(Bloomberg) -- India is set to lure billions of dollars more inflows when JPMorgan Chase & Co. adds the nation's government bonds to its emerging markets index on Friday, opening up a $1.3 trillion market to a broader range of investors.

Global funds have already poured close to $11 billion into index-eligible bonds since JPMorgan's announcement in September. The US bank expects $20 billion to $25 billion to come in over the next 10 months, raising foreign ownership to 4.4% from 2.5% currently.

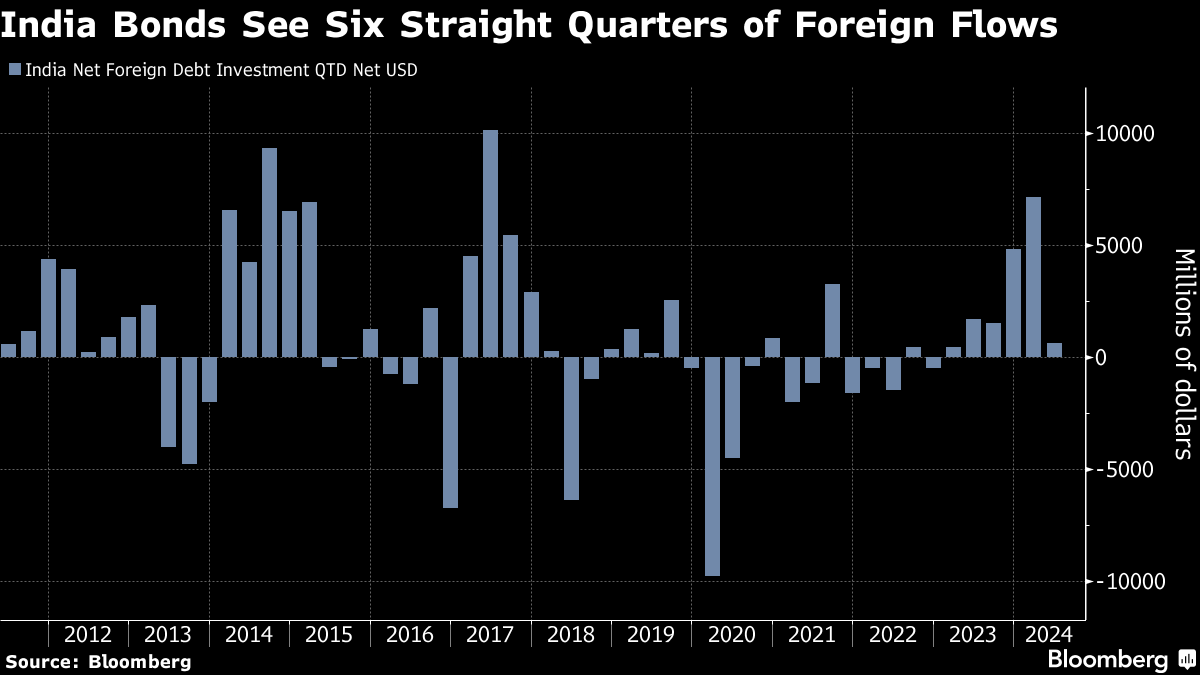

India's debt has become a favorite among emerging market investors, attracted to the nation's robust economic growth and a stable currency, which comes courtesy of the central bank. Both sovereign and corporate notes are headed for a sixth straight quarter of foreign inflows, a streak last seen 11 years ago, data compiled by Bloomberg show.

“Most of the flows we're seeing are driven by investors who are tracking the index and should be fairly sticky,” said Vikas Jain, head of India fixed income, currencies and commodities trading at Bank of America Corp. “Declining debt-to-GDP ratio, stable macros and favorable demand-supply for India's bonds are positive factors.”

For global investors, Indian bonds offer access to a high-growth, high-yield market. The nation's sovereign debt has outperformed its index counterparts over the past decade, according to JPMorgan. India is starting out with a 1% weightage on the key emerging markets bond index. This will increase by a percentage point every month over ten months, the index compiler said.

India Finance Is on the Brink of Its Breakout Moment: QuickTake

Indian government debt is Asia's top performing so far this year, returning 5.3% compared to a 1.3% gain in Indonesian local currency bonds, according to data compiled by Bloomberg.

Yields on the benchmark 10-year bond were steady at 7.01% on Friday, and the rupee edged higher to 83.3913 against the dollar. Yields have fallen about 20 basis points since JPMorgan's inclusion decision, and Australia & New Zealand Banking Group Ltd. expects it to tread lower to 6.8% in the near term.

“The RBI may have a window to cut rates one time in December, and further cuts in 2025 could guide yields lower,” Jennifer Kusuma, senior Asia rates strategist at ANZ, said on Bloomberg Television Friday. “The market has largely priced in a lot of the good news” on inclusion.

Within the so-called Fully Accessible Route bonds eligible for index inclusion, 28 securities worth more than $400 billion will give India a 10% share in the index at peak. That's a similar weighting to China.

“India's relatively high yields among the other index constituents can potentially convince active managers to shift to overweight stance for these papers,” DBS Group Holdings Senior Economist Radhika Rao wrote.

The country's foreign exchange reserves rose to $653.7 billion in the week of June 21, according to latest data from the Reserve Bank of India. The rise came as the central bank may have absorbed the foreign flows triggered by the inclusion.

--With assistance from Toby Alder, Catherine Bosley, Avril Hong, Yvonne Man, Anand Menon and Ronojoy Mazumdar.

(Updates with bond inflow data second deck, latest forex reserves in last paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.