The Federal Bank Ltd., IDFC First Bank Ltd. and AU Small Finance Bank Ltd. will be the impacted the most among private sector banks by the RBI's draft circular on liquidity management as they have lower liquidity-coverage ratio, according to analysts.

Among public sector banks, Bank of Baroda has a lower liquidity ratio, Motilal Oswal Financial Services Ltd. said in a report.

The Reserve Bank of India's framework suggests a new set of rules, which will require banks to make special arrangements to avoid excessive run-off of retail deposits. "While increased usage of technology has facilitated the ability to make instantaneous bank transfers and withdrawals, it has also led to a concomitant increase in risks, requiring proactive management," it said.

Bernstein Research explained that the key change was a higher runoff for retail deposits, which could reduce the liquidity coverage ratio by 10–15 percentage points for the large banks.

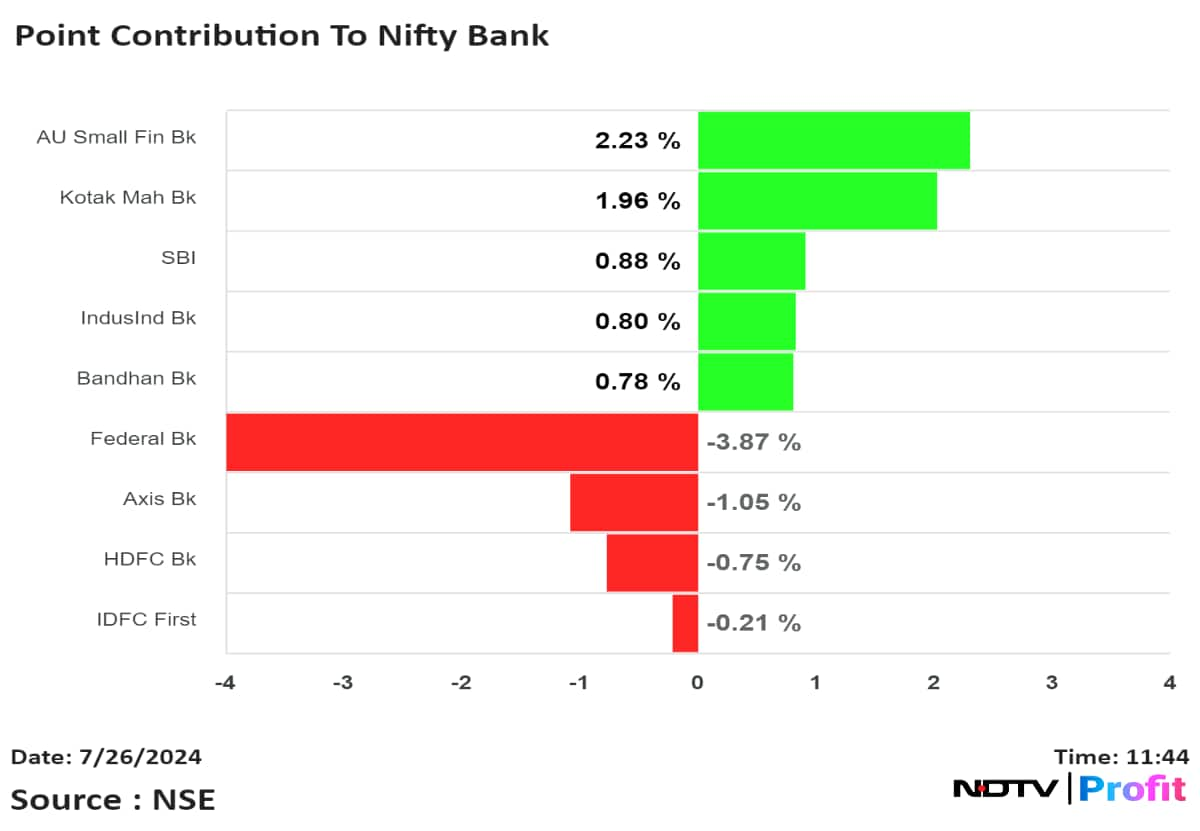

Federal Bank was the top loser among the Nifty Bank's constituents. The stock snapped its four-day rally on Friday. Shares of AU Small Finance, however, were up over 2%, while those of IDFC First Bank fell as much as 3% to hit lowest since June 5.

IIFL Securities' report said the LCR might fall below the threshold for Federal Bank, adding that these norms would drive the credit-deposit ratio and margin lower for banks.

