Gold prices crossed Rs 81,000 per 10 grams in India. Parents going shopping for wedding jewellery have the rest of the world to thank for the record-breaking prices. The war between Israel and Iran and fears of economies slowing have moved investors the world over to safe havens—in this case, gold. Parents may be rueing the escalation in prices, but money launderers are likely rejoicing. Their preferred choice of converting black money to white just got more lucrative.

Why Gold Is Loved By Money Launderers

Gold is the go-to for organised crime. It is easy to transport across borders; its value never really falls and in India, illicit gold is easily absorbed into the mainstream, no questions asked. Plus, Indians love the yellow metal.

“According to the FATF (Financial Action Task Force), gold is an attractive commodity for laundering money due to its cash-intensive nature and associated anonymity,” said Prem Mahadevan, senior analyst at Global Initiative against Transnational Organised Crime.

“By refining gold repeatedly, smuggling syndicates attempt to erase its source, such that investigators cannot easily establish what percentage of a particular consignment is part of the legitimate gold trade. Trade in recycled gold requires little by way of start-up capital and thus, operations can be opened or shut down quite rapidly. This flexibility is an added asset when it comes to evading detection and tracking by law enforcement,” said Mahadevan.

Let's put this in numbers.

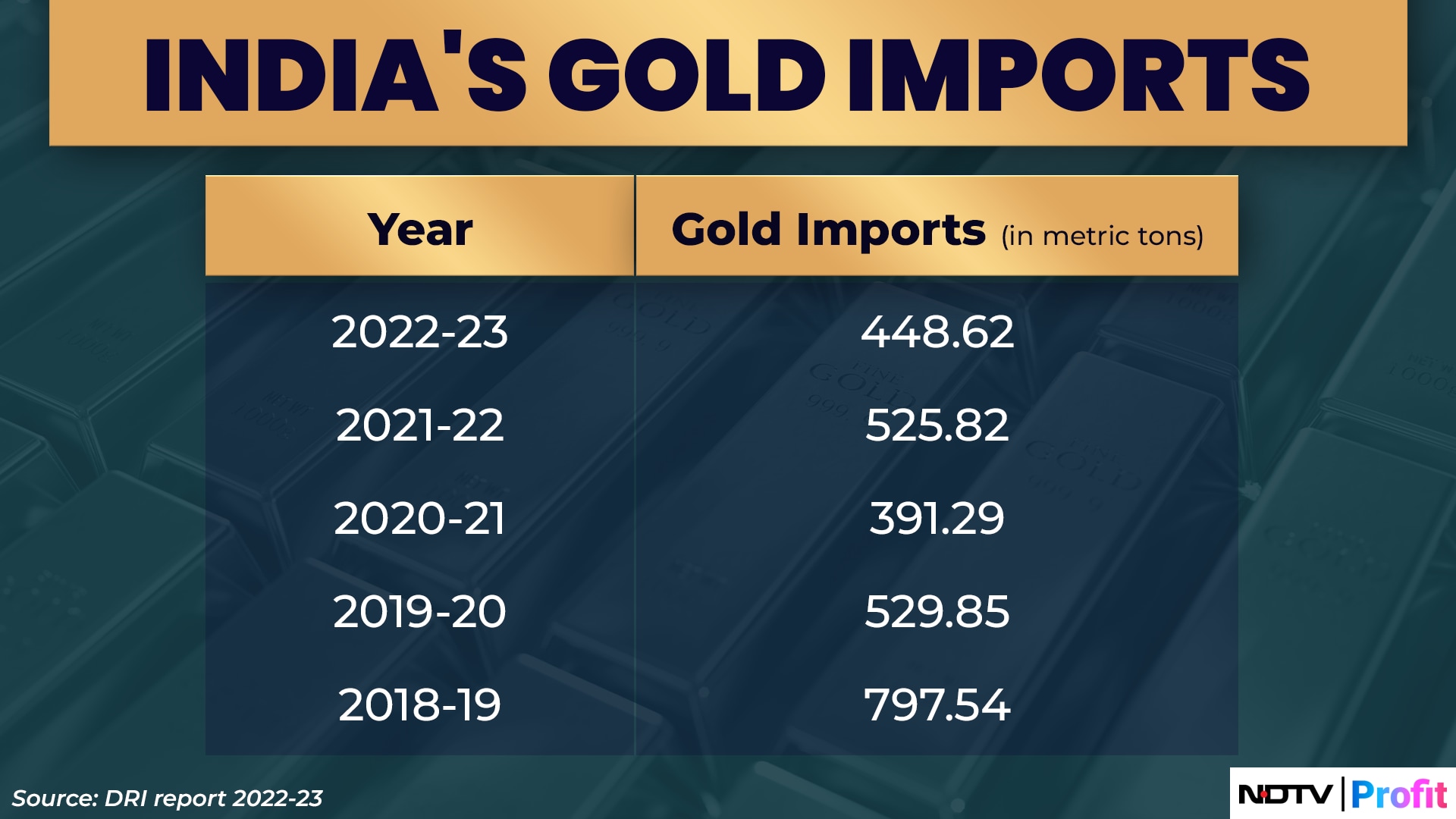

In 2022–23, India imported close to 500 metric tonnes of gold, primarily from Switzerland, Bolivia, Peru and the UAE.

Imports dipped during the pandemic but staged a strong comeback almost immediately after.

Compare this to the pre-pandemic year 2018-19, when close to 800 metric tonnes of gold were imported.

