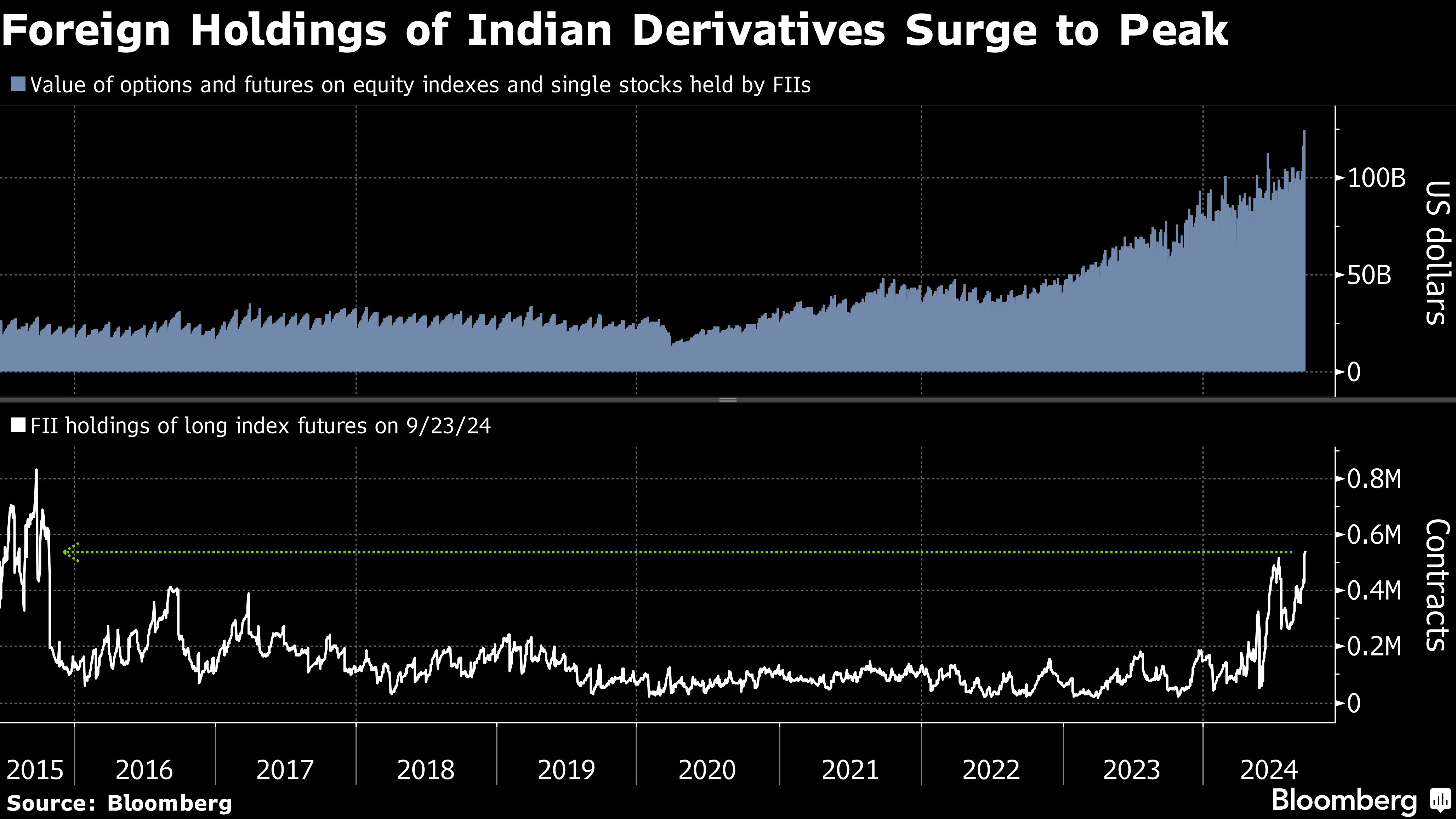

With Indian stocks hitting successive records, global funds have pushed up their derivatives wagers to unprecedented levels.

By Monday, foreign institutional investors owned more than Rs 10 lakh crore ($124 billion) of options and futures on equity indexes and single stocks listed on the National Stock Exchange, according to data compiled by Bloomberg. At the same time, they bumped up their bullish bets on index futures, including those tied to the NSE Nifty 50 gauge, to almost 5.4 lakh contracts — the highest level since 2015.

Since stumbling in June after Prime Minister Narendra Modi's party lost its majority in parliament, Indian equities have staged a remarkable comeback. The Nifty has rallied 18% from a low that month to become one of Asia's top performers. It hit a fresh peak Monday amid a risk-on sentiment in global markets following the Federal Reserve's jumbo rate cut last week.

“The indication is clear that foreigners are turning bullish on India and this stance is expected to stay for a while,” said Anuj Dixit, executive vice president of equities at Mumbai-based Sovereign Global.

Global funds have plowed a net $8.5 billion into local shares from July 1 through the end of last week, set for the biggest quarterly inflow in more than a year. That's despite stocks trading at high valuations relative to emerging-market peers.

--With assistance from Paresh Jatakia.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.