Banks with a larger share of retail deposits will see a greater impact, especially the public sector banks. The measure appears directionally negative due to the limited number of commercial banks in the country as compared to other markets, according to Bernstein.

"This appears as an excessive measure, especially when the increased runoff factor for retail deposits is not offset by any changes," it said. "If the banks intend to maintain same levels of LCR, they could see a RoA (return on assets) impact of around 5 basis points."

The impact on the banks' LCR ratio is broadly 7–13%, according to Motilal Oswal.

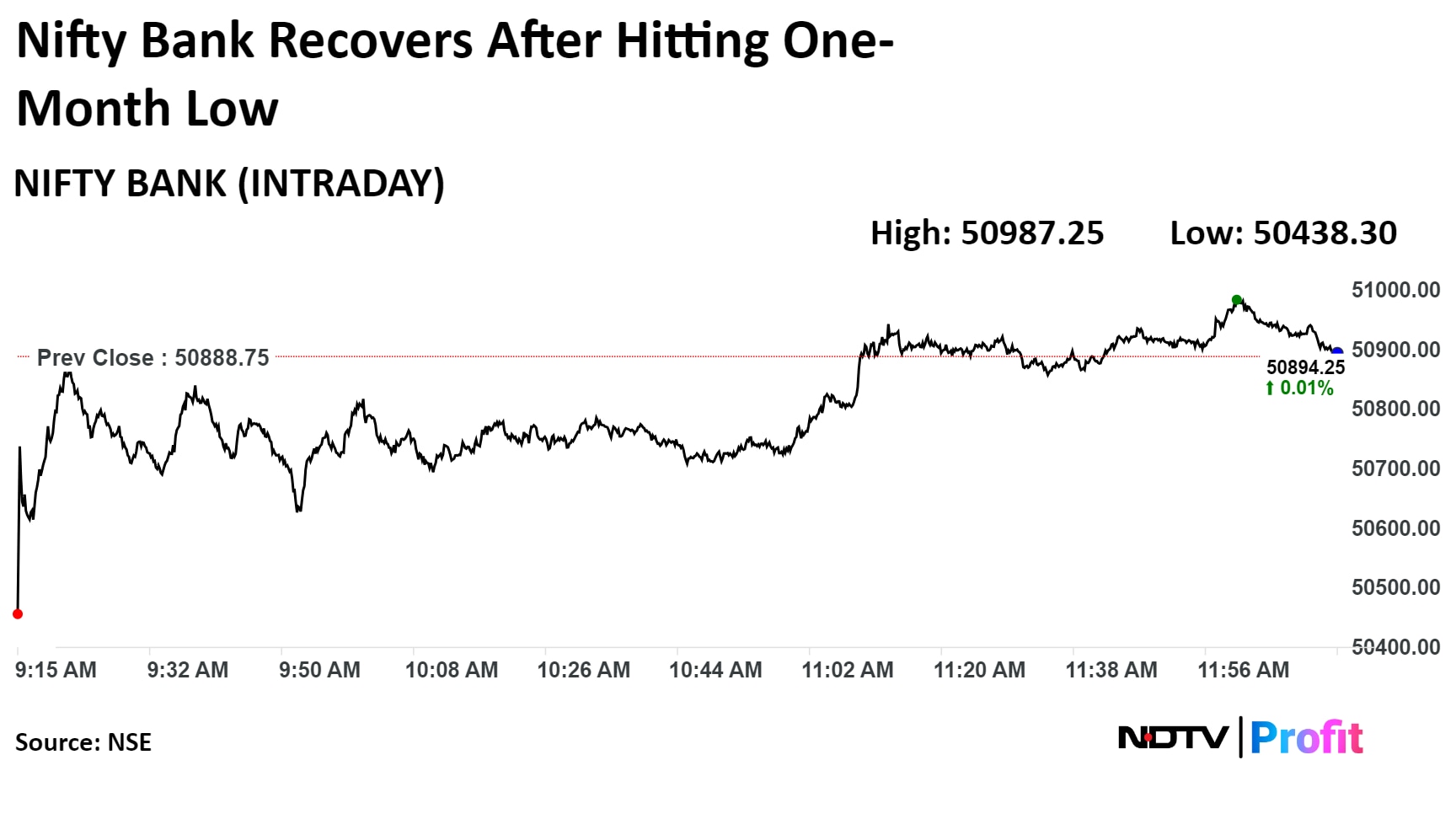

The Nifty Bank had fallen 0.9% during the day to 50,438.30, the lowest in over a month. It recovered to trade flat as of 12:15 p.m.

More On RBI's Draft Rules For Liquidity Management | Watch

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.