(Bloomberg) -- India and Indonesia were once famously lumped together as part of Morgan Stanley's “Fragile Five.” A decade later they are investor favorites.

The outlook for the bonds and currencies of the two Asian behemoths has brightened following successful programs of reforms and fiscal restraint, according to fund managers including Fidelity International, Robeco Group and abrdn. Even elections in the two countries this year are unlikely to spook investors.

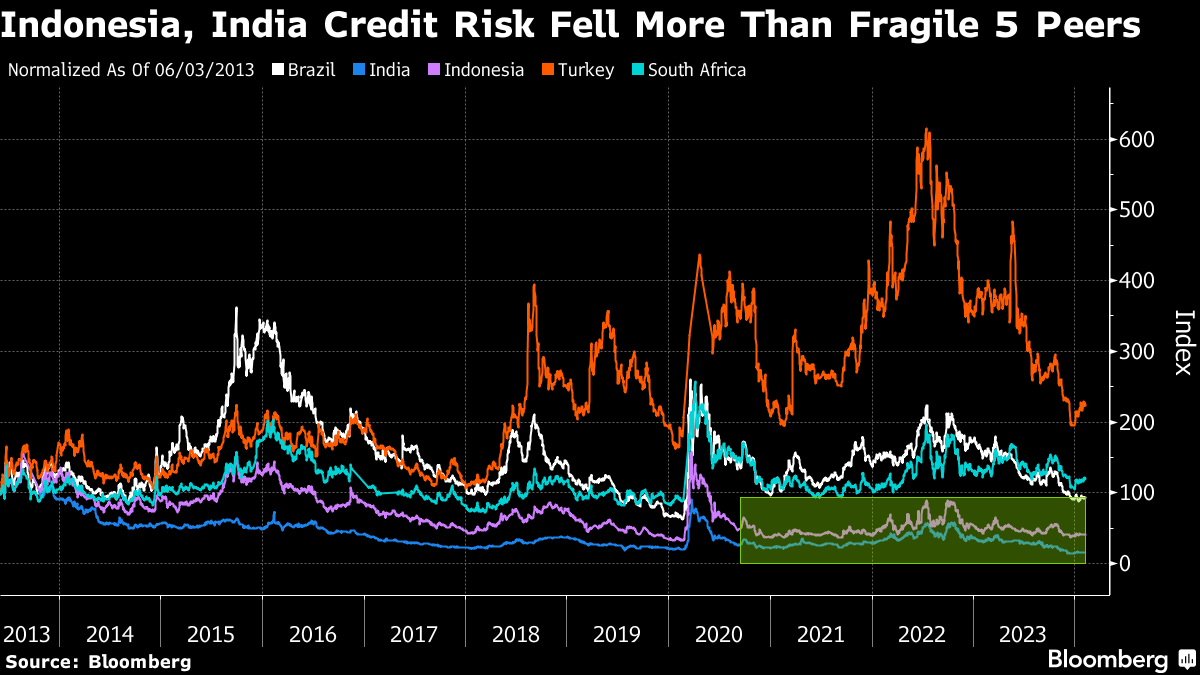

The original Fragile Five — which also included Turkey, South Africa and Brazil — referred to nations perceived to be most at risk due to their heavy reliance on foreign investment to drive growth. Improving finances — as reflected in credit-default swaps — show the market's view of India and Indonesia has swung almost 180 degrees since the term was coined in 2013.

“Both India and Indonesia have strong near- and long-term fundamentals,” said Kitty Yang, tactical asset allocation analyst for multi asset at Fidelity International in London. “Growth is underpinned by positive (and continuing) reforms over the past 10 years under Prime Minister Modi and President Jokowi.”

India's five-year credit default swaps — derivatives used to protect bonds against default — have dropped about 85% from their 2013 peak, reflecting an improvement in the nation's credit quality. Similar-maturity CDS on Indonesia's debt has fallen 70% in the same period. In contrast, prices of Turkey's default swaps have risen.

