.png?downsize=773:435)

The massive selling that Indian financial stocks have seen this year has made the sector lucrative in a market with a dearth of valuation comfort. This space is further poised for strong growth given the tailwinds, according to experts.

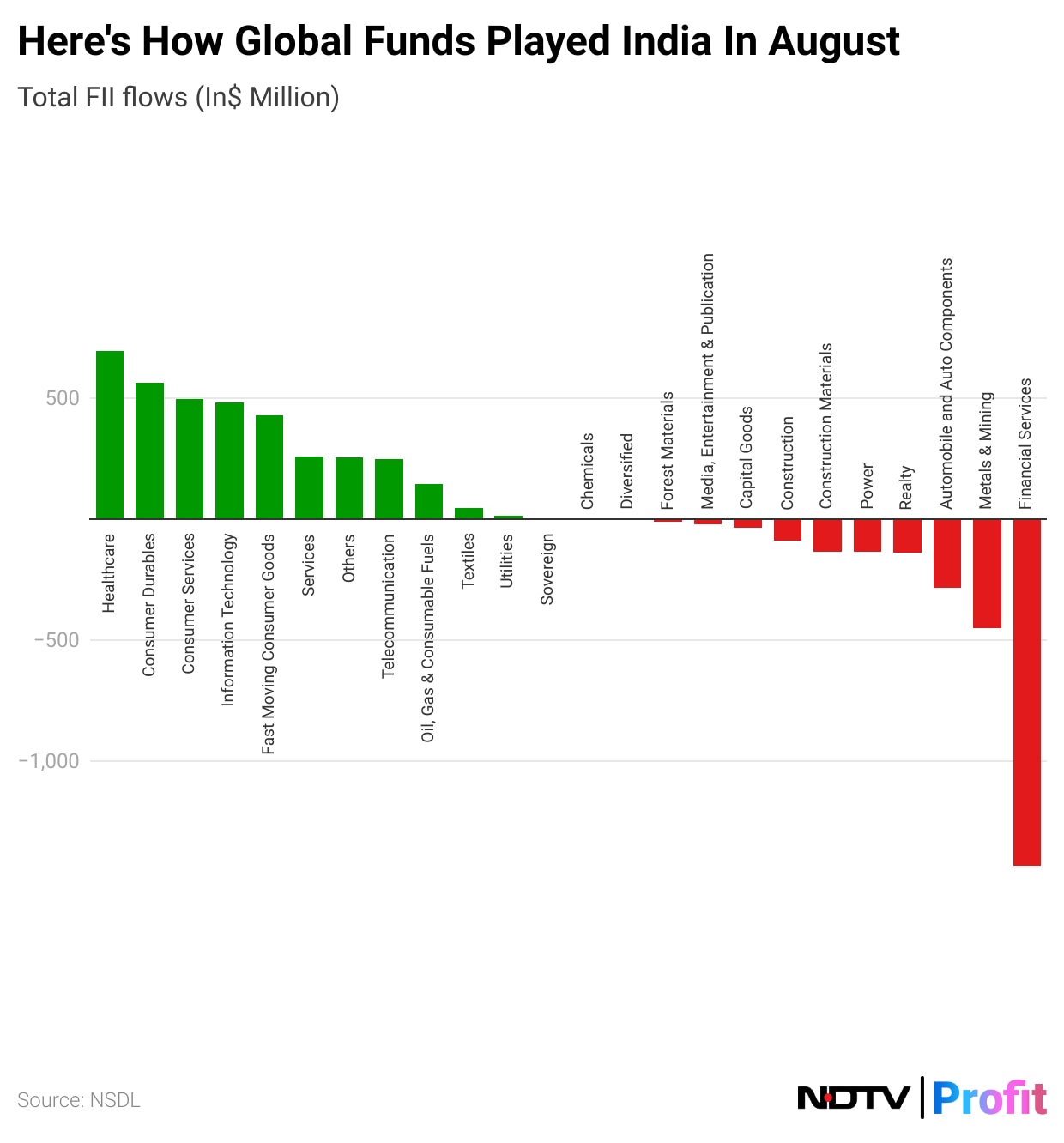

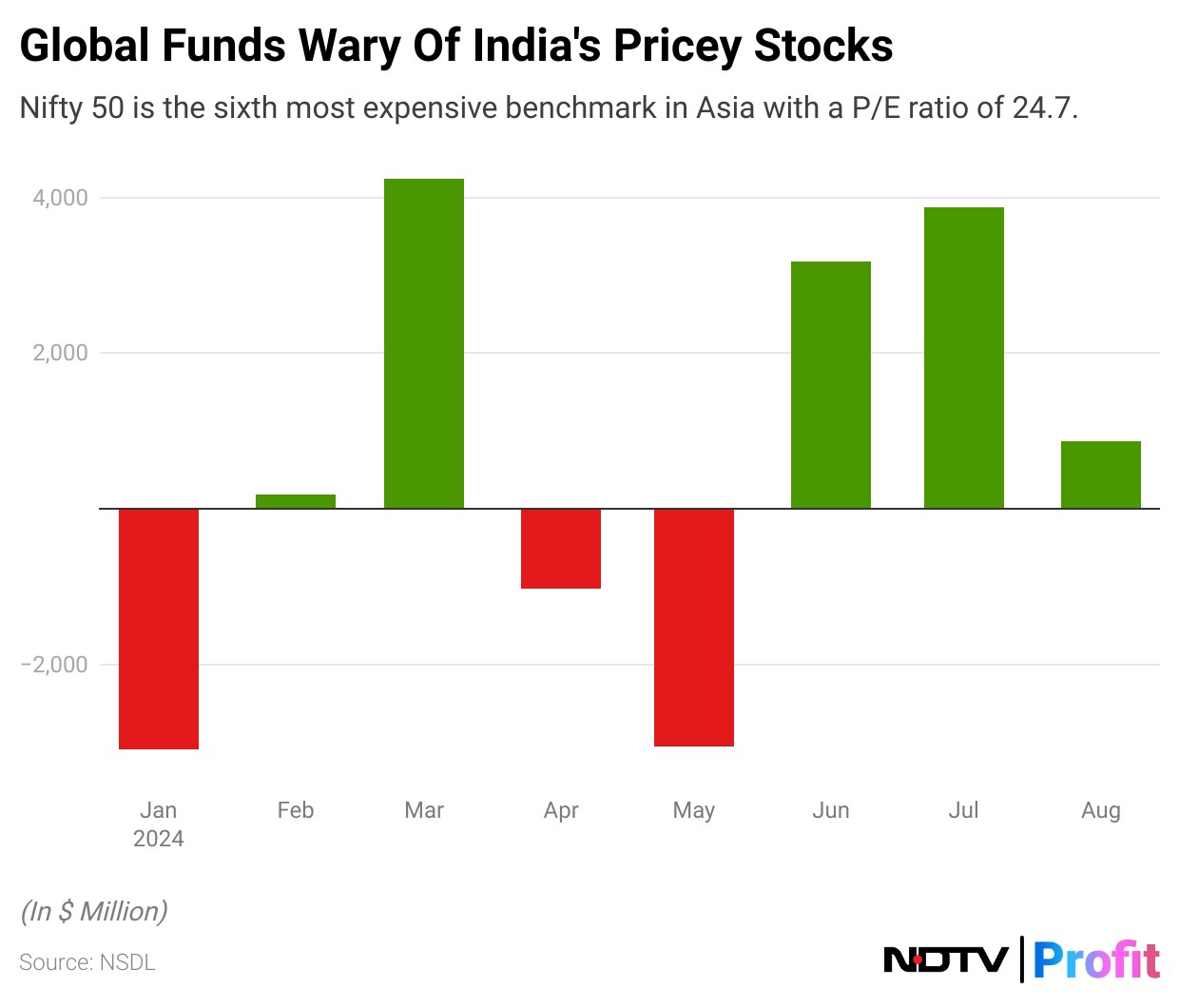

Domestic financial services companies have once again seen outflows of over a billion dollars in August taking the net tally to $7.7 billion. Outflows in the sector have outweighed the gains of $6.3 billion made in the overall equity market this year.

Except for March and June, global funds offloaded financial stocks, thereby being a hurdle for the Indian markets to inch up further as they hold a significant weight in the benchmark gauges. January saw the biggest sell-off this year as concerns over HDFC Bank Ltd. aided foreign institutions to pull funds from the banking stocks.

