(Bloomberg) -- European equities posted their longest weekly gaining streak since April, with optimism that central banks are ready to start cutting interest rates sending the Stoxx 600 to trade around its highest levels since early 2022.

The benchmark Stoxx Europe 600 Index ended the session little-changed, trimming earlier gains after New York Federal Reserve President John Williams commented on rates. He pushed back against the idea that the central bank has begun to cuts, and said it's “premature” to be thinking about cutting interest rates in March.

And data showed private-sector activity in France and Germany has worsened from a month prior, finishing the year in a deeper contraction due to low demand for goods and services.

Among sectors, miners and tech stocks outperformed, while real estate stocks and telecoms were among the laggards. Among individual movers, German chemicals maker Symrise AG fell after a profit warning. Campari Group also dropped after it agreed to buy Courvoisier Cognac from Beam Suntory for at least $1.2 billion in the largest acquisition in the Italian drinks maker's history.

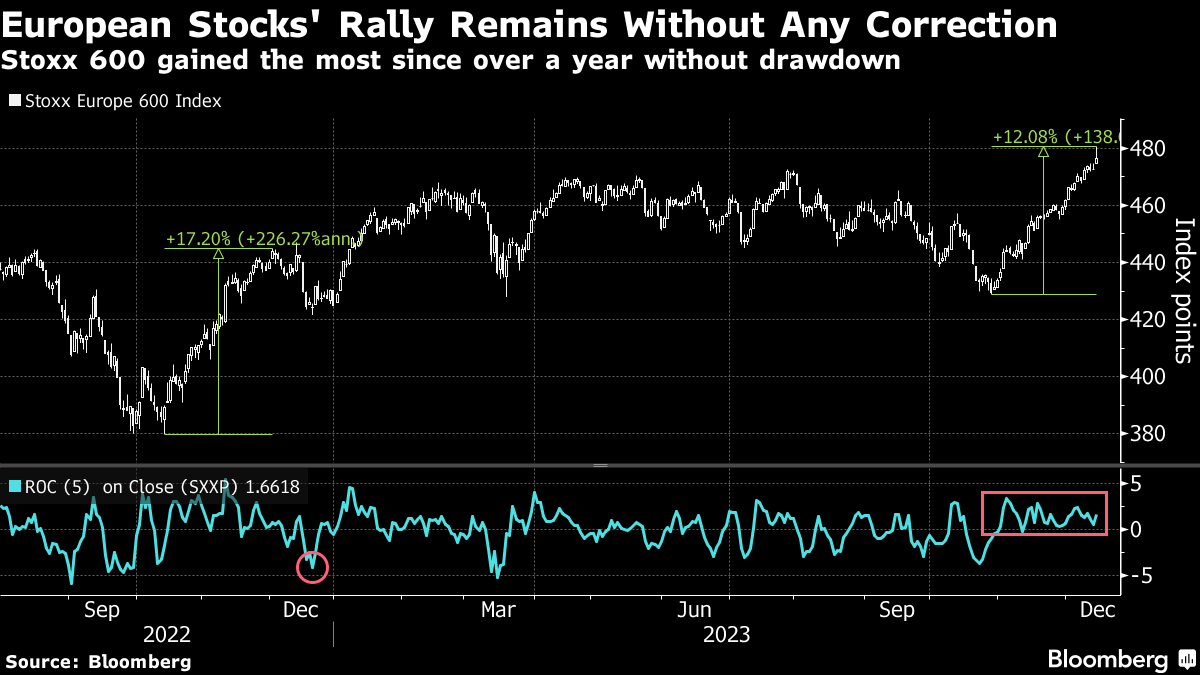

European stocks have bounced since hitting a low in late October as investors bet that central banks would not raise interest rates further. Dovish signals from policymakers this week ignited a rally in this year's laggards, including Swedish real estate stocks.

However, the market is now looking overheated, according to some technical indicators. The Stoxx 600's Relative Strength Index shows the benchmark is now the most overbought since November 2021.

Frederique Carrier, head of investment strategy for RBC Wealth Management in the British Isles and Asia, said stocks might be due to “take a breather.” “Performance in Europe this year has largely been driven by less than 10 high quality large cap stocks and we expect this dispersion to narrow,” she said. “The combination of a cheap, underowned and unloved market can be a powerful one.”

Meanwhile, Bank of America Corp. strategists see a 19% downside for the Stoxx 600 by mid-2024.

For more on equity markets:

- Equity Investors Bet Soft Landing Is a Done Deal: Taking Stock

- M&A Watch Europe: Unilever, Campari, JCDecaux, Kahoot!, Essity

- HSBC Boosted by Mideast IPOs to Top of EMEA Ranking: ECM Watch

- US Stock Futures Fall; Eos Energy, Scholastic, Lennar Fall

- The BOE's Rate-Cut Conundrum: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika, Jan-Patrick Barnert, Sagarika Jaisinghani and Kit Rees.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.