Nomura Holdings Inc. has initiated coverage of the Federal Bank Ltd. with a 'buy' rating and a target price of Rs 190 as the private lender is expected to post strong core operating profit within the next four years.

Nomura expects unsecured loans, which have always been low in the private bank's portfolio, to grow up to 7% of the total portfolio between the current financial year and fiscal 2026. In the first half of the fiscal, Federal Bank's unsecured retail portfolio constituted 3% of the total loan portfolio, according to a note on Monday.

The private lender's loan growth will also get a boost from an uptick in the unsecured loan. Its loan is expected to grow at a 19% compound annual growth rate between the current fiscal and 2025–26.

On the Reserve Bank of India's new tougher norms on unsecured loans, Nomura said the Federal Bank's conservative approach to "underwriting" and low contribution of this segment to the mix is to provide comfort. "Federal Bank ticks all the right boxes for a strong banking franchise, in our view, well-capitalised, strong liabilities franchise, with historically strong asset quality that is expanding its product bouquet."

Nomura sees a 22% growth in core pre-provisional operating profit over fiscal 2024–26. A strong thrust on fees will drive pre-provision operating-profit growth over the next four years. The return on equity is expected to grow by 13.8% for the period.

Nomura expects the private lender's net interest margin to be on an improving trajectory, even though it is currently less than that of other private banks. Key risks to the Federal Bank's growth trajectory include slow growth in the NIMs and an increase in the cost of funds.

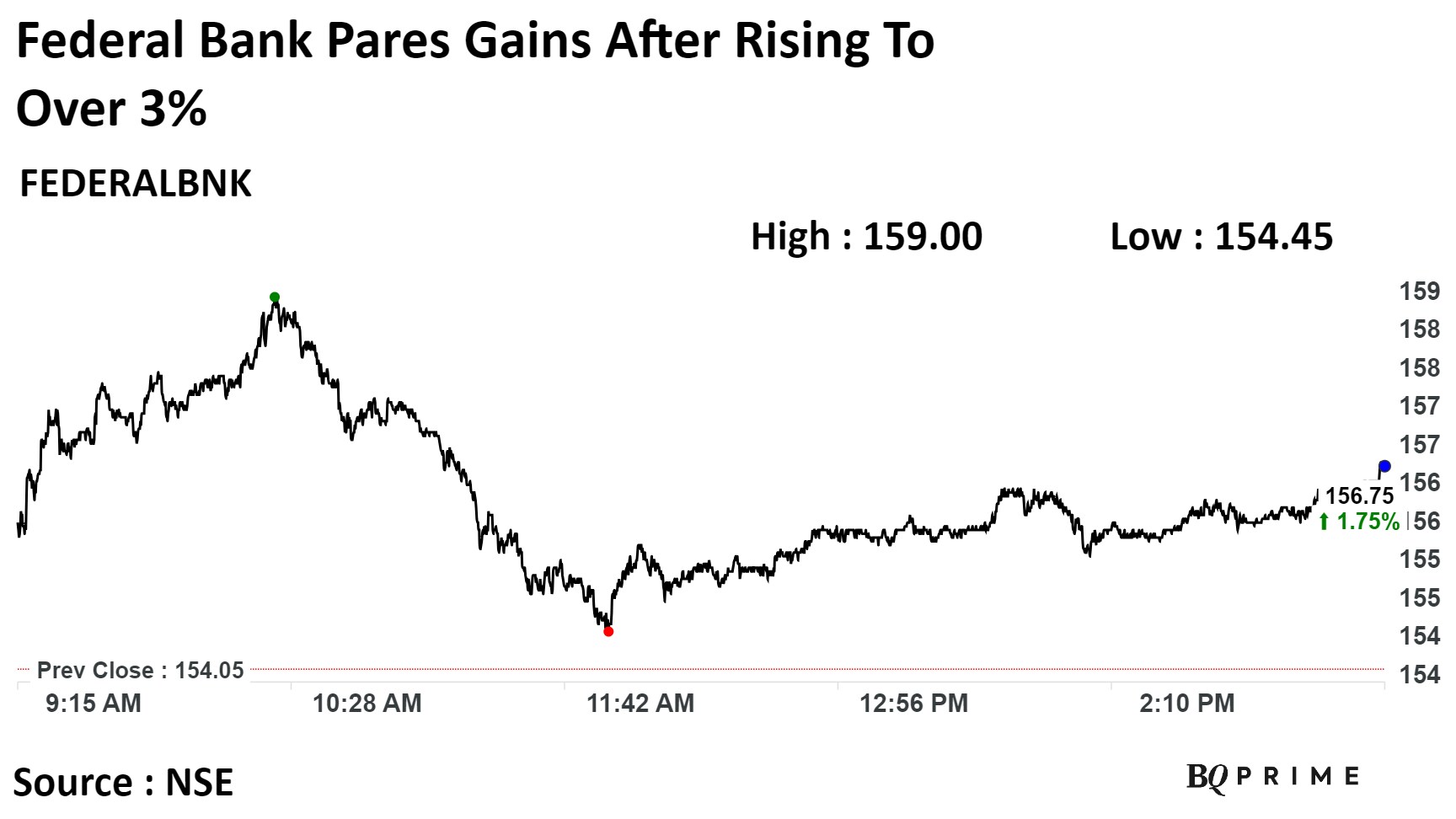

The Federal Bank's stock rose as much as 3.25% during the day to Rs 159 apiece on the NSE. It pared gains to close 1.62% higher at Rs 156.55 per share, compared to a 0.81% advance in the benchmark Nifty 50 on Tuesday.

It has risen 12.37% on a year-to-date basis. The total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was 67.48.

Thirty-five out of the 40 analysts tracking Federal Bank maintain a 'buy' rating on the stock, while five recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.