Coffee's premium arabica bean is soaring in a move that's set to impact the price of your morning caffeine fix. Silver demand is outstripping supply. And Europe will face more expensive natural gas after drawing down stockpiles to weather winter.

Here are five notable charts to consider in global commodity markets as the week gets underway.

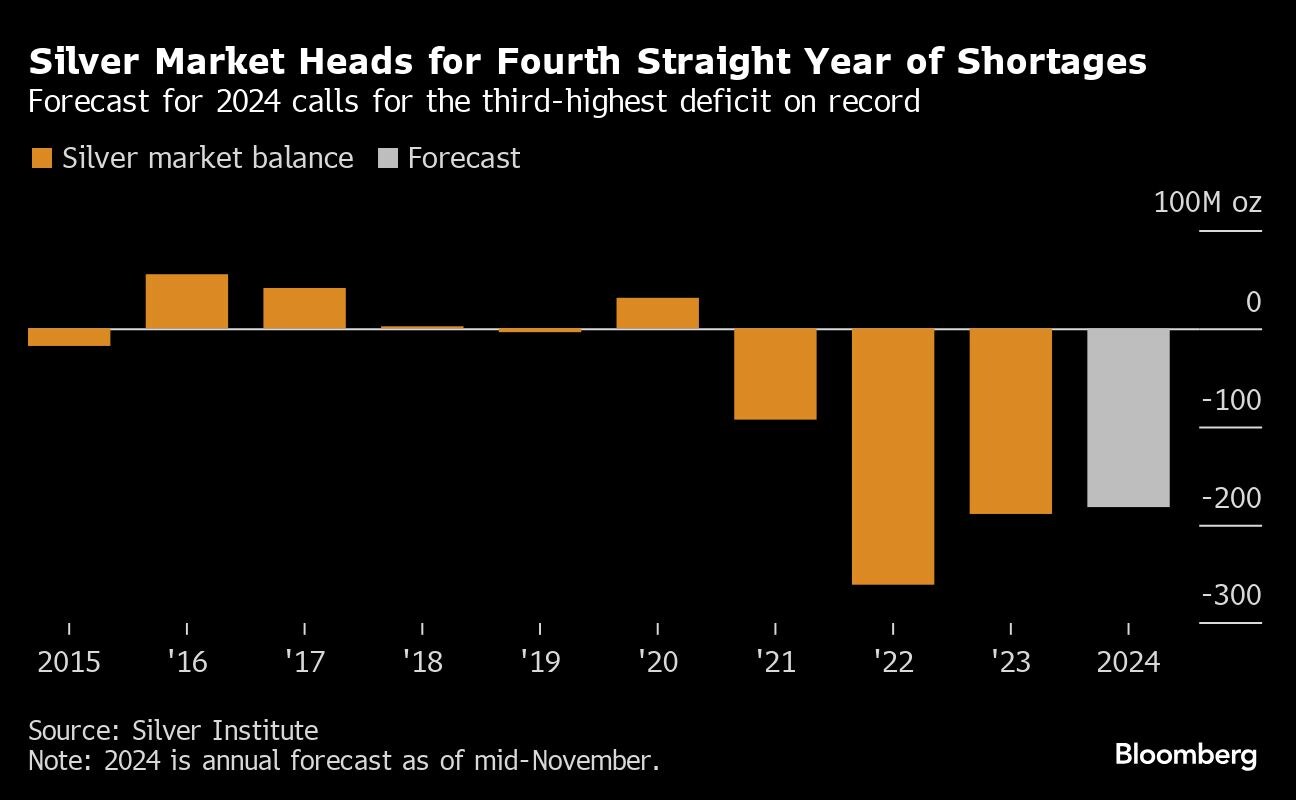

Silver

Demand for silver has been so strong since 2021 that supply from mines cannot keep up. That's causing a production shortfall for the precious metal, which is widely used in electronics and solar panels as well as for jewelery and investment. The market is expected to record its fourth straight year of shortages in 2024, according to the Silver Institute, the metal's industry association. The supply deficit is helping to boost prices, with a 31% gain since January that puts the metal on track for its best year since 2020.

