(Bloomberg) -- The US dollar jumped the most in two weeks after the blowout jobs report, pushing the currency back near levels last seen before the Federal Reserve's December pivot and wrong-footing traders betting on imminent interest-rate cuts.

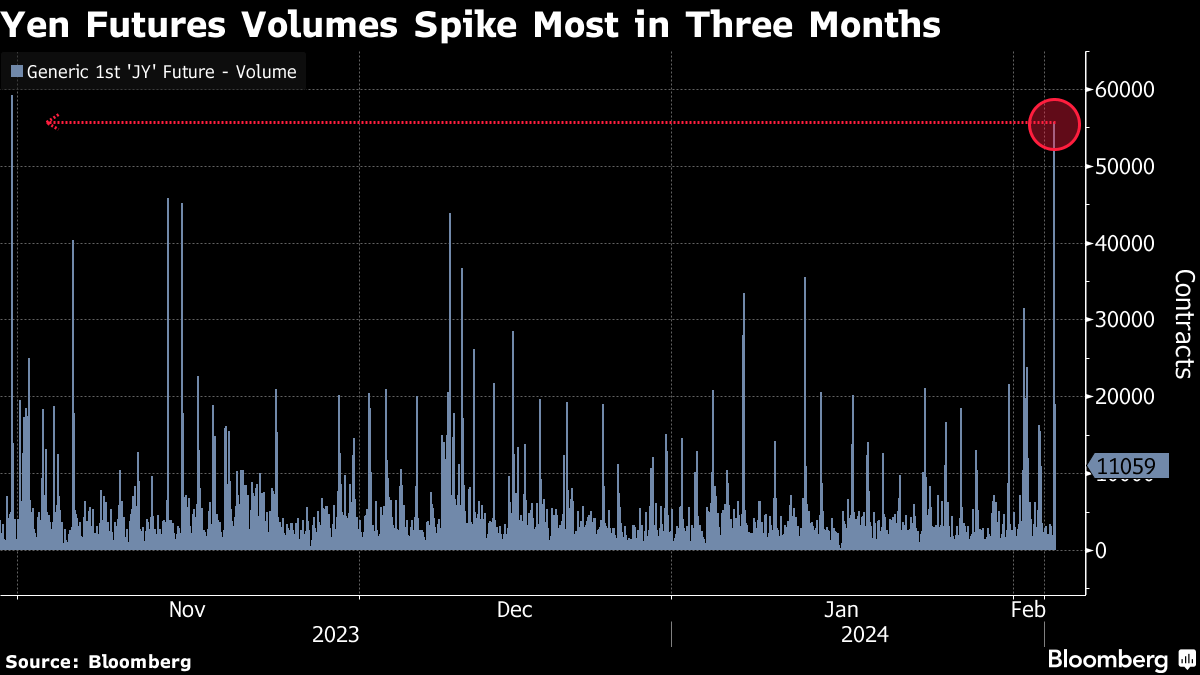

The Bloomberg Dollar Spot Index rose as much as 0.7% after Friday's employment data showed a January surge in payrolls alongside a boost in hourly wages, pushing bond yields up sharply. Against the yen, the greenback rose 1.3% to 148.34, the largest intraday advance since Dec. 19.

The dollar gained against all the Group-of-10 currencies, with the Norwegian krone, yen and New Zealand dollar leading the losses. The Swiss franc and euro each saw their biggest drop in a month.

“The signal from payrolls seems pretty clear — the dollar will continue to at least hold its ground so long as US jobs demand remains strong and wages stay firm — in essence refreshing the US exceptionalism narrative,” said Patrick Locke, a foreign-exchange strategist at JPMorgan Chase & Co.

Read more: US Payrolls and Wages Surge, Likely Keeping Fed Rates on Hold

The jobs report Friday showed US employers added 353,000 workers to their payrolls last month while hourly wages jumped 0.6% on a monthly basis, the most since March 2022.