(Photo source: NDTV Profit)

Research shows that India imported close to 800 metric tonnes of gold per year between 2012 and 2017, to the tune of $30 billion.

To understand the insidiousness of this business, let us compare India's gold imports with exports of gold jewellery.

(Photo source: NDTV Profit)

Arguably, the value of gold goes up when it is made into jewellery—either studded or plain. But a sizeable amount of the gold that is exported is also smuggled gold, which has been remade into jewellery.

Estimates by researchers show that on average, 150 to 200 tonnes of gold are smuggled into the country and swallowed up by the grey market.

This smuggled gold is then melted down, turned into gold jewellery and exported to countries like the UAE. Mumbai's Zaveri Bazaar is one such place where smuggled gold is absorbed and given legitimacy.

Prominent Ways Of Gold Smuggling

Gold is smuggled into India by air, sea and land. Smuggled gold arrives in Sri Lanka from countries like Uganda, Peru and the UAE. It is then transported by boat to India. Mid-sea exchanges are common, with Indians collecting the gold via fishing boats and smuggling it through Tamil Nadu and Kerala.

Similarly, gold also arrives at ports in Mumbai and Gujarat in consignments, often disguised as powder or as compounds with other metals, to avoid detection.

Couriers carry smuggled gold by air. The most popular route is from the UAE, Saudi Arabia, Qatar and Bahrain to Kerala. Gold is hidden in the body's orifices, in the linings of bags, and disguised in cavities in suitcases and tools.

The yellow metal is smuggled from Bangladesh, Myanmar and Nepal by land through the northeastern states of Manipur and Mizoram. Thanks to porous borders and the residents of border towns in India being allowed to travel within a certain distance of neighbouring countries, these areas have become hotbeds of gold smuggling.

The Directorate of Revenue Intelligence seized 1,452 kg of illicit smuggled gold in 2022–23 alone.

Illicit money is laundered using gold through international hawala.

The Indian's love for gold has fuelled the rush. Gold privately held in India was in the range of 20,000-25,000 metric tonnes as of 2018-19, as per Fintelekt, a firm specialising in anti-money laundering practices.

Fintelekt estimates that 700 kg of gold is smuggled into India every day, which causes losses of $9.8 billion (as of FY19). They have calculated the size and scale of money laundering in India at $5.75 trillion to $14.375 trillion.

Much of this is through round-tripping of finances. The money, often from drug, arms and terror financing, is routed from Venezuela to Dubai. From there, it goes to Uganda, back to Dubai and then to Switzerland before arriving in India.

GFMS Thomson Reuters is another organisation that tracks gold smuggling around the world. They found that 78% of the gold imported into India for export purposes is used for round tripping.

In 2018, 176 tonnes of gold were utilised for round-tripping, while only 50 tonnes covered actual gold exports.

Similarly, in 2017, 157 tonnes of gold were used for round tripping while only 41 tonnes covered actual gold exports.

In the first 10 months of 2018, 114 tonnes of gold were estimated for round tripping, according to GFMS.

A Brief History Of Gold Smuggling In India

Gold smuggling began in India in the 1960s and 70s, as part of a large-scale migration of the labour workforce to the UAE, writes Prem Mahadevan in his 2020 report called Gilded Aspirations. Impoverished migrant labourers, mostly from Kerala, were eager to make a quick buck by smuggling gold into India via fishing dhows.

Mafia dons like Haji Mastan and later Dawood Ibrahim made their careers in crime by indulging in gold and electronics smuggling.

When the Indian economy was liberalised in 1991, gold smuggling almost disappeared. However, it would rear its head again in the early 2000s, when the government raised import taxes on gold from 1% to 10% in barely 10 months in 2012 and 2013.

The infamous 80:20 scheme, too, was launched in August 2013. Under the scheme, 80% of gold imports could be sold in the country. At least 20% of imports had to be exported before importers could bring in new consignments.

This scheme gave a huge boost to gold smuggling, as the local markets absorbed large quantities of illicit gold.

All of this resulted in a 300% spike in estimates of gold smuggled to India as the prices became sharply higher.

This smuggled gold caused a loss of government revenue to the tune of $1.3 billion, according to GI-TOC's Mahadevan.

By 2019, the customs duty on gold was raised to 12.5% and the GST regime increased sales tax on gold from 1.2% to 3%.

How Can India Prevent Gold Smuggling?

India has, since, cut import duty tax on gold, possibly in a bid to stave off gold smuggling.

Finance minister Nirmala Sitharaman had slashed customs duty on gold from 15% to 6% in the latest budget.

As a consequence, India's gold imports spiked by 221% between July and August this year. The value of gold imports went from $3.13 billion in July to $10.06 billion in August, according to Commerce Ministry data.

Curbing gold smuggling must be a priority for India, as, apart from losses to the exchequer, it also functions as a network that enables terrorism and drug trade.

“The Indian security community has carried out intelligence-based operations indicating an ability to penetrate smuggling networks with high-grade informants,” said Prem Mahadevan.

“Such efforts should of course be maintained and wherever possible stepped up, as the geographic concentration of gold smuggling cases in India indicates an effort to undermine India's economic security by land, air and perhaps sea routes. The last is worrying due to the risk of maritime terrorism. We have the tragic experiences of the 1993 and 2008 attacks on Mumbai before us, planned by elements of a hostile state's intelligence agencies with the support of non-state proxies and making use of smuggling infrastructure to support the pre-attack reconnaissance and logistics,” he explained.

With rising gold prices, it is now all the more necessary for border security agencies to step up their vigil to prevent gold smuggling.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.