Coffee

Futures of the premium arabica bean reached fresh 13-year highs, as concerns rise over supplies from top grower Brazil. A strong pace of exports this season out of Brazil, the world's top supplier, is seen draining the country's stockpiles, raising concerns over tightening supplies before the new harvest arrives in July. Fears are also mounting over the size of the crop after dry weather earlier this year hurt trees. Brazil's annual arabica production is expected to slump 11%, according to StoneX's first estimate for the 2025-26 season.

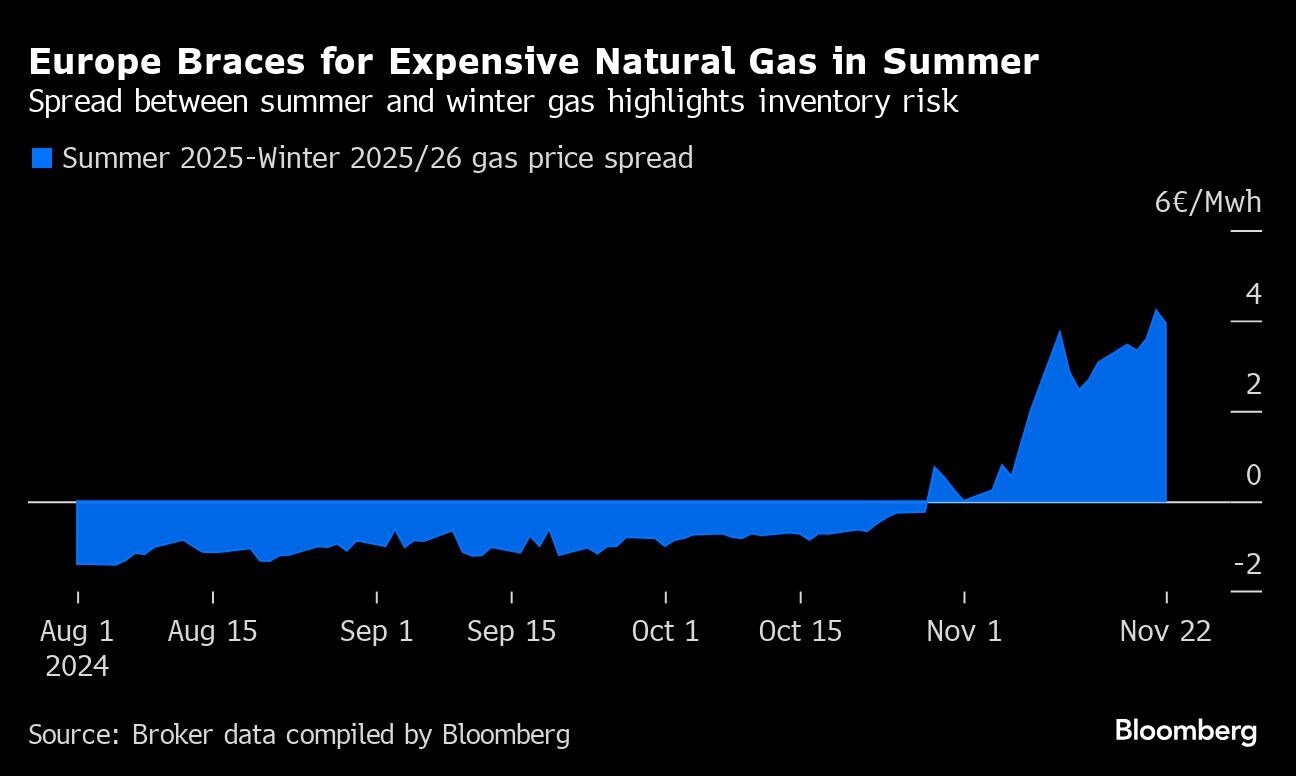

Natural Gas

Natural gas is going to be expensive for Europe just when the region will have to work harder to refill its storage sites. Prices for next summer are trading at a premium to rates seen next winter, which can make the next stockpiling campaign more challenging and costly. Europe is actively using inventories at the start of this year's cold winter and faces a loss of Russian gas transiting Ukraine next year, meaning the continent will have to compete with Asia to attract global liquefied natural gas instead.

