(Bloomberg) -- The European Central Bank's forecasts and any accompanying messaging are about to take prominence as President Christine Lagarde weighs how far to push against market wagers on interest-rate cuts.

With rapidly weakening inflation, a feeble economy, and one hawkish policymaker changing tack, traders are heaping bets on a reduction as soon as March. They're now seeing the rate falling to 2.5% by the end of 2024; just last week, they envisaged borrowing costs staying above 3%.

If markets are right, the ECB will be the first among major central banks to cut next year, delivering the most aggressive easing cycle. But officials show no rush to act, even though their new projections will need to acknowledge the changed economic backdrop with a lower outlook for prices.

The quandary policymakers face evokes December 2021, when they dragged their feet as the US Federal Reserve enacted a hawkish pivot and investors began betting on ECB rate increases. Forecasts then showed inflation accelerating, but hikes only started seven months later, a move most observers judged as behind the curve.

Lagarde and her colleagues, who entered a blackout period on Thursday before the Dec. 14 decision, face a similar trade-off now as they ask which error they'd rather risk making: cutting too soon and letting inflation run rampant, or crashing the economy with too much constriction.

Bjoern Griesbach, senior investment strategist at Allianz, reckons the consumer-price danger is still weighing on many officials' minds.

“The projections will be very important,” he said. “One thing is clear: they need to come down. But the ECB is determined not to be caught underestimating inflation for a second time.”

Officials are putting finishing touches on the forecasts that Lagarde will present next Thursday along with a view of where the risks lie — communication that may in itself massage expectations.

The projections are more comprehensive than those in September and involve a half-yearly process compiling numbers from national central banks, whose deadline to provide data was a week ago. December forecasts are also the only ones out of the four annually to feature a longer horizon into the future — in this case, 2026.