Overseas investors poured a combined $14 billion into Indian and Indonesian bonds last year, even as global debt markets were sold off on the prospect of higher-for-longer global interest rates. That was the highest joint inflow into the two countries since 2019, and compares with outflows of $3.9 billion in 2013.

‘Long Overdue'

India's bonds have rallied over the past four months on the prospect of global index inclusion, and they extended gains in February after the government surprised the markets by announcing lower-than-estimated debt sales. The yield on the ten-year note slipped one basis point on Monday to 7.10%, taking its decline since an October high to nearly thirty basis points.

The government also said it planned to cut its budget deficit to 5.1% of gross domestic product, below the 5.3% predicted by economists in a Bloomberg survey.

“India is long overdue for a credit rating upgrade” as reforms have improved its fundamentals and resilience, thus creating some of the best opportunities in equity and fixed-income markets, said Kenneth Akintewe, head of Asian sovereign debt at abrdn Asia in Singapore.

Prime Minister Narendra Modi, who is standing for re-election in May, referenced the Fragile Five in a speech to parliament this month. During the previous government, “the entire world used words like ‘Fragile Five' and policy paralysis for India. And in our 10 years - among the Top 5 economies. That is how the world talks about us today,” he said.

The expression “Fragile Five” was coined by Morgan Stanley's James Lord about a decade ago, identifying the countries as vulnerable economies. Lord is now global head of FX and EM strategy at the bank. A representative from Morgan Stanley declined to comment.

Disciplined Indonesia

Indonesia has also taken great strides in improving its finances.

After temporarily breaching the regulatory fiscal deficit limit of 3% of gross domestic product in 2020 and 2021 due to Covid-related spending, the government narrowed the shortfall to 2.38% in 2022, one year earlier than projected. The fiscal gap shrank to 1.65% in 2023, below a revised projection of 2.28% made in July.

Indonesia has been very disciplined with keeping its fiscal deficit below the 3% threshold, with the exception for a couple of years during Covid, said Stephen Chang, a fund manager at Pacific Investment Management Co. in Hong Kong. “Even with a new administration, we think some of these economic policies will continue.”

Risk Factors

An election to appoint a new Indonesian president on Feb. 14 would previously have been a major risk factor for investors, but is currently seen as less of a concern given reforms are so entrenched.

That's despite the fact that front-runner Prabowo Subianto has campaigned on promises such as free lunches for 83 million beneficiaries, and said he's comfortable with the nation increasing its debt levels to as much as 50% of gross domestic product.

Markets have also been jittery about the potential resignation of Finance Minister Sri Mulyani Indrawati who has been credited with stabilizing the government's finances.

Sri Mulyani has made the Ministry of Finance “a better place than she found it in both of her terms, and that assists the fundamental investment thesis for Indonesia,” said Philip McNicholas, an Asia sovereign strategist at Robeco Group in Singapore. Still, “it seems unlikely that there would be an evident deterioration in the overall process of the ministry,” he said.

McNicholas said the outlook for both Indonesia and India remains positive.

“Both economies have favorable longer-term economic outlooks. A lot of low-hanging fruit remains, offering scope to enhance growth prospects further.”

What to Watch

- India, Poland and the Czech Republic will release inflation figures with any signs of further disinflation likely to spur dovish bets

- The Philippine central bank will announce a rate decision on Thursday

- Hungary, Poland and Colombia publish GDP data

- Chinese markets will be closed for the whole week for Lunar New Year, while South Korea, Taiwan, Singapore and Malaysia are all shut at least on Monday

- Brazilian markets are also closed for a holiday Monday and Tuesday, returning for a half-day on Wednesday

--With assistance from Ruth Carson, Malavika Kaur Makol and Carolina Wilson.

(Updates with Indian bond prices in paragraph under ‘Long Overdue')

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.