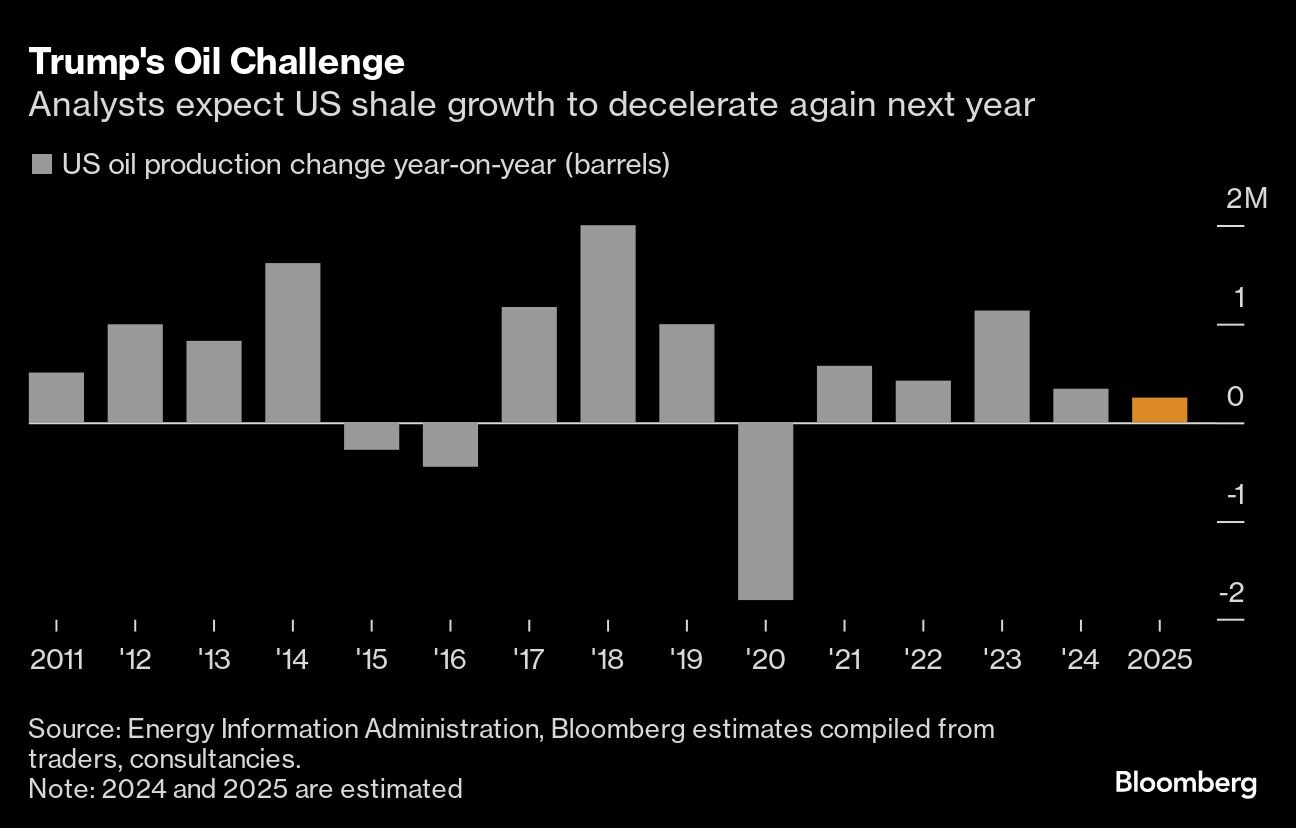

Oil

US President-elect Donald Trump's vow to “frack, frack, frack” is about to collide with a global crude oil glut that's set to temper record shale production. Trump has said he'll push America's shale companies to ramp up output, but his second term will follow two straight years of record US output. Against this backdrop, analysts and traders surveyed by Bloomberg see the US adding just 251,000 barrels a day from the end of this year through 2025, the slowest pace since a pandemic-driven drop in 2020.