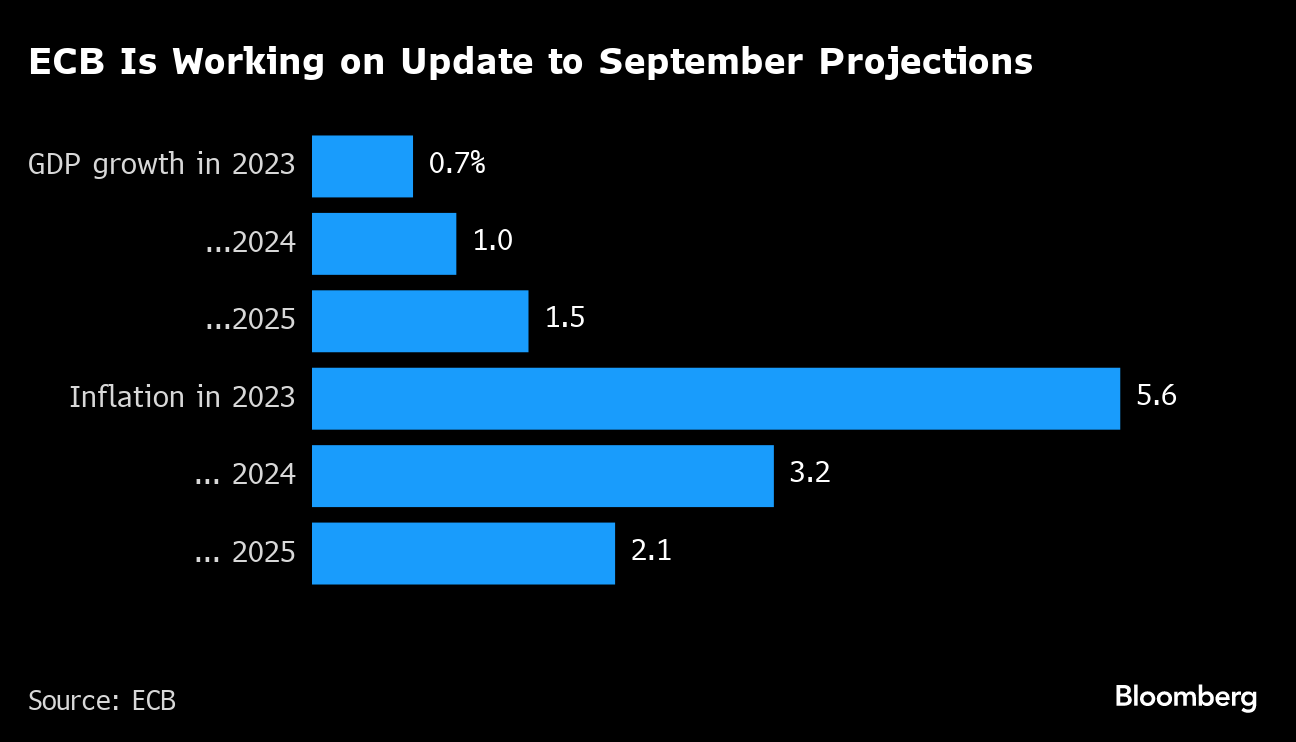

The ECB previously predicted inflation to average 3.2% next year and return to the 2% goal in the second half of 2025. That outlook seems increasingly obsolete after consumer-price growth in November slowed to 2.4%, the lowest since mid-2021.

ECB Executive Board member Isabel Schnabel, normally a hawk, admitted that the number was “remarkable” and that any further rate hike is unlikely. She wouldn't be drawn on the prospect of a cut in the first half, though Bank of France Governor Francois Villeroy de Galhau did say that the question may come up in 2024.

Schnabel and others warn that inflation could yet quicken again, but the data and their commentary have persuaded investors to bet on earlier and deeper rate cuts.

It also led some economists to revise outlooks, with Deutsche Bank on Wednesday forecasting 150 basis points of easing next year, and a first move in April instead of June. Last week, Goldman Sachs switched to predict a cut as soon as April.

The bond rally that accompanied the rate repricing further raises the stakes for Lagarde next week. An index of sovereign debt that excludes Treasuries surged to the highest since April 2022 this week, extending November's stellar rally.

Erik Nielsen, chief economics adviser to UniCredit group, is sympathetic to the market shift, and reckons that any uptick in consumer prices won't last.

“That pickup won't drive inflation expectations or wage growth,” he said. “If that's what they want to kill, then welcome to the graveyard.”

A sluggish economy normally comes with a softer jobs market, Nielsen argues, saying that wouldn't drive inflation. Bank of Portugal Governor Mario Centeno, one of the ECB's doves and a labor economist, echoed that in an article this week.

“Job destruction and the freezing of new hires are more synchronized in recessions than during upswings,” he said. “It took three years to reach the pre-pandemic employment trend; it will require less time to reverse those historical gains.”

What Bloomberg Economics Says...

“The ECB has increased borrowing costs well beyond any estimate of neutral. That's becoming increasingly obvious in the economic data and the impact is also being seen in inflation. The story is similar on the other side of the Atlantic and the global mood music is changing. Any one of those three developments could cause the ECB to cut before the middle of next year.”

—David Powell and Jamie Rush. Read more here

For hawks such as Bundesbank President Joachim Nagel, the danger remains that inflation returns with a vengeance. He has repeatedly ruled out saying that rates have reached a peak. His Belgian colleague Pierre Wunsch even declared that officials could raise again to keep policy restrictive enough as investors bet on cuts.

Nagel points to war in the Middle East, with the danger of regional spillover that prompts an inflationary oil-price spike, as one reason for caution.

Officials, speaking on condition of anonymity, say that the overall picture won't be clear until the full extent of wage deals and fiscal plans emerges after the first quarter. Another complication is that the ECB may also want to accelerate winding down its balance sheet.

Whatever the case, economists such as Anatoli Annenkov at Societe Generale warn that, amid mounting rate-cut speculation, there's a risk of complacency.

“Don't get fooled by the fact that inflation has been dropping quite quickly,” he said. “There's a danger with people drawing a straight line, suggesting we'll undershoot the target within six months.”

Guarding against that threat is likely to limit how far the ECB does opens the door to rate cuts at next week's meeting. So far, the noise from officials hasn't signaled so much of a shift.

“When do they change their view?” asked UniCredit's Nielsen. “Maybe when we get the fourth quarter GDP number, which will almost certainly be negative, and we get another bad first quarter with inflation coming down faster than expected. That's when they may stand pretty red-faced.”

--With assistance from Alexander Weber.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.