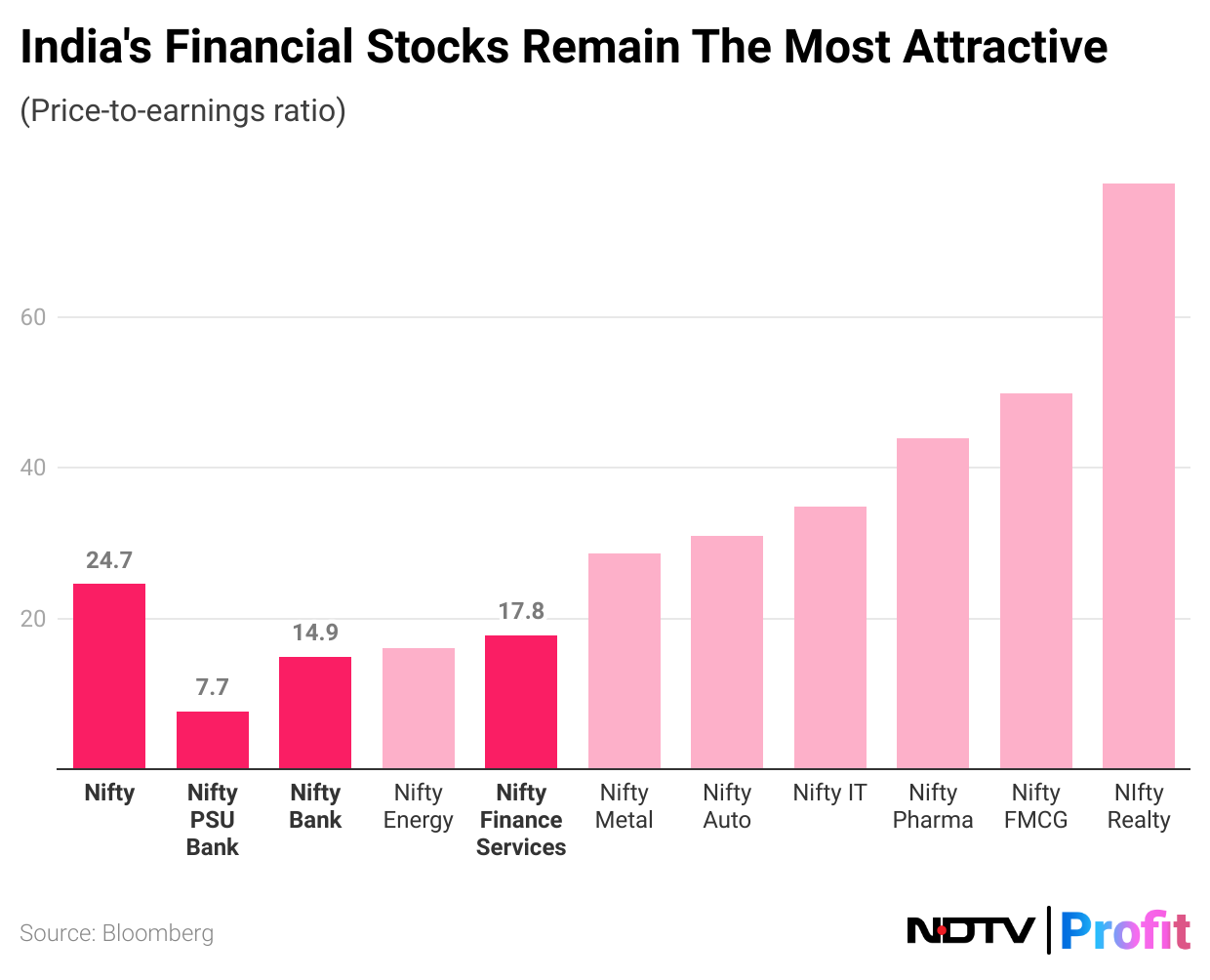

Given the trouble of finding valuation comfort, investors should refrain from aggressive investment in poor-quality stocks, according to V K Vijayakumar, chief investment strategist, Geojit Financial Services Ltd. But banking stocks offer good contrarian buying opportunities for long-term investors as valuations remain depressed.

There are temporary troubles plaguing the banking industry led by the decline in the share of overall deposits. This remains a downside risk to system credit growth in the current financial year, according to HSBC Global Research.

.png)

