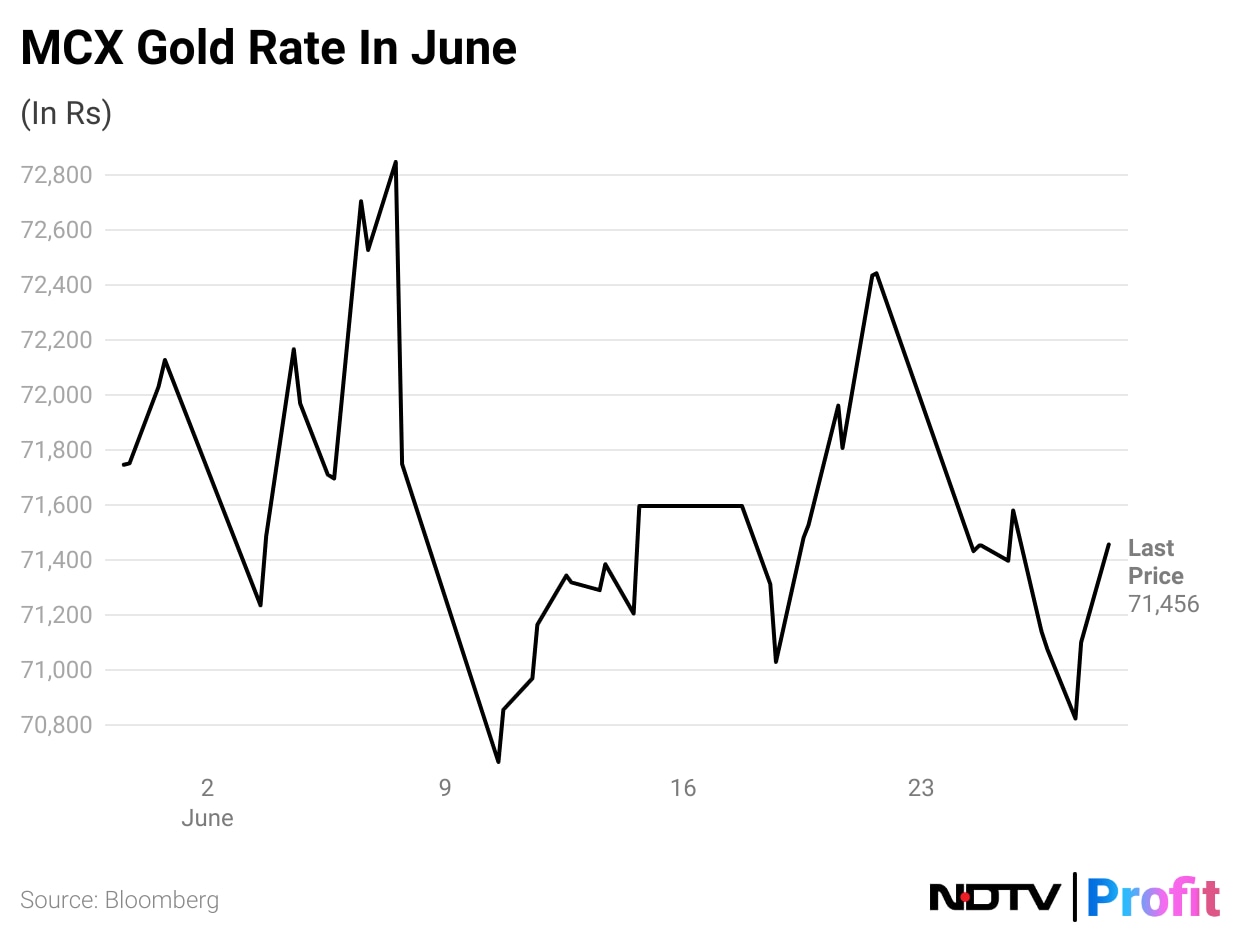

Gold prices cooled off from their highs in May to hover around Rs 71,000 per 10 grams after heating faster than the heatwave this summer. While the bull market run might not be over, prices could see corrections and volatility in the near term. They, too, can provide opportunities for accumulation, according to experts.

