011123-2.jpg?downsize=773:435)

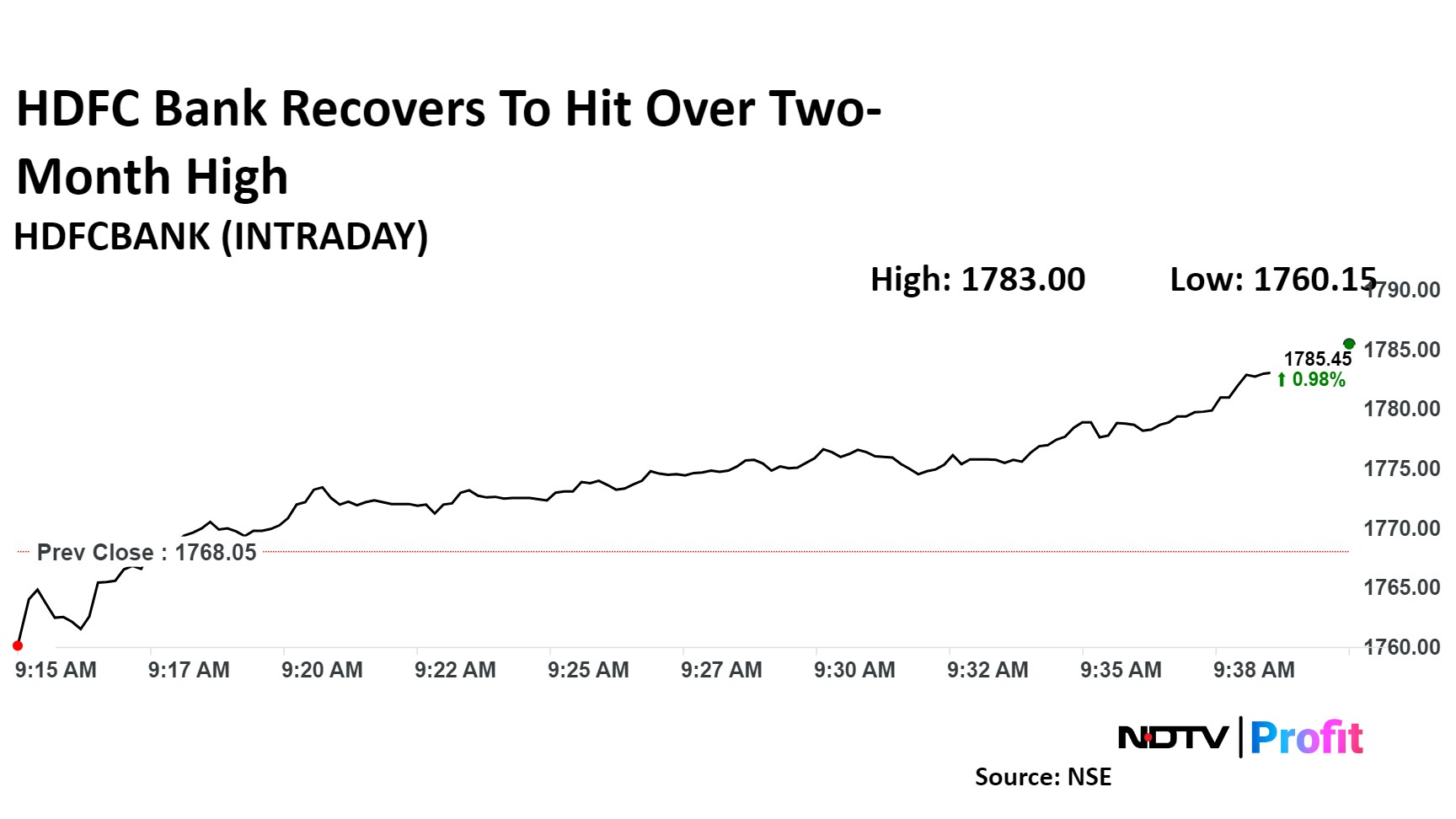

HDFC Bank Ltd.'s share price hit a two-month high on Wednesday after HSBC raised its target price for the stock while maintaining a 'Buy' call.

The development comes a day after NDTV Profit in an exclusive report said that the private lender is looking at selling about Rs 60,000-70,000 crore worth of loan assets to potential investors. The likely move aims to free up liquidity and reduce its credit-deposit ratio.

The target price, raised to Rs 2,010 from Rs 1,870, implies an upside of 13.7%.

"We raise our TP (target price) to Rs 2,010 from Rs 1,870 as we factor in a higher multiple for the bank and for its NBFC subsidiary," it said.

Following this, HDFC Bank share price recovered from its opening fall and climbed to hit its highest level since July 3.

Citing a recent press release by India Ratings on 18th Sept. and a media article by NDTV Profit on 24th Sept., the brokerage firm noted that this along with any further sell-downs, would accelerate a return to normal LDR levels, and normal operations, for the bank. It also noted that the Rs 700-800 billion worth of loans cumulatively account for 2.5-3% of loans in the first quarter of this fiscal.

The brokerage noted several positives of this recent development. It said that expectations of deposit accretion will become realistic and there would be reduced pressure to raise bulk deposits or raise deposit rates.

In addition, a faster reduction in LDR would allow for a faster return to normalisation in loan growth and it would be easier for the bank to protect NIM – by letting go of lower yielding loans, and through reduced pressure on funding costs.

"Incremental EPS cuts due to slower loan growth would be very little, in our estimate, as higher NIM / lower costs would protect ROA," said HSBC.

Despite this, HSBC has cut its earnings estimates for the fiscals 2025-2027 by 0.5-3%, "but hardly any change in book value estimates", it said. This is as it builds in a sharp slowdown in headline loan growth over FY25-26 which brings down the LDR to 93% by end FY26.

The brokerage expects loan growth to start recovering by early FY26 as incremental LDRs may start picking up by then.

"We maintain our Buy rating on the stock because we believe the current balance sheet restructuring will pave the way for better growth and profitability over FY25-27," it said.

On the downside, it noted some of the risks to its call including NIM/RoA not recovering as estimated. If that happens, the brokerage said HDFC Bank's stock could get derated as the gap of its operating metrics to the nearest competitor would expand.

The scrip rose as much as 1.06% to Rs 1,786.85 apiece, the highest level since July 3. It pared gains to trade 0.9% higher at Rs 1,784.25 apiece, as of 9:46 a.m. This compares to a flat NSE Nifty 50 index.

It has risen 4.38% on a year-to-date basis and 16.9% in the last 12 months. Total traded volume so far in the day stood at 0.13 times its 30-day average. The relative strength index was at 81.81, indicating that the stock may be overbought.

Out of the 47 analysts tracking the company, 38 maintain a 'buy' rating, and nine recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.