(Bloomberg) -- India's regulator wants stock trades to be settled instantly, racing far ahead of other major markets in pushing reforms meant to attract more investors.

The Securities and Exchange Board of India is proposing to start same-day settlement from March, before moving to a real-time process in 2025. The shorter cycles will be optional for investors and run alongside the existing system where trades are settled in one day, or T+1 in industry parlance.

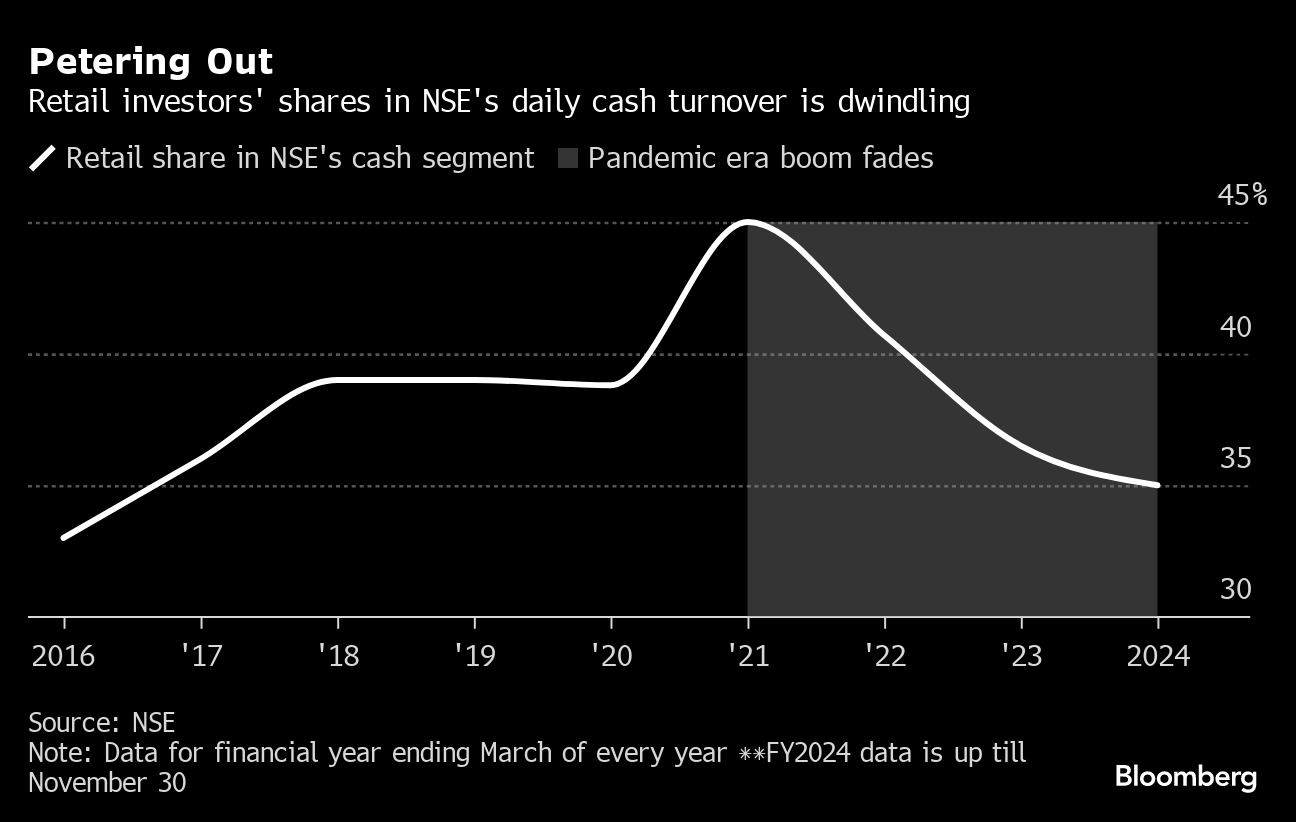

Global appetite for quicker resolution has grown after a spike in prices of ‘meme stocks' in 2021 left brokers like Robinhood Markets Inc. struggling to post collateral for those trades during the two days it took to settle them. For the Sebi, faster settlement is also a magnet to lure retail investors who are shunning direct bets on stocks in favor of equity derivatives.

“If India's market has to go from $4 trillion to $40 trillion, we need to constantly keep evolving and using new-age technology and next practices to strengthen our market,” said Sunil Sanghai, founder of NovaaOne Capital and a senior former banker at Indian units of HSBC Holdings Plc and Goldman Sachs Group Inc. “Our market has embraced many changes in the past, no matter how big.”

India's $4.3 trillion market moved to what's known as T+2 back in 2003 — 14 years before the US — and became the second country after China last year to adopt T+1 approach, a regime the US will roll out this May.

“In today's age, reliability, low cost and high speed of transactions are key features that attract investors,” Sebi said in the consultation paper while inviting comments on its plan until Jan. 12. “Reducing settlement time and increasing operational efficiency of dealing can further draw and retain investors.”

The number of active individual investors — defined as those who trade at least once a year on the National Stock Exchange's cash market — rose just 1% to 27 million in 2023 from a year earlier. The retail count in futures and options jumped 33% to over eight million, data from India's biggest exchange show.

Read: About the ‘T+1' Rule Making US Stocks Settle in a Day: QuickTake

For all the anticipated benefits, the initiative has left overseas investors concerned about the operational risks of trading on parallel systems. The new mechanism may lead to the same security trading at different prices on the two cycles.

Sebi has said that any price and liquidity gaps created by the two systems running simultaneously can be bridged by arbitragers. The regulator is working with market participants to iron out wrinkles, according to Chairwoman Madhabi Puri Buch.

Despite those reassurances, “our concerns about market fragmentation remain when a market has two settlement cycles,” Eugenie Shen, managing director and head of the asset management group at the Asia Securities Industry & Financial Markets Association, said by email.

To be sure, Sebi's plan in 2021 to adopt T+1 settlement had also received a pushback from global funds, with ASIFMA citing concern over timezone differences and foreign currency-related issues at the time.

The regulator rolled out the regime with the bottom 100 stocks by market value, a segment global funds don't trade in. That gave investors time to adapt to the shift.

“Sebi will ensure issues raised by foreign investors are addressed before the new system is rolled out,” said Deven Choksey, a strategist with KRChoksey Finserv in Mumbai. “Foreigners will comply, like in the past.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.