Indian markets are strong and healthy enough to withstand shocks from foreign institutional investors, according to Finance Minister Nirmala Sitharaman.

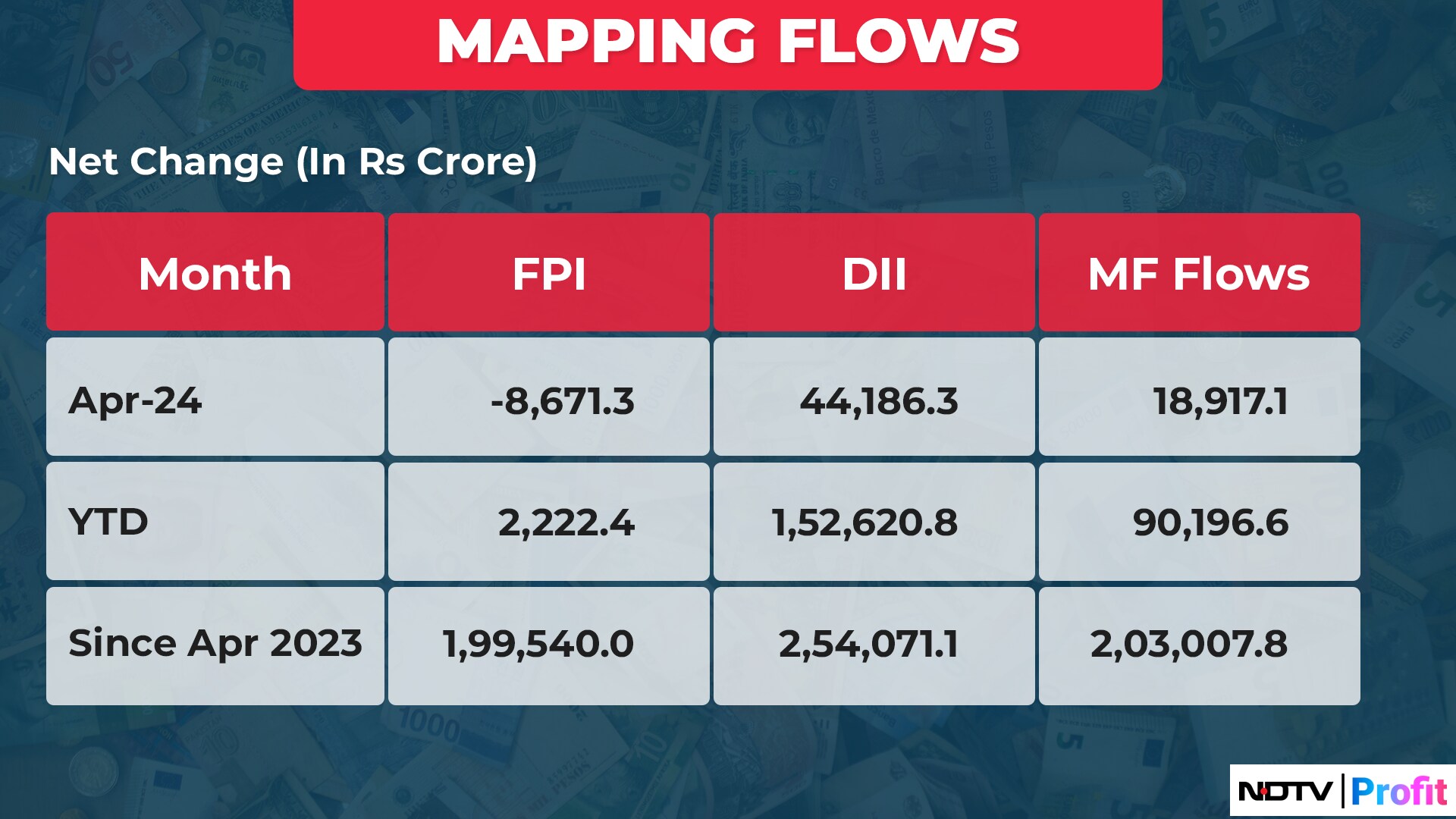

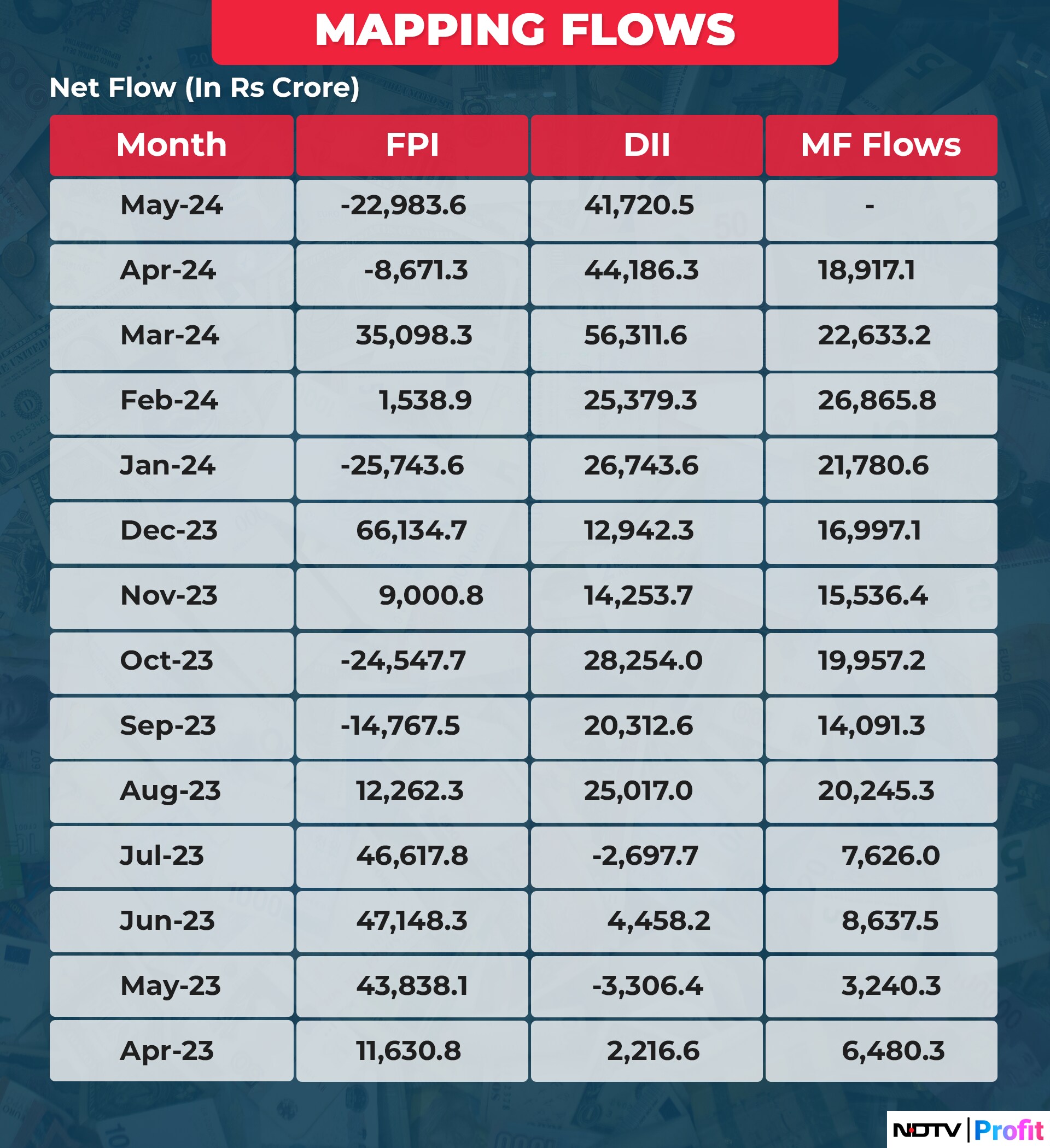

Sitharaman said small investors, regardless of the market's risks, are entering due to the good information flow. "This trend has served as a cushion when foreign portfolio investors flow out of India. There is no shock because these investors are there to absorb it," she told NDTV in an exclusive televised interview on Monday.

"People are benefiting from the transparent ways in which listed companies are disclosing information," she said, adding, "They understand that well-governed companies are performing well and can provide good dividends."

Sitharaman's comments come as foreign investors have pulled out Rs 22,000 crore from Indian equities so far this month, ahead of the Lok Sabha election results. Despite this, Indian equity benchmarks have surged nearly 3% since April, hitting new all-time highs, crossing new milestones.

The ongoing Lok Sabha elections, running from April to June 1, involve nearly 100 crore eligible voters choosing representatives for 543 Lok Sabha seats. To form a government, a party or coalition needs a simple majority of 272 seats.

Sitharaman also highlighted the relative stability of Indian markets compared to international markets, even during the heightened volatility of the election period. She said the accessibility of information for small investors is a positive development.

The Indian stock market has seen its highest volatility during this election period. Since phase 1 began on April 20, the volatility gauge has increased by about 72%, surpassing the highs during the 2014 elections. However, historically, volatility tends to decrease post-election, suggesting potential stabilisation once the elections conclude.

Sitharaman emphasised that Indian markets generally show less volatility compared to foreign markets, even amid the current election-induced fluctuations.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.