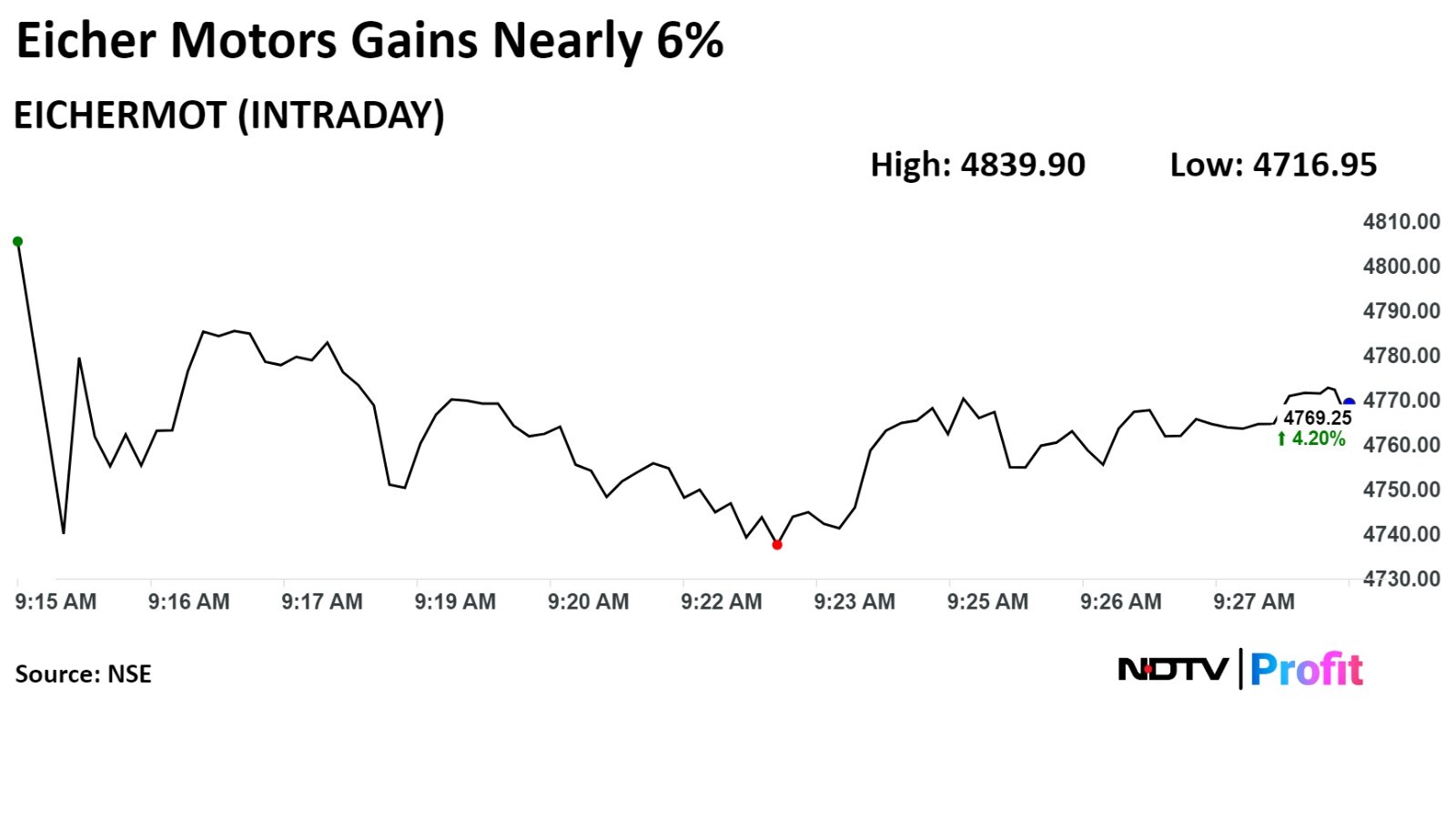

Shares of Eicher Motors Ltd. came out of their six-day losing streak and rose nearly 6% after the company reported better than expected earnings in the June quarter.

Shares rose as much as 5.75% before cooling off a bit to trade 4.2% higher at Rs 4,769 apiece as of 10:40 a.m. This compares to a 1.6% rise in the NSE Nifty 50.

The company posted a 19.93% rise in profit to Rs 1,101 crore year-on-year for the three months ended June as compared to Rs 918 crore for the same period last year, according to an exchange filing.

Brokerages like Citi, in the earnings note, have forecasted that Eicher-owned Royal Enfield's earnings will grow by 11% each year from fiscal 2024 to fiscal 2026.

However, for the near-term, Citi has trimmed its target price to Rs 5,250 from Rs 5,300 due to reduced volume estimates and, similarly, Motilal Oswal has scaled it down from Rs 4,045 to Rs 3,920.

Motilal Oswal expect Royal Enfield's sales to grow by 5% each year from fiscal 2024 to fiscal 2026. Their profit margins will stay mostly the same because even though selling more spare parts and apparel could help, tougher competition might offset these gains, it said.

Although their sales were lower than usual, Citi mentioned that the company is still positive about the future. The brokerage expects that new models like the Guerrilla 450 and changes in how dealers manage their inventory will boost sales.

Despite the recent drop in Royal Enfield sales, we think the stock is fairly priced, Jefferies said. "The company is trading similarly to its competitors."

The brokerage recommended 'buying' rating but have lowered their target price to Rs 5,500 from Rs 6,000. This valuation puts Royal Enfield at 27 times its projected fiscal 2026 earnings and VE Commercial Vehicles Ltd., or VECV, at 6 times its expected fiscal 2026 book value.

VECV is a joint venture between the Volvo Group and Eicher Motors.

They also have a cautiously optimistic view on international sales. The focus on their new 450-cc bikes is likely to keep improving their profit margins, it said.

Eicher Motors Q1 FY25 Highlights (Consolidated, YoY)

Revenue up 10.3% to Rs 4,313.34 crore. (Bloomberg estimate: Rs 4,307 crore).

Ebitda up 14% to Rs 1,165.43 crore. (Bloomberg estimate: Rs 1,127 crore).

Ebitda margin up 92 basis points to 26.5%. (Bloomberg estimate: 26.20%).

Net profit up 20% to Rs 1,101.46 crore. (Bloomberg estimate: Rs 1,016 crore).

The Eicher stock has risen 39.48% in the last 12 months and 14.76% year-to-date. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was 47.62.

Out of 42 analysts tracking the company, 17 maintain a 'buy', 11 suggests a 'hold', and 14 recommend a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 1.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.