The data sent Treasury yields surging across the curve, pushing the dollar back near where it was before Fed Chair Jerome Powell in December signaled the bank was likely to start easing policy this year. Swaps traders further pared bets on a March interest-rate cut to around 15%, though they are still placing high odds that the Fed will kick off a series of cuts in May.

Locke said the expected pace of cuts still “looks aggressive” compared with other central banks, which “should help put a floor under the dollar as well.”

Read more: Treasury Yields Surge as Hot Jobs Data Dashes Rate-Cut Hopes

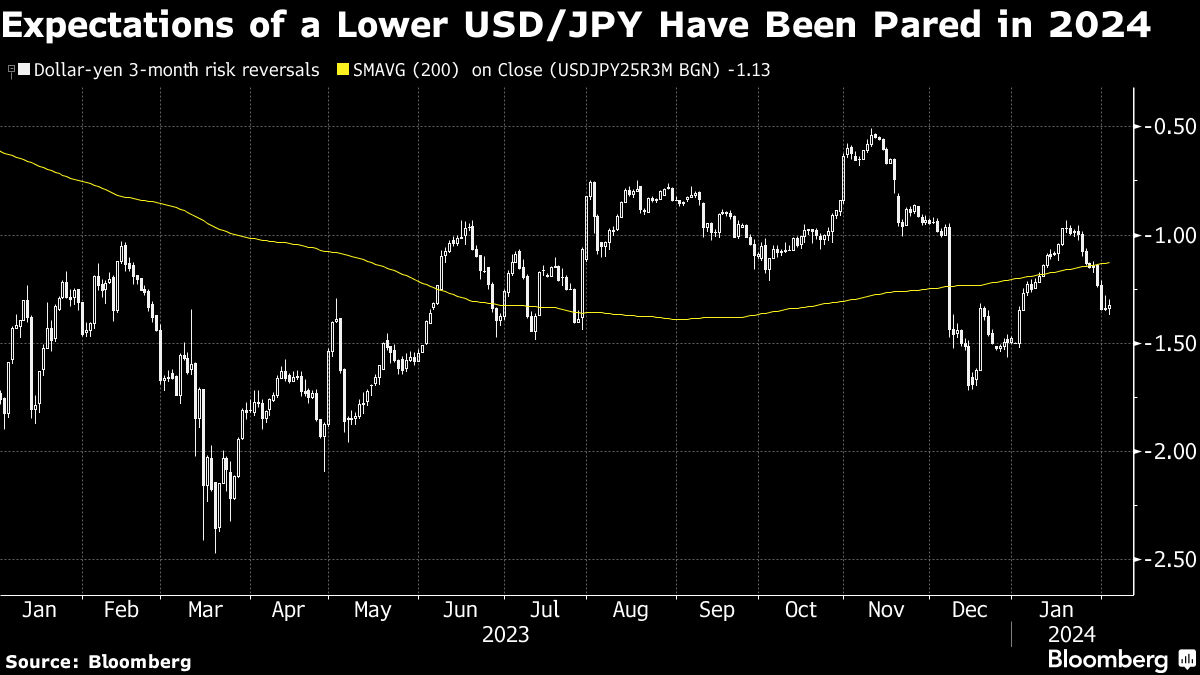

Heading into 2024, forecasters expected the yen to gain the most from divergent central bank monetary policy as the Fed nears its easing point just as the Bank of Japan reconsiders its long-running negative-interest-rate policy.

But the timing of such a shift remains in doubt. Resilient US economic data have called into question the extent of rate cuts to come from the Fed, while the Bank of Japan has given few clear signals of exactly when it will look to tighten policy.

The dollar is set for its fifth-straight week of gains, the longest such streak since September. The Japanese currency has lost nearly 5% this year, the worst performance among the Group of 10, and continues to face pressure as bets on Fed easing are pushed back.

“A later start to Fed easing is suggestive of a more resilient USD and thus implies less scope for sharp JPY gains vs the USD assuming the BoJ hikes rates in next couple of months,” said Jane Foley, head of FX strategy at Rabobank.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.