(Bloomberg) -- Gold declined after surging to a fresh record as simmering Middle East tensions intensified buying momentum of the haven asset.

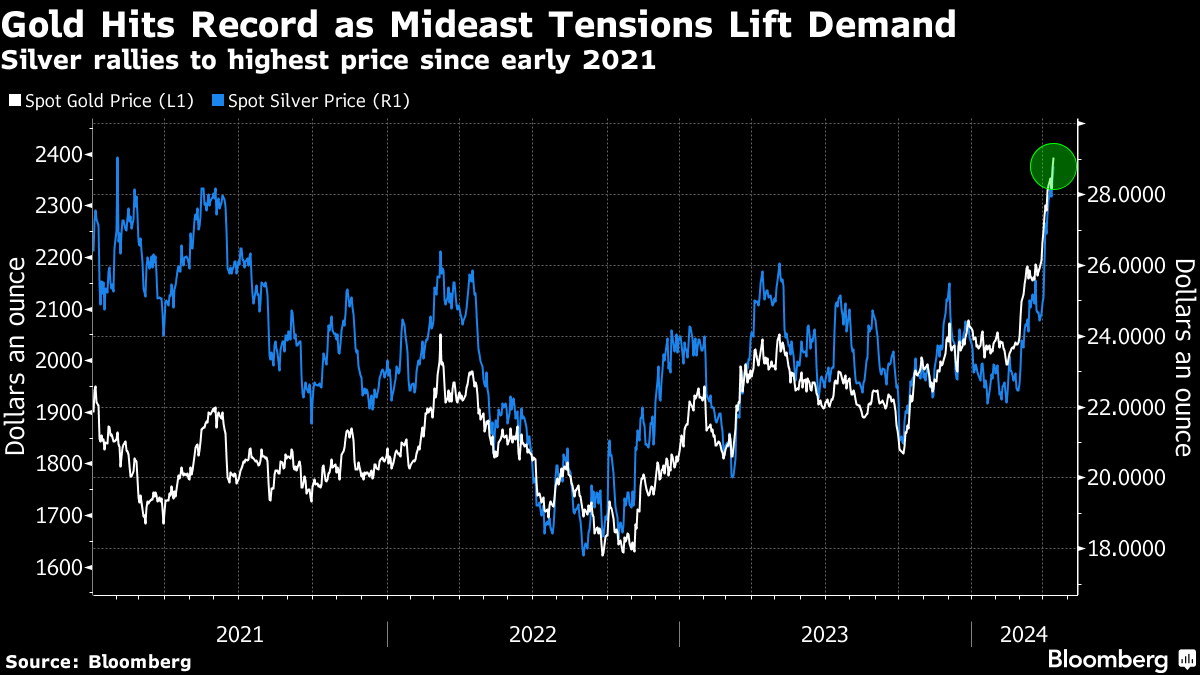

Bullion broke the $2,400-an-ounce mark for the first time early Friday, climbing as much as 2.5% to $2,431.52 before erasing gains to fall as much as 0.6%.

The precious metal has advanced nearly 15% so far this year, exceeding the 13% advance registered for all of last year. Its rally and often-outsized moves have left some onlookers puzzled because of the lack of any obvious triggers — particularly as the outlook for interest-rate cuts by the Federal Reserve has become muddier in recent weeks.

Elevated tensions in the Middle East and Ukraine and ongoing problems in China's economy are adding to bullion's allure as a haven asset. Meanwhile, some investors have been seeking safety on bets that inflation may stick higher in the long run, underpinning gold's run. Central banks buying, led by China, have added some bullish momentum.

Israel is bracing for a direct and unprecedented attack by Iran on government targets as soon as Saturday, according to people familiar with western intelligence assessments, a move that has the potential to trigger an all-out regional war.

Continued strong buying from China also underpinned prices, with the premium in Shanghai surging, according to Nicky Shiels, head of metals strategy at Geneva-based MKS PAMP SA. “The markets have become rather disorderly as convexity kicks in and it just starts trading big figure to big figure,” she said.

Traders are buying gold call options around $2,500 and $3,000 to chase the rally, further supporting prices.

Spot gold was down 0.4% at $2,363.16 an ounce at 1:10 p.m. in New York, with the metal on track for a fourth weekly advance, the longest such run since early 2023.

The buying momentum in gold has spilled over to silver. The white metal rallied to as much as $29.797 an ounce, the highest since February 2021. Both metals' 14-day relative-strength indexes are hovering near 80, well beyond the level that some investors see as overbought, potentially heralding a pause.

Platinum and palladium advanced, even as the Bloomberg Dollar Spot Index traded at the highest level since November. A stronger US currency is typically a headwind for commodities priced in the greenback as it can dull interest from overseas buyers.

“Geopolitical risk is the fulcrum here,” said Rhona O'Connell, head of market analysis at StoneX Financial Ltd. In a year with more than 50 local and national elections, ongoing tensions in the Middle East add “further fuel to the fire.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.