Indian equities may experience volatility in 2024 as investors await the outcome of general elections and monitor other macro factors, according to Morgan Stanley.

However, it is hard to argue against India's investment case due to strong earnings, macro stability, and domestic flows, the brokerage firm said in a note.

Several factors have reduced the correlations and volatility of Indian stocks compared to emerging markets, the note said. These include strong macroeconomic stability, expectations of earnings growth of 20% annually in the next four to five years, and a reliable source of domestic risk capital.

In terms of macro stability, the brokerage firm said that investment flows in the country are being driven by the idea of a multipolar world. This could lead to a balance of payments surplus and excess domestic liquidity. This is why return trends in Indian equity markets have a lower correlation with oil prices, Fed Fund rate changes, and U.S. growth.

Moreover, India's beta to the emerging market is less than 0.4, and India's rate spread with the US has also declined, explaining India's rich headline multiple.

"In our base case, we expect equities to rise into the 2024 general elections, as the market is likely to price in continuity and a majority government," said Morgan Stanley.

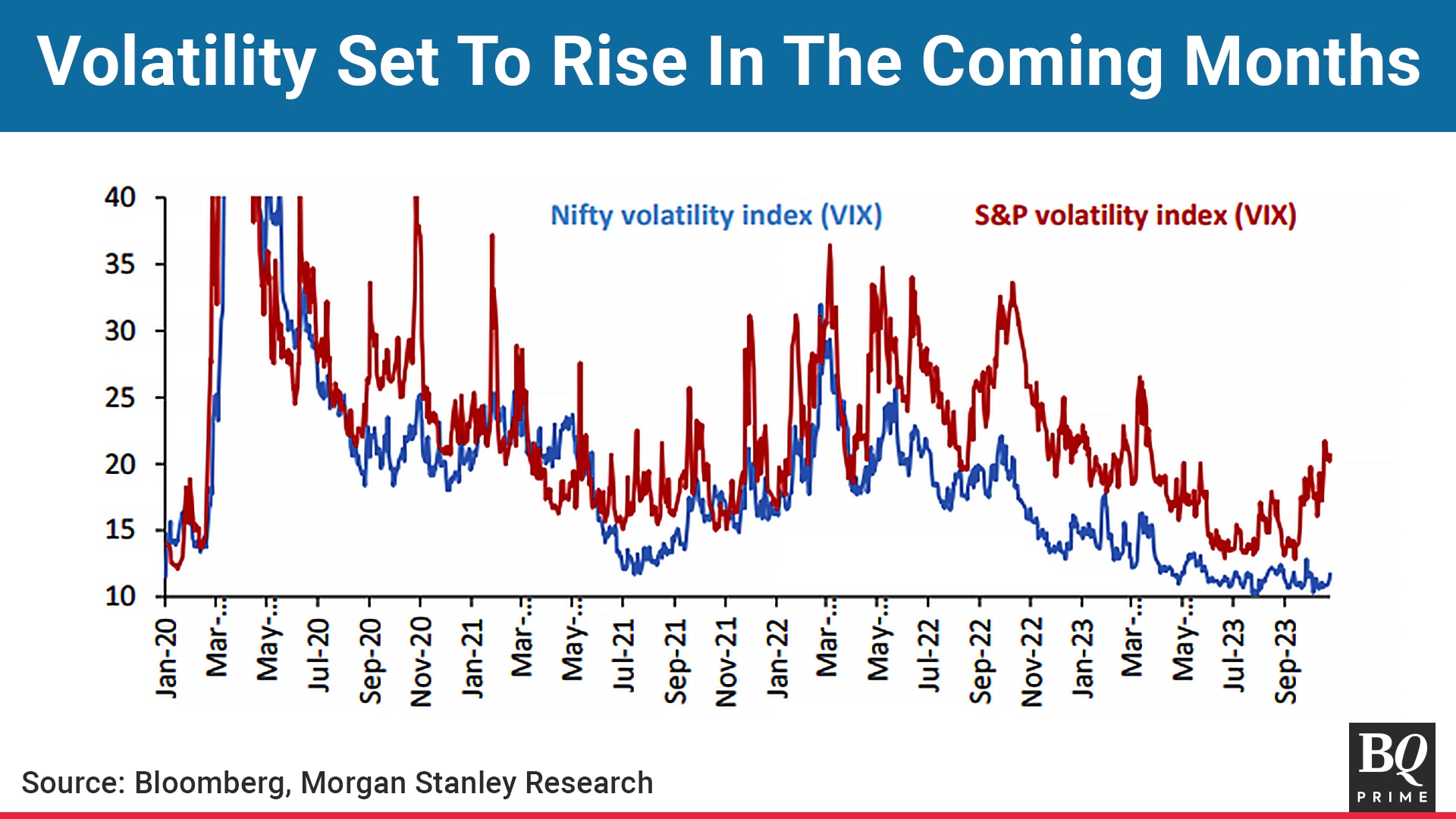

However, the BJP losing a majority of the five states could create volatility, according to the brokerage firm. While the country has remained less affected by oil prices in the past, a further rise above $110 will present headwinds to the macro.

The brokerage's base case also assumes that the RBI executes a calibrated exit from its current hold stance with robust domestic growth, the U.S. does not slip into a protracted recession, and oil prices are benign.

"We forecast BSE Sensex earnings to compound 21.5% annually through the financial year 2026," the brokerage firm said. "However, the base case masks the potential for volatility in 2024, which is evident in the spread of our bull-bear scenarios."

Strategy

For the portfolio, the brokerage firm recommends buying domestic cyclicals as growth is likely to be capex-driven and improving credit availability. Financial, consumer and industry cyclicals are expected to outperform, the brokerage said.

On the other hand, growth in global cyclicals is expected to be limited due to slow global growth, the brokerage firm said. Defensives including consumer staples, utilities, healthcare and telecoms are expected to underperform unless the election outcome is unfavourable for the market.

Large-caps are likely to outperform small and mid-caps—the opposite of our call this time last year, Morgan Stanley said. It is 'overweight' on consumer discretionary, industrials, financials and technology but is 'underweight' on all other sectors.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.