“The prices will remain choppy in the near term as I see a technical correction. The prices have gained 20% since January 2024 and settled at 16% as of now. But the phase of consolidation will not last long,” says Hareesh V, head of commodities at Geojit Financial Services.

The staggeringly high prices might have kept retail investors away, but the phase of correction provides good entry potential. “We recommend new investors wait for fresh buying opportunities, which should commence around Rs 69,000 on MCX future prices. Overall, we maintain a strong long-term outlook for gold,” says Rahul Kalantri, vice president of commodities at Mehta Equities.

Gold price in rupee, daily chart

Unwinding Of Expectations

This correction is a result of too fast a run, based on ballooning expectations. China's central bank also paused its gold purchases, which slowed down the rally, while the street was expecting to continue its accumulation.

The street has also been pricing in US Fed interest rate cuts, which have not yet come through. When the Fed lowers interest rates, the dollar weakens and gold prices rise.

The European Central Bank, the Bank of England, the Bank of Canada, and the Swiss National Bank cut interest rates recently. This has sparked hopes of a US Fed interest rate cut, which have not yet materialised.

“The upside price potential for gold is limited in the short term, as the first interest rate cut in the US is only expected to take place at the end of the year,” says Kalantri.

Gold's status as a safe haven was also greatly enhanced in early 2024, after tensions rose around the Gaza Strip. Subsequently, volatility seeped after peace talks in the Middle East.

Chirag Mehta, chief investment officer at Quantum Asset Management, too believes that gold prices could keep moving sideways for some time. “Some of the triggers for the rally have been unwinding. The geopolitical premium is unwinding due to talks of a ceasefire. The market was earlier expecting five interest rate cuts by the Fed, which fell to three, and now it's baking in one,” he said.

Long-Term Triggers Ahead

While trading might be tricky at these levels of volatility, it's good for investors who intend to take long positions. While some of the rally factors have altered temporarily, the underlying factors have remained strong.

“Potential recessions, global inflation, and rising global debts continue to make the gold stronger for investment as they minimise the risk for investors,” says Krishnan R., chief executive officer and director at Unimoni Financial Services.

Mehta explains that the strong run seen in gold is also an impact of long-standing factors like central banks shifting away from the dollar, leading to gains in gold as an alternative asset.

"The main trigger is the underlying debt levels of the US, with trillion-dollar deficits. That leads to nervousness around US treasuries. Gold offers diversity away from the dollar,” Mehta says.

On this account, central banks might continue to accumulate gold, even if there is a temporary pause. “For the last two years, central bank purchases have been at a record level. The trend will continue this year too,” says Hareesh.

On the other hand, retail demand has been strong too, as seen in global physically-backed gold exchange-traded funds (ETFs). They saw inflows to the tune of $212 million, or 2.1 metric tonne, last week, according to the World Gold Council.

More Triggers Ahead

While the depth of expectations might be flatlining, the factors that aid gold value remain. Most experts believe that the next trigger would be a US Fed cut, and from there, there would be another rally in gold.

“In the long run, the broad fundamentals are positive. The global economy is experiencing little growth. These pressures are positive for gold,” says Hareesh.

The events that investors must watch out for are wars and rising tensions across the world. “Geopolitical tensions could be the primary catalyst for the next gold bull rally. The ongoing conflicts between Russia and Ukraine, as well as Israel and Iran, remain unresolved, and tensions are escalating between China and Taiwan. If this situation escalates further, we may witness the most significant and rapid surge in gold prices ever seen,” says Kalantri.

The world has been giving mixed messages, with stubborn inflation at one end and concerns around an economic slowdown, apart from conflicts. In these times, gold is expected to shine in the portfolios of investors who want to save for a rainy day.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of NDTV Profit or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.