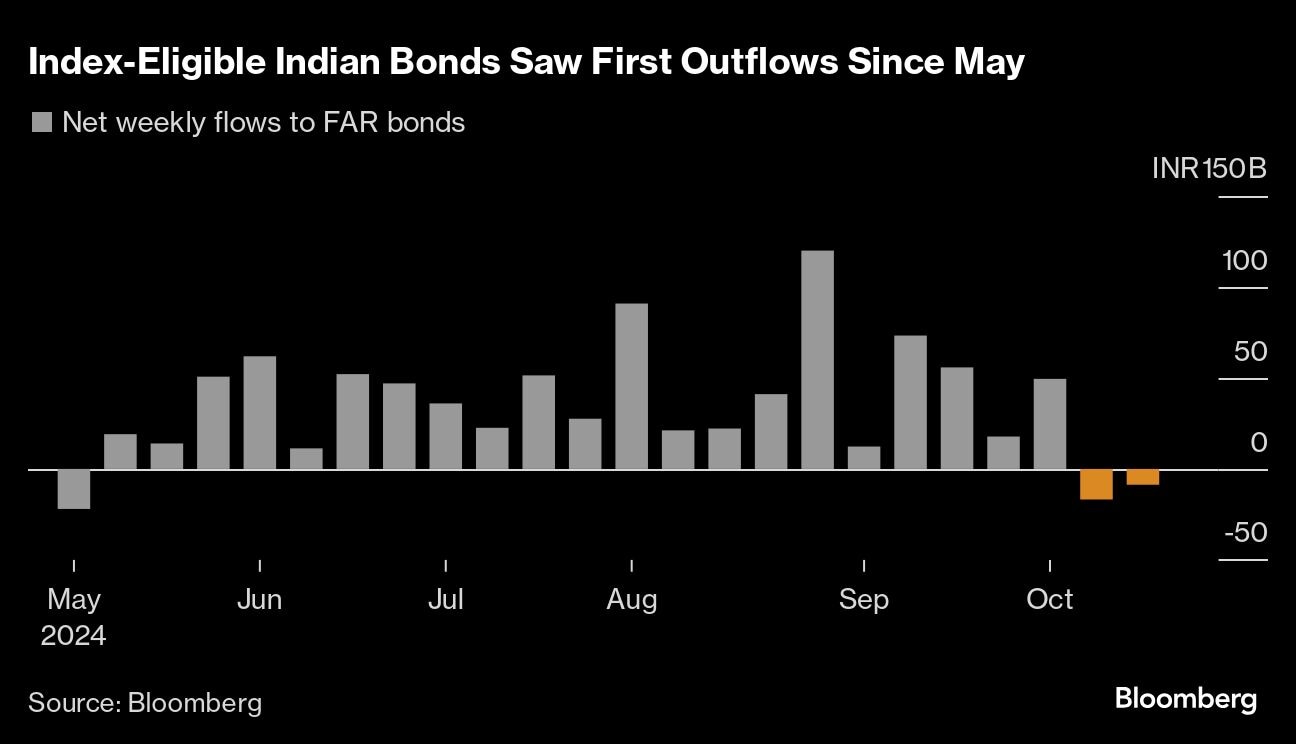

Indian sovereign bonds that are eligible to trade on global debt indexes saw their second weekly outflow, signaling overseas investors are cooling on the nation's debt.

Global funds last week sold Rs 870 crore ($104 million) of the so-called Fully Accessible Route bonds — a special category of debt that's freely available to foreigners, according to the Clearing Corporation of India data.

This follows withdrawals of about $200 million in the previous week — the first net sale of such bonds since the addition of Indian debt into JPMorgan Chase & Co.'s index in June. Overall, foreigners have been net sellers of local bonds, prompted in part by Indian central bank's reluctance to follow global monetary authorities in cutting rates.

The shift comes as traders pare back expectations for Federal Reserve interest-rate cuts, boosting the dollar. That's putting pressure on emerging-market assets, with the gap between India and US yields narrowing. A return of almost 8% on Indian debt this year — among the highest in Asia — is also prompting some investors to take profit.

“It's a kind of profit-booking,” said Sandeep Agarwal, head of fixed income at Sundaram Asset Management Co. in Mumbai. “If we look at the buying that happened before the actual inclusion in June, Indian yields have been steady, while globally yields have moved up.”

The spread between yields on 10-year Indian government bonds and US Treasuries of the same maturity has narrowed about 50 basis points since early September.

A more hawkish Indian central bank is also damping the allure of the nation's debt. Central bank Governor Shaktikanta Das said Friday a rate cut at this stage would be “very, very risky” and he's in no hurry to join the wave of easing by global policymakers. This suggests the yields will not fall anytime soon, limiting capital gains for investors.

Despite the outflows in the past two weeks, net inflows into the FAR bonds are more than $7 billion since the index inclusion in June. India is also due to join FTSE Russell and Bloomberg emerging market indexes next year. These inclusions, however, are likely to have a limited incremental impact on passive inflows.

Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which administers indexes that compete with indexes from other providers.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.