(Bloomberg) -- Options traders are getting less skeptical about Indian banks after months of underperformance.

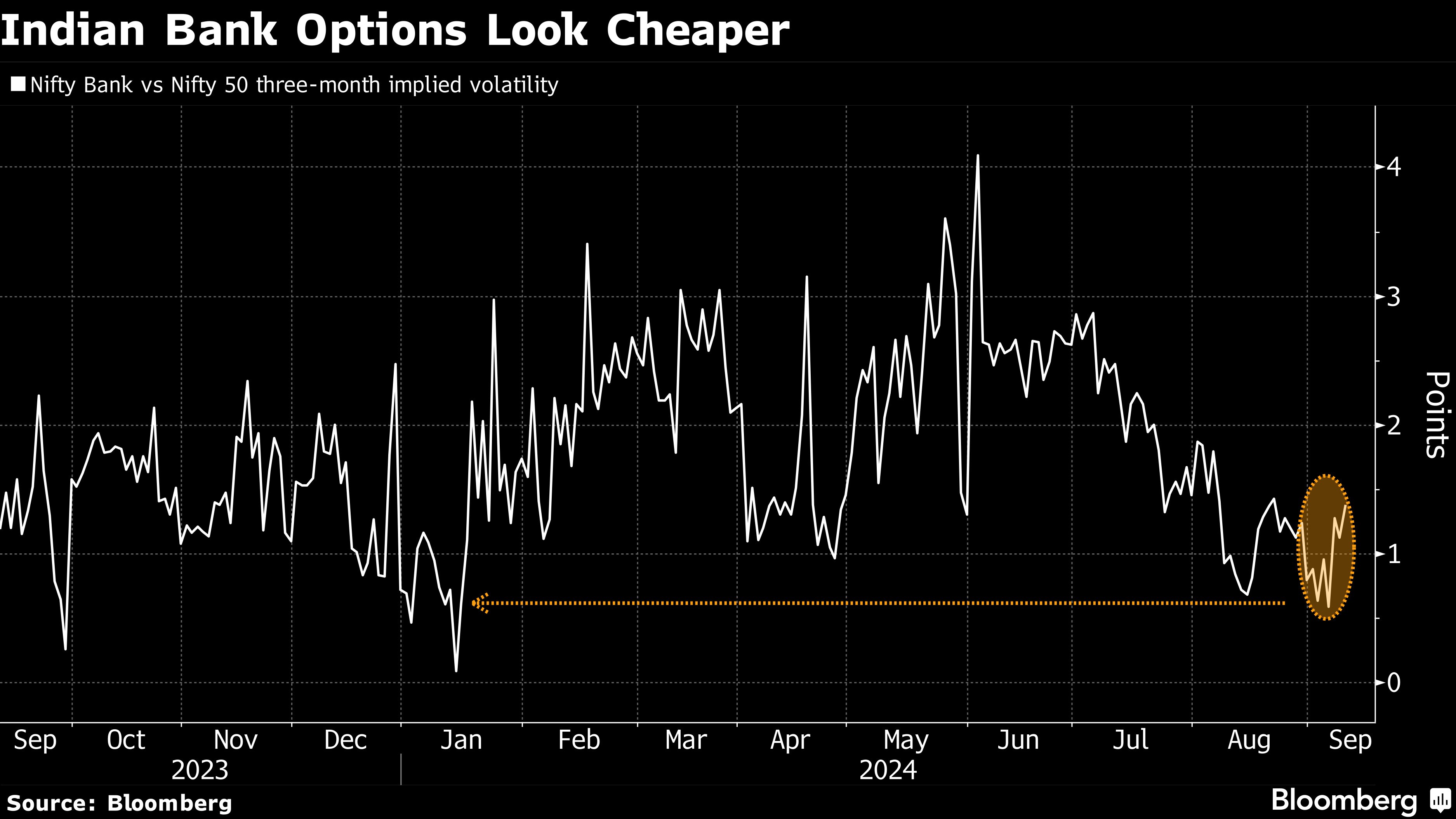

The cost of hedging against volatility in the NSE Nifty Bank Index is near its lowest level since January relative to the broader NSE Nifty 50 Index, indicating less demand for protection. Meanwhile, the number of bearish options outstanding on the banking gauge hit a three-week low on Friday versus bullish contracts, data compiled by Bloomberg show.

Indian bank stocks have lagged the broader market, with sluggish deposit growth raising concerns that more regulation may be coming. While firms including Morgan Stanley remain bearish, Jefferies Financial Group Inc. says valuations already reflect the worries and a potential easing of liquidity could help smoothen the impact should interest rates fall. Demand for retail loans remains strong, and lenders including HDFC Bank Ltd., Kotak Mahindra Bank Ltd. and ICICI Bank Ltd. beat analysts' profit estimates in the June quarter.

“Traders' appetite is clearly shifting toward private banks, so if you are deploying fresh capital that's the space to do it in,” said Tejas Shah, head of derivatives trading at Equirus Securities Pvt. “Private banks are well positioned to outperform.”

The Nifty 50 has rallied 25% in the past year to a fresh record high earlier this month, yet the banking gauge is up only about 12% as the Reserve Bank of India has stepped up a crackdown on shadow lending and asked firms in the sector to increase buffers for some consumer loans. Now the Bank index is trading at 2.3 times book value, slightly below its three-year average and lower than the Nifty 50, data compiled by Bloomberg show.

“India's recent slew of regulatory measures may slow loan growth and impact interest margins modestly in fiscal 2025 but should help maintain healthy asset quality in the sector by managing broader systemic risks,” said Rena Kwok, a fixed income analyst for Bloomberg Intelligence.

While the three-month implied volatility of the Bank index relative to the Nifty 50 has rebounded slightly from a Sept. 5 low, the spread remains more than one-fifth below its one-year average. Should the banking gauge surpass the 51,800 zone “decisively” — it closed 1% below that level on Tuesday — it could move higher to retest its intraday peak of around 53,300, Vaishali Parekh, vice president of technical research at Prabhudas Lilladher, wrote in a Sept. 10 note.

“In light of our defensive stance on the market near term, banks would outperform,” Jefferies analysts including Mahesh Nandurkar wrote in a Sept. 9 note. They added that ICICI Bank, Axis and State Bank of India are their top picks.

(Adds context and comment from fifth paragraph)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.