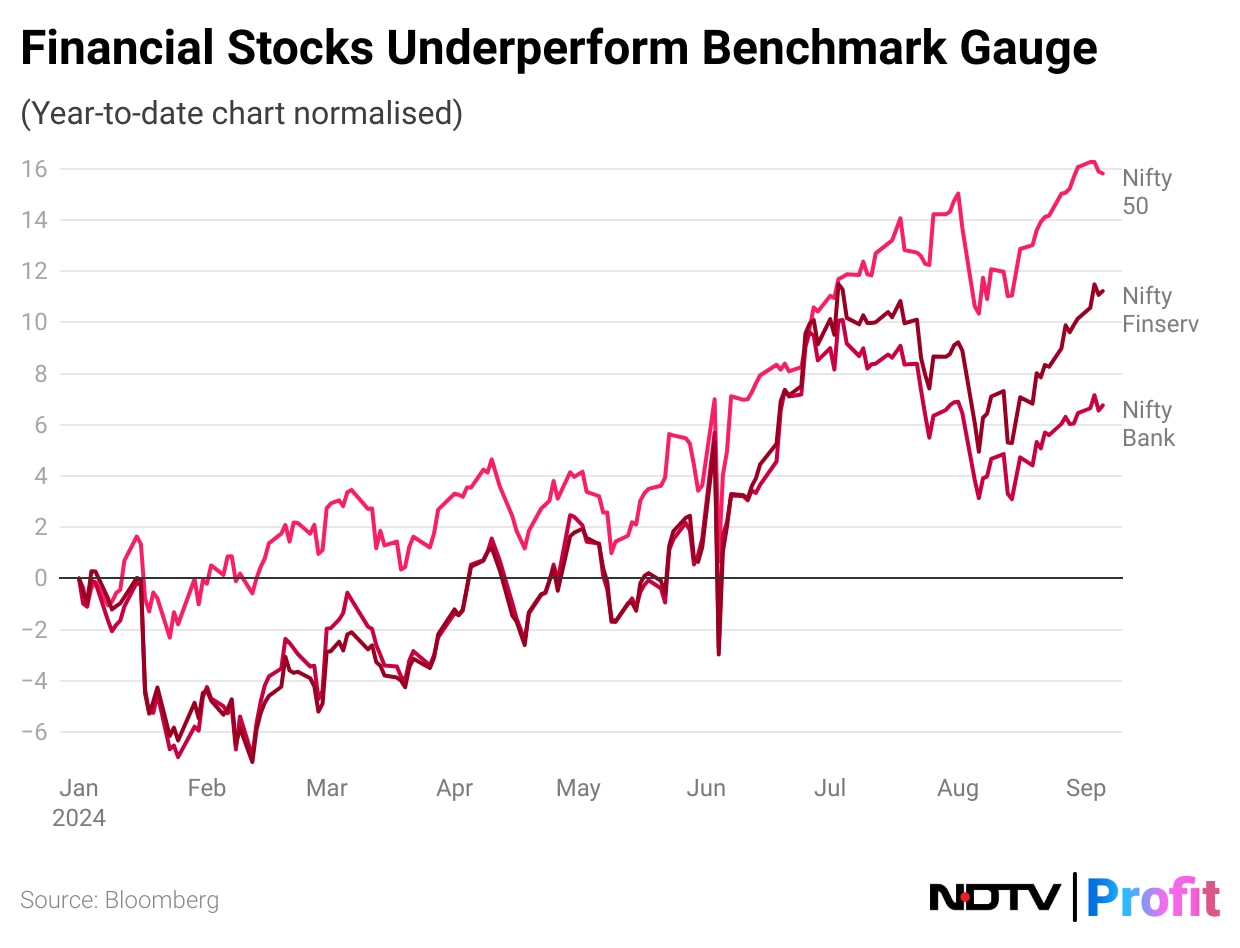

The stock performance of the financial stocks corresponds to overseas investors offloading these companies. The Nifty Financial Services and Nifty Bank have risen by 11% and 6.5% to trail behind the benchmark NSE Nifty 50 gauge.

The Nifty bank index is on course to register the biggest decline since 2020, having surged by 12.3% in the last calendar year. Meanwhile, the gauge for public sector banks has posted a gain of 20% so far this year.

Despite this fall, private banking space is one of the few places where there is valuation comfort, Subramaniam said.

If credit growth decelerates significantly, it will hurt areas that are more priced for growth, he said. "Cheap valuations are a function of markets' inability to look beyond current data. But that is where the opportunity lies. Happy that there are issues in banking because it gives me the opportunity to invest with valuation comfort."

The price-to-earnings ratio of Nifty PSU Bank stood at 7.7, the lowest in the Nifty sectors. This was followed by Nifty Bank and Nifty Financial Services with a P/E of 14.9 and 17.5 respectively, compared to a P/E of 24.7 for the Nifty 50.

Metals and mining and the automobile industry continued to see FII outflows while healthcare, consumer services and information technology stocks saw inflows ahead of the rate cuts in the US.

India has surpassed its rival China to secure the largest weighting in the MSCI EM investable market index, and is poised to surpass its neighbour as the largest emerging market. India's rising weight in a key emerging market index would draw more absolute foreign flows, according to Morgan Stanley.

Valuations in the Indian equity market have risen to relatively high levels, leading FIIs to exercise caution when investing in India, according to Vaibhav Porwal, co-founder, Dezerv. "They have been selectively investing in defensive market segments, focusing on sectors such as healthcare and FMCG."

Indian equity markets could see cautious trade this September as the US Federal Reserve's policy pivot might not result in expected flows given the price at which the domestic stocks are quoted.

The US Fed is expected to start its rate cut cycle in September and historically, rate cut cycles in the US market have not been favourable for their equity markets, Porwal said. FIIs will shift their focus to emerging markets, deploying capital where valuations are more appealing. "However, India may not be a significant beneficiary of these flows."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.