bank Sells Entire Stake

More than 1.78 crore shares of Nippon Life changed hands before the markets opened.

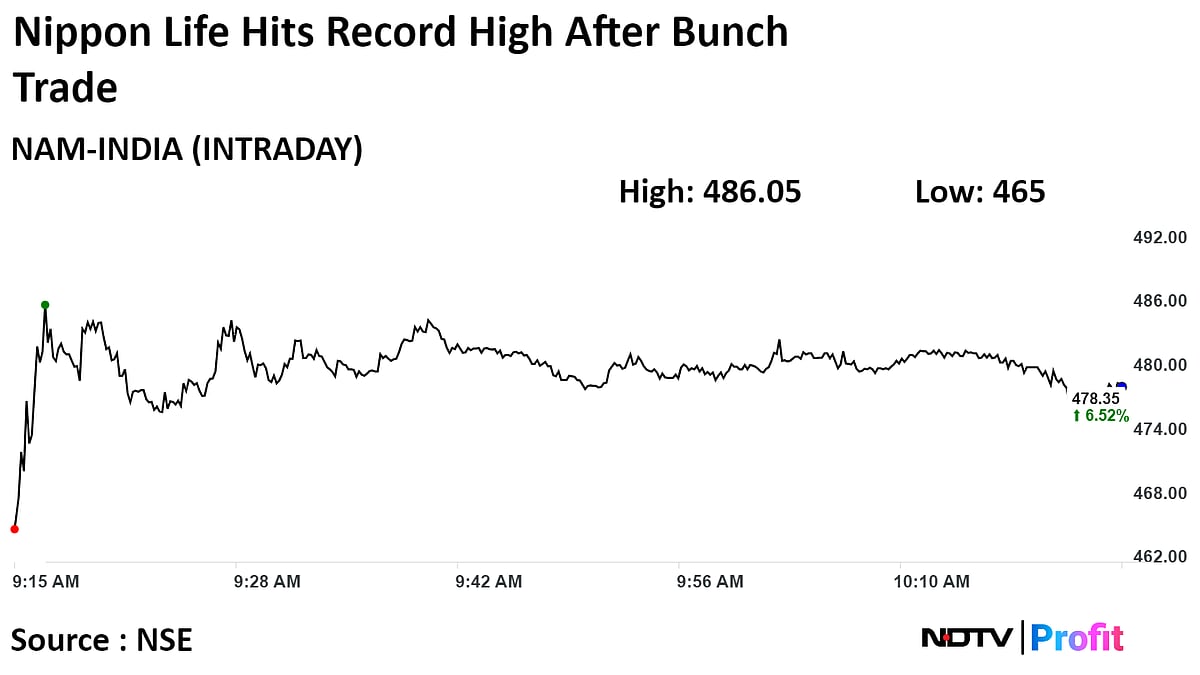

Nippon Life India Asset Management Ltd.'s shares hit a record high on Wednesday after IndusInd Bank Ltd. sold its entire stake in a pre-market large trade.

As much as 2.86% stake of Nippon Life India Asset Management Ltd. changed hands. More than 1.78 crore shares of Nippon were traded on the bunch-trade window before the markets opened.

While the buyers and sellers were not disclosed, NDTV Profit had reported, based on terms for the deal, that IndusInd Bank will sell its entire 2.86% stake in the asset management company.

IndusInd held 1,78,57,355 equity shares in Nippon in the quarter-ended September, according to the shareholding pattern on the BSE.

The offer size of the deal is at around Rs 760.72 crore. JM Financial is the sole bookrunner for the deal, according to the term sheet.

Shares of Nippon Life rose 8.22% to a life high after the pre-market large trade. The stock was trading 7.17% higher as of 10:12 a.m. against a 0.44% rise in the NSE Nifty 50.

The scrip has risen nearly 92% in the year so far. The total traded volume stood at 199 times the 30-day average. The RSI was 71, indicating that the stock may be overbought.

Of the 18 analysts tracking the stock, 15 have a 'buy' rating, while three suggesting 'hold'. The 12-month analyst price target of Rs 423.07 implies a potential downside of 11.8%.