Shares of Hindalco Industries Ltd. gained over 2% on Wednesday after its profit surged 25% in the first quarter of fiscal ending March 2025. However, the aluminium producer missed analysts' bottom-line estimates.

The company's net profit increased 25% year-on-year to Rs 3,074 crore in the quarter ended June, according to an exchange filing on Wednesday. This compares with the Rs 3,428-crore consensus estimate of analysts polled by Bloomberg.

However, the aluminum and copper manufacturer company's topline and operating profit met analysts' expectations.

Hindalco Q1 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 7.6% to Rs 57,013 crore (Bloomberg estimate: Rs 56,236.4 crore).

Ebitda up 31% to Rs 7,503 crore (Bloomberg estimate: Rs 7,201.3 crore).

Ebitda margin expands 237 basis points to 13.16% (Bloomberg estimate: 12.8%).

Net profit up 25% to Rs 3,074 crore (Bloomberg estimate: Rs 3,428 crore).

The Ebitda margin expanded 237 basis points on the year to 13.16%, compared to 12.8% estimated by Bloomberg for April–June. Higher realisation and an alteration in the cost structure for aluminium production helped the margin expansion, Yes Securities said.

Its first quarter performance was impressive due to LME pricing for Indian aluminium businesses, strong Novelis performance, and better copper volume, the brokerage said in a note on Tuesday.

Yes Securities maintained 'Add' on the stock with a target price of Rs 722, which implied 16.3% upside from Tuesday's closing price.

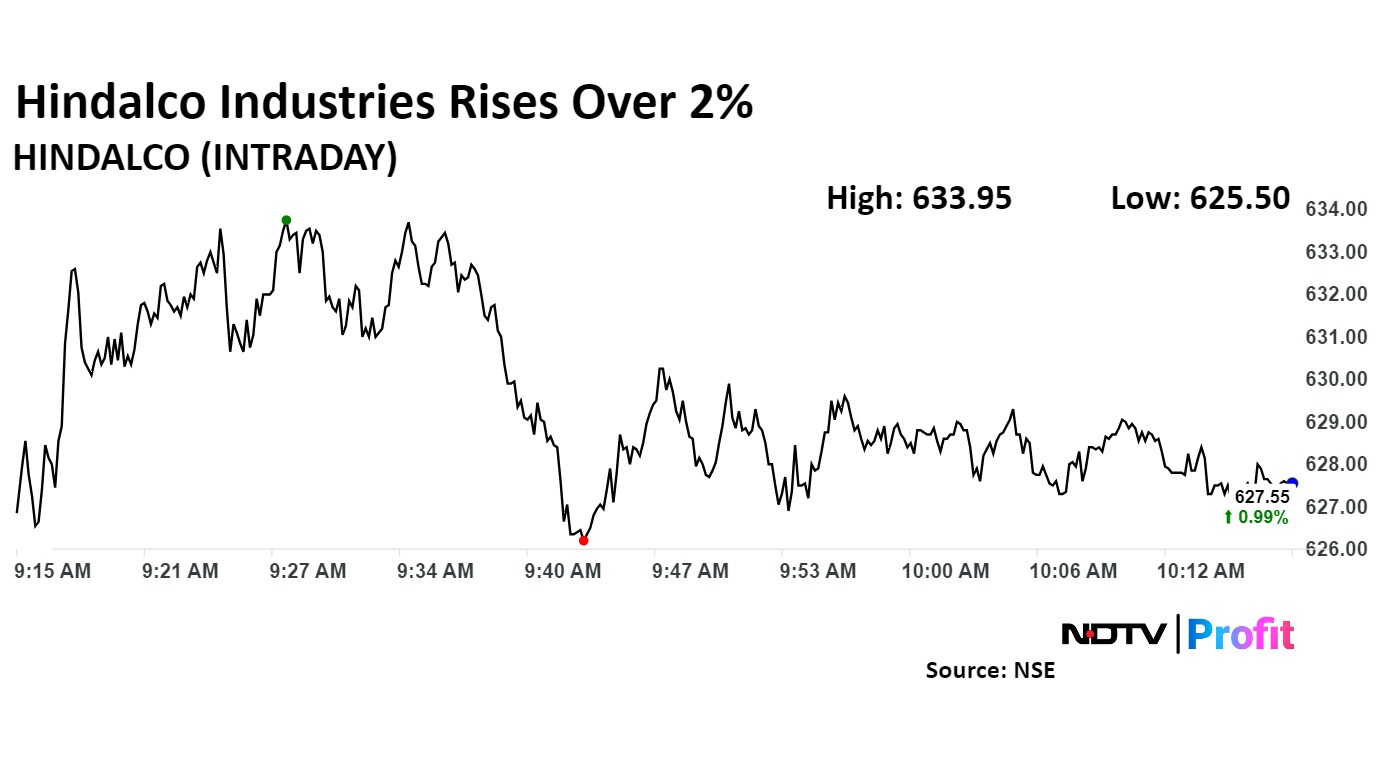

Shares of Hindalco Industries rose 2.02% to Rs 633.95 apiece, the highest level since Aug. 13. It pared gains to trade 0.94% higher at Rs 627.25 as of 10:18 a.m., compared to 0.11% advance in the NSE Nifty 50 index.

The stock gained 37.48% in last 12 months and rose 2.12% on year to date basis. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 41.63.

Out of 28 analysts tracking the company, 25 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.