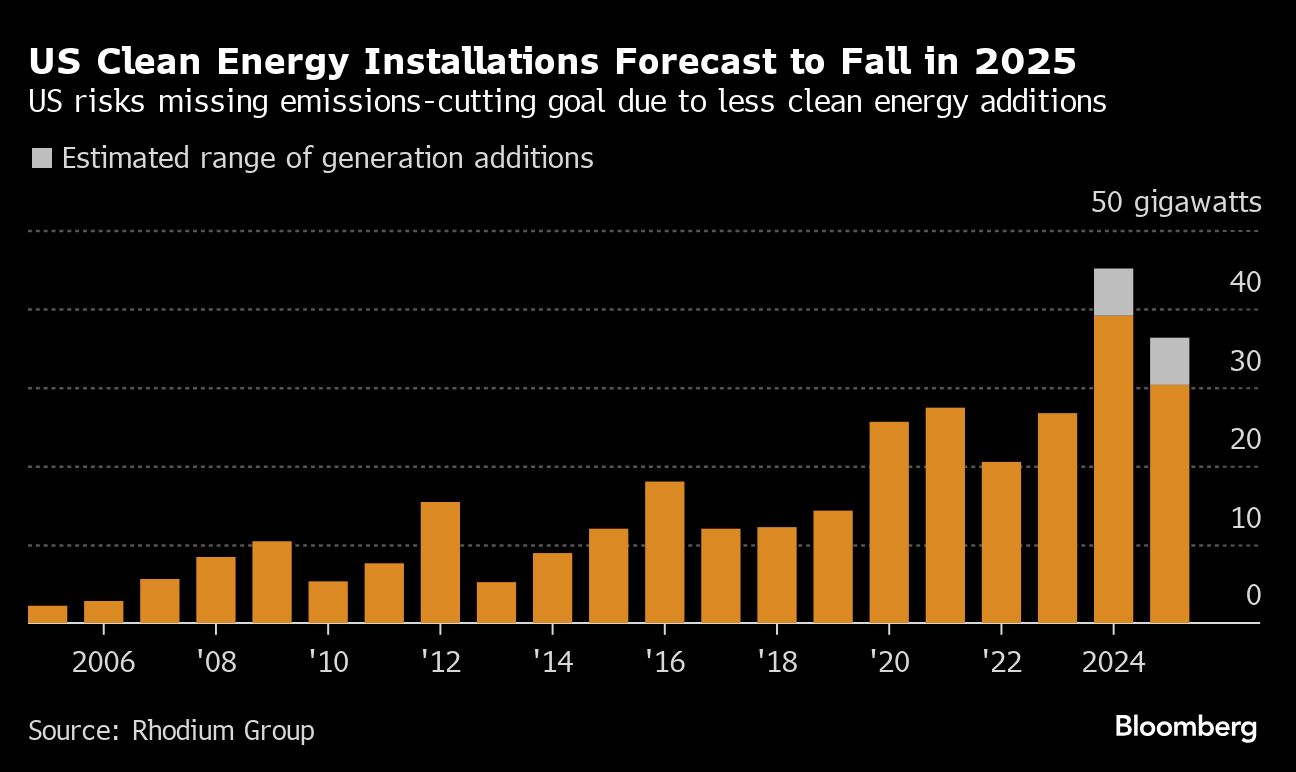

Renewables

President Joe Biden's push to curb carbon emissions by boosting clean energy output is falling short of expectations. The US is on track to curb greenhouse gas emissions by 30% by 2030, according to estimates from research firm Rhodium Group, which is less than the government's own prediction of a 40% decline in five years. Rhodium researchers say the shortfall is due to lower-than-expected additions of projects such as wind turbines and solar farms — even with 2024's “record-breaking surge” of additions to clean electricity capacity.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.