(Bloomberg) -- Global government bonds got off to a cautious start as traders pared bets on deep interest-rate cuts from major central banks this year.

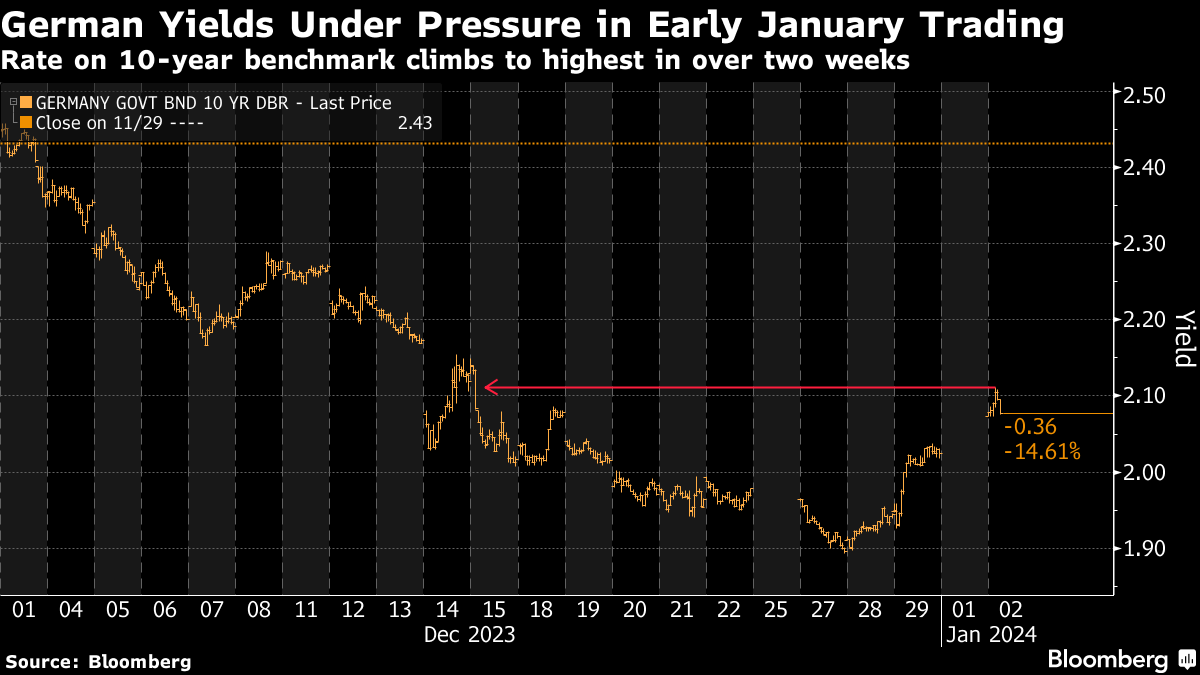

Germany's 10-year yield jumped as much as nine basis points to 2.11%, the highest in more than two weeks, while the equivalent UK rate rose 13 basis points. US Treasury yields were up at least six basis points across the curve, putting the Bloomberg Dollar Spot Index on track for its biggest daily advance in almost three months.

The moves reflect doubts that policymakers will deliver the extent of monetary easing that's priced by money markets. While central banks have indicated that they've likely delivered the final hikes of this cycle, they will also be reluctant to give up the fight against inflation too soon.

“The market should probably have a bit more of a bearish tone going forward,” Emmanouil Karimalis, a rates strategist at UBS Group AG, said in an interview with Bloomberg TV. “The ECB and other central banks have not signaled the all clear.”

Traders are betting on 158 basis points of European Central Bank easing this year, about 10 basis points less than last week.

While euro-area inflation has been in retreat, central bank officials see a risk that readings tick up in the coming months, and traders will be attentive to consumer price growth data for the region due Friday. The conflict in the Middle East has also spurred fears over the oil price, which was rising on Tuesday.

In the US, money markets briefly priced fewer than 150 basis points of Federal Reserve easing in 2024 for the first time since Dec. 21. While the pace of hiring is moderating, a resilient labor market supports views that the economy will continue to expand in 2024, albeit at a slower rate.

The prospect of heavy new issuance is also likely weighing on bonds, particularly after their strong performance ahead of year-end. The US 10-year has rallied sharply since late October, when it briefly yielded more than 5%.

“Maybe bond yields have moved a little bit too low just in near term,” said Iain Stealey, international chief investment officer for fixed income at JPMorgan Asset Management. Still, yields look “attractive” from a long-term strategic perspective if central banks have finished hiking rates, he added.

(Adds dollar move in second paragraph, comment in last.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.