(Bloomberg) -- Goldman Sachs Asset Management sees attractive opportunities in South Korea and India after Monday's savage selloff in global equities.

Hiren Dasani, co-head of emerging markets equity, said he is bullish on South Korean shares and some artificial intelligence-related stocks in the region. He also emphasized the potential in companies manufacturing auto ancillaries, chemicals, and power equipment in India.

“We still believe the broader AI-theme is not done and over,” said Dasani, who is also lead portfolio manager of India equity strategies. “It's important to take a step back during time of markets volatility and remember that these themes are not going anywhere, and fundamentals will prevail,” he said, declining to name specific stocks.

The dramatic selloff has tempered the global artificial intelligence rally, which had pushed some stocks to extreme valuations in recent weeks. Even if AI-related spending grows at a slower pace, the sector's earnings remain healthy, according to Dasani.

“With the recent correction, valuations are not looking very expensive, giving selective opportunities,” he said.

South Korea's initiatives to improve management practices and shareholder returns at listed companies also adds to the attractiveness of the country's shares. These measures are expected to lead to better valuations, Dasani noted.

Read: South Korea Defends ‘Value-up' Push as Local Stock Market Lags

Regarding India, Dasani cited a combination of strong earnings, relatively lower correlation with the rest of the world, and domestic-driven growth as the basis for his optimism about the nation's $4.8 trillion market.

While there are concerns around valuations, Dasani believes the manufacturing theme presents opportunities due to the nation's push toward localization and its goal to position itself as a credible alternative to China.

Goldman Sachs India Equity Portfolio, managed by Dasani, held auto component maker Samvardhana Motherson International Ltd., wind turbine manufacturer Suzlon Energy Ltd. and textile firm Gokaldas Exports Ltd. as of June 28, data compiled by Bloomberg show. This fund held $4.4 billion in assets as on Aug. 5, the data show.

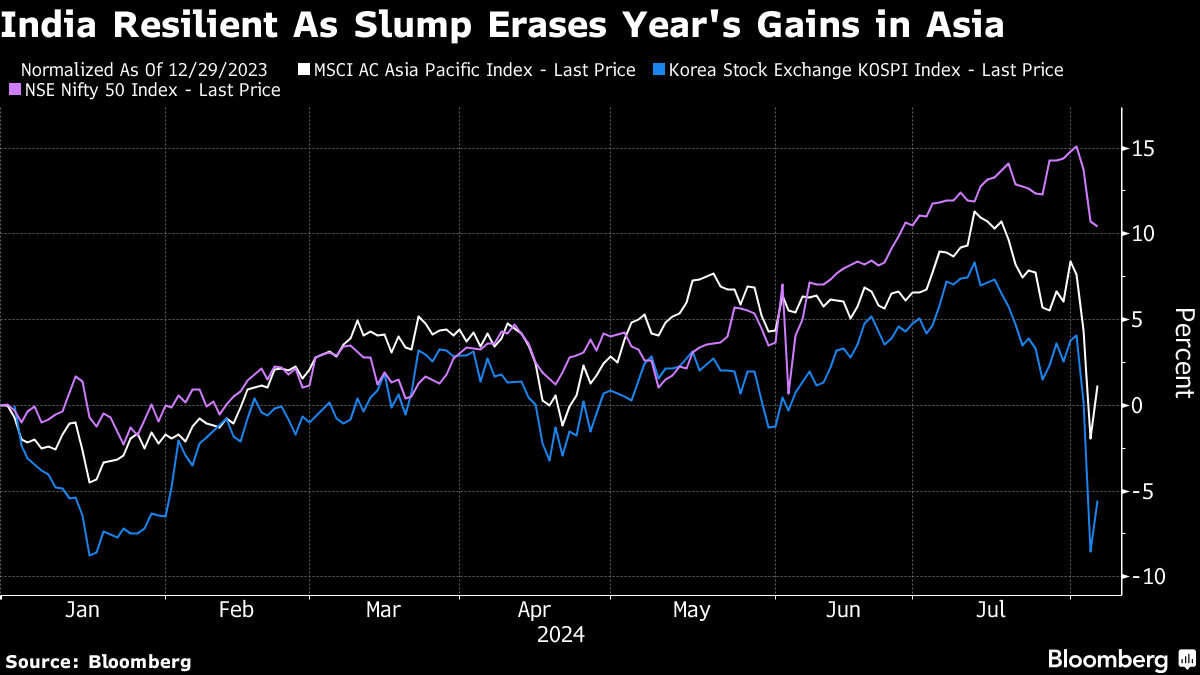

The recent federal budget in India, which focused on fiscal consolidation and capital expenditure, has further bolstered confidence in policy continuity, he added. Additionally, the resilience of the nation's equities to sudden downturns has enhanced the market's appeal.

The nation's benchmark NSE Nifty 50 Index slid 2.7% on Monday, its biggest fall in two months. In comparison, the MSCI Asia Pacific Index, a regional benchmark, tumbled more than 6%, its worst rout since 2008.

“Indian markets didn't correct like other Asian markets did,” Dasani said. “This is a testimony to the domestic-driven economic growth and the fact that domestic institutional flows have become a bigger counterweight over the few years.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.