HSBC has downgraded Oil and Natural Gas Corp. from 'hold' to 'reduce', citing significant downside risks amid a decline in global oil prices. The new target price of Rs 230 reflects a projected downside of 21.9% from the price at which it was trading on Sept. 17.

The bank's analysts noted that oil prices falling below $75 per barrel expose ONGC's earnings to increased volatility. The brokerage highlighted that the company's earnings largely depend on production rather than oil prices due to government-imposed price caps, which currently limit oil realisations at approximately $75 per barrel and gas at $6.50 per million British thermal units

HSBC's report underscores a troubling trend in ONGC's production track record, which has been described as "uninspiring". The company's most promising KG-DWN-98/2 field is reportedly facing delays and has lowered its output guidance. This comes on the heels of an overall decline in production volumes from aging fields, raising concerns over the viability of future growth.

The report also pointed out that reduced oil prices could negatively impact ONGC's earnings and internal rate of returns. Furthermore, the performance of key subsidiaries, including Hindustan Petroleum Corp. and Mangalore Refinery and Petrochemicals Ltd., has been weak, potentially impacting dividend distributions for financial year 2025.

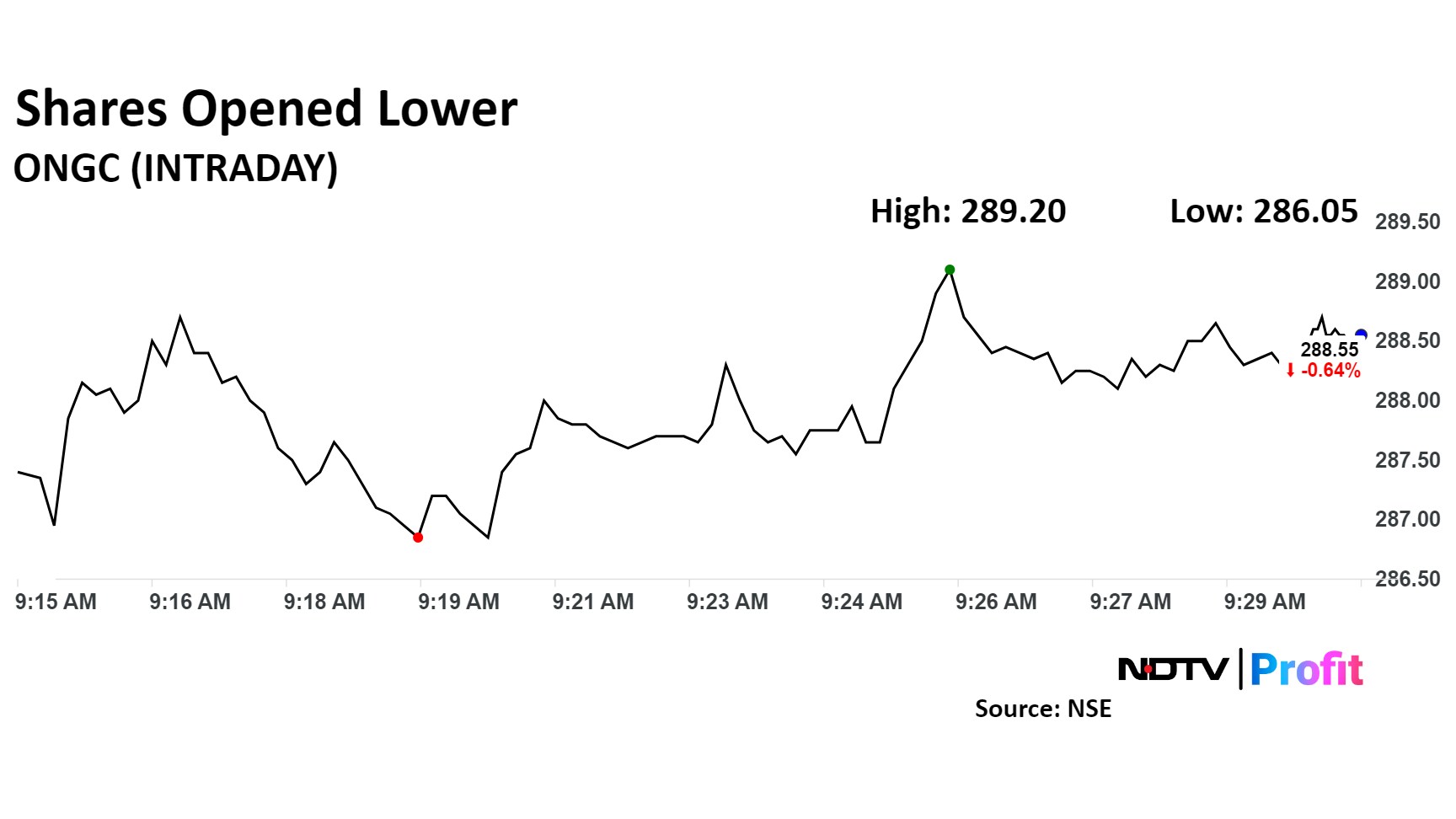

The scrip fell as much as 1.50% to 286.05 apiece. It pared losses to trade 0.69% lower at Rs 288.40 apiece, as of 09:33 a.m. This compares to a 0.83% advance in the NSE Nifty 50 Index.

It has risen 53.24% in the last 12 months. Total traded volume so far in the day stood at 0.29 times its 30-day average. The relative strength index was at 34.

Out of 28 analysts tracking the company, 18 maintain a 'buy' rating, four recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.