Shares of Gland Pharma Ltd. fell to their lowest level in nearly one month on Wednesday after its first-quarter profit missed analysts' estimates.

The company's consolidated net profit declined 26% on the year to Rs 144 crore in the quarter ended June 2024, according to an exchange filing. That compares with Rs 214 crore consensus estimates of analysts tracked by Bloomberg. Gland Pharma's operating profit also decreased 10% on the year to Rs 264 crore during the same period.

Higher raw material costs, tax payments, and employee costs weighed on the pharmaceutical company's revenue and consequently affected the bottom line, Nirmal Bang said in a note.

Delays in new launches in European markets during the first quarter also affected earnings for the period, according to Motilal Oswal Financial Services Ltd.

Gland Pharma's consolidated top line grew 16% on the year to Rs 1,402 crore during the first quarter from Rs 1,209 crore. Volume growth in key injectables and new product launches supported the revenue growth, Gland Pharma said in a press release. Gland Pharma uses 16% of its revenue for research and development, the company said.

However, the revenue figure for the period was below the estimated Rs 1,519 crore projected by a Bloomberg survey. India outlook for Gland Pharma and the recovery in the Chinese market remain bleak, according to Motilal Oswal Financial Services.

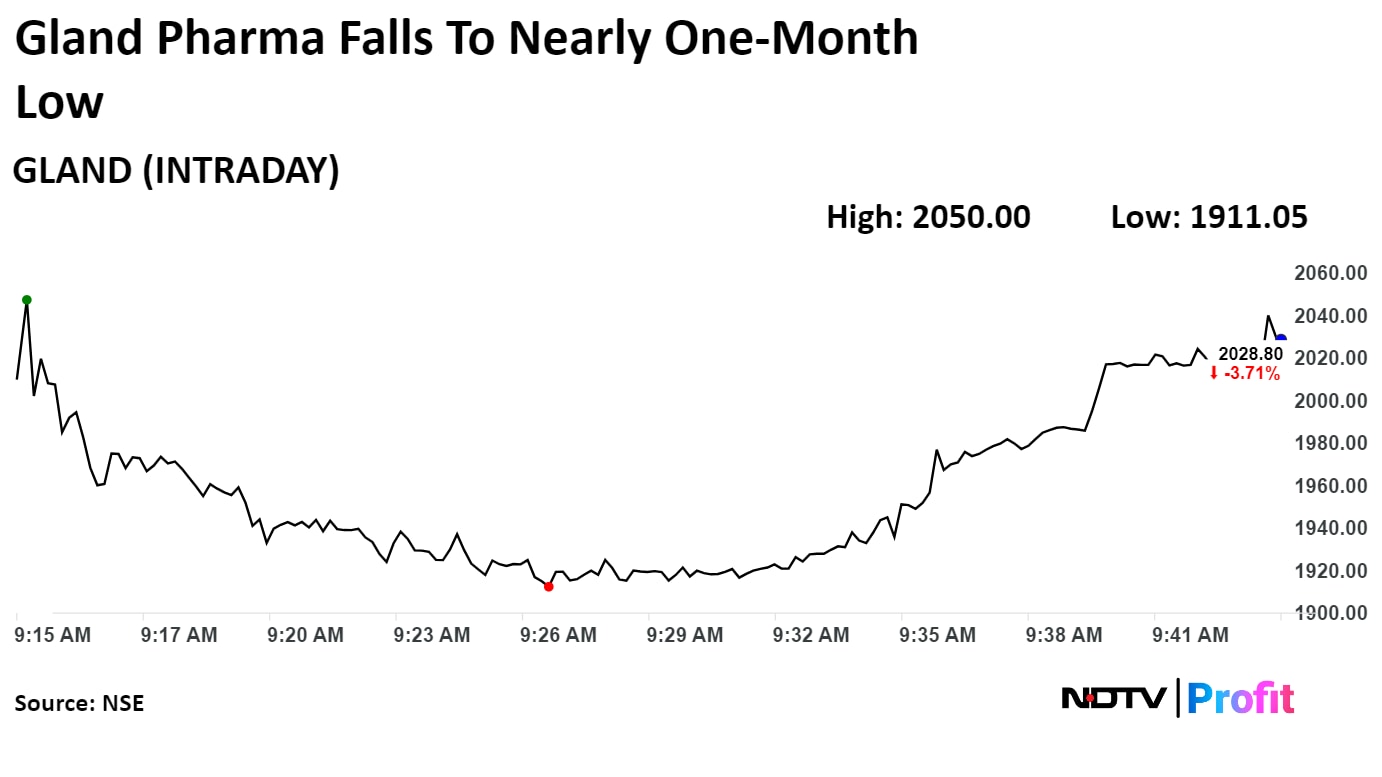

Shares of Gland Pharma slumped 9.30% to Rs 1,911.05, the lowest level since July 9. It pared some of its losses to trade 3.67% lower at Rs 2,029.55 as of 09:58 a.m., compared to 0.94% advance in the NSE Nifty 50 index.

The stock gained 42.89% in last 12 months and declined 0.17% on year to date basis. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 41.77.

Out of 19 analysts tracking the company, 10 maintain a 'buy' rating, three recommend a 'hold,' and six suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a upside of 2.9%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.