Shares of Indiabulls Housing Finance Ltd. tumbled again, but this time not because of fears stemming from IL&FS crisis. Investors now seem to be concerned about its exposure to SuperTech Ltd., a property developer whose credit facilities have been downgraded to default.

Macquarie's sales team, in a note to clients today, said Indiabulls Housing Finance's loans to SuperTech could be more than Rs 500 crore. The lending, the brokerage said citing its discussions with the management, was for a specific project that is ringfenced and earns monthly rentals of close to Rs 30-35 crore.

Indiabulls Housing Finance didn't respond to phone calls and BloombergQuint awaits its reply to emailed queries.

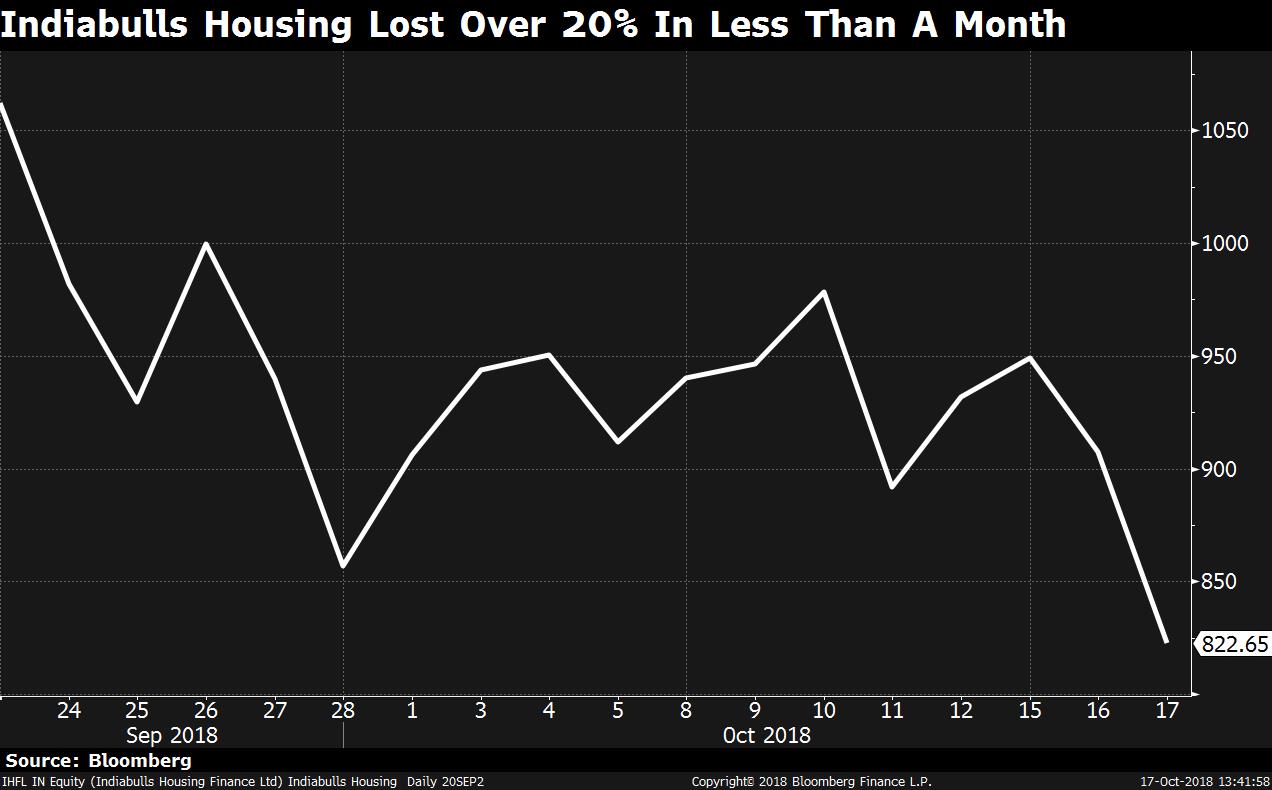

Indiabulls Housing Finance dropped as much as 13.2 percent today. That comes when its shares have fallen more than 21 percent since Sept. 20 on liquidity concerns. On Sept. 21, the mortgage lender's stock plunged as much as 35 percent in intra-day trade after defaults by Infrastructure Leasing & Financial Services Ltd. and its subsidiaries sparked fears of a contagion in Indian financial markets.

Brickwork last week revised ratings on Rs 1,866.4 crore of SuperTech's bank facilities to default citing its failure to service debt obligations. It blamed the developer's troubles on cash-flow mismatches because of a slowdown in the real estate industry. The firm, with projects in National Capital Region, Uttar Pradesh, Uttarakhand and Haryana, has been dragged to the Supreme Court by homebuyers for not handing over apartments on time. Haryana's housing regulator in July also sent notices to the property company for selling flats in non-existent projects.

“We have seen entire housing finance space reacting including stocks that do not have any exposure to Supertech Group,” Edelweiss Securities said. “This is largely due to concerns around rub-on effect of current operating environment on stress for real estate financing segment in general.”

Indiabulls Housing Finance's exposure to the property developer is restricted to Rs 600 crore, Edelweiss Securities said in a note also citing its interactions with the management. The brokerage said the exposure is towards two projects: Supernova in Noida, and Hill Town in Gurugram. It's backed by an escrow mechanism—all collections from customers go into it— and reallocation of funds is not possible after the rollout of new Real Estate Regulation Act, it said. “Which suggest that potential default in this projects are unlikely till the time sales are effected in these projects.”

Indiabulls Housing Finance's gross bad loans stood at 0.77 percent of total advances and net non-performing assets were 0.58 percent as of September, according to its filings. Gagan Banga, managing director and chief executive officer of Indiabulls Housing Finance, told analysts in an conference call that the mortgage lender has made adequate provisions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.