(Bloomberg) -- The US dollar dropped the most in a nearly a month after a key measure of underlying US inflation stepped down last month, giving optimism that the Federal Reserve may act sooner on the interest-rate reduction.

The Bloomberg Dollar Spot Index fell as much as 0.5%, the worst drop since May 15. The drop came after four days of gains as central banks in the euro region and Canada started lowering borrowing costs, while the strength of the US economy was muddying the timeline for the Fed's first cut. US price growth report is showing potentially early stages of inflation resuming the downward trend.

This opens the door to “a more dovish tone from Jerome Powell this afternoon, which could prompt some further dollar weakness in the short term,” said Helen Given, a foreign-exchange trader at Monex. “A hawkish hold is still all but guaranteed today.”

Fed officials will announce their decision on the benchmark rates as well as share their updated economic projections later on Wednesday. The markets have been poring over incoming data in the world's biggest economy to decipher the timing of the Fed joining other central banks in the interest-rate easing cycle.

“Today's data reinforces our view of September cut,” said Yusuke Miyairi, a currency strategist at Nomura International Plc.

Traders ramped up expectations for the pace of Fed moves, factoring in rate reductions in November and December — and increasing odds of a September cut to about 76%.

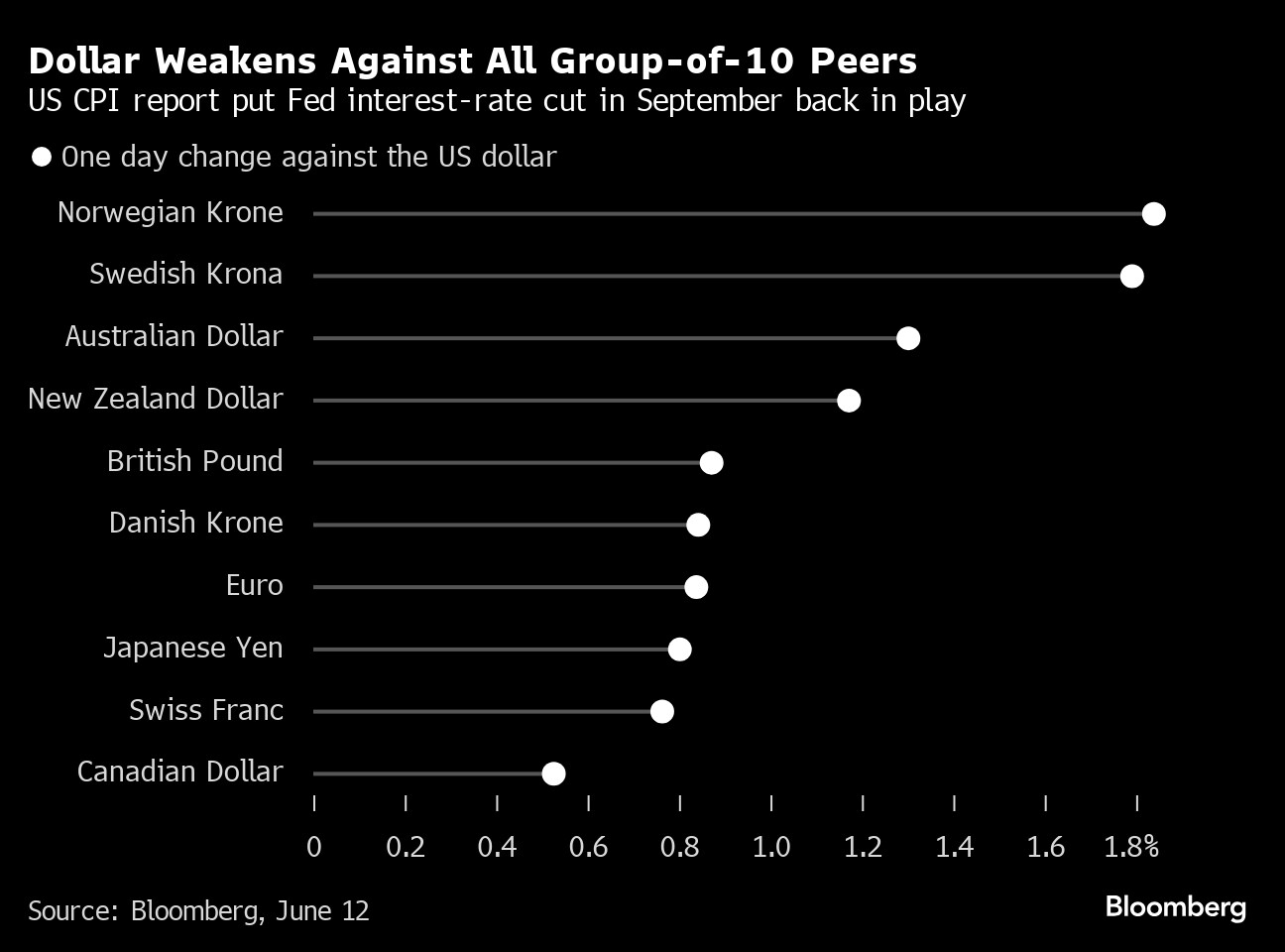

The Norwegian krone and Swedish krona are leading gains in the Group-of-10, with the Australian and New Zealand dollars advancing more than 1% against the greenback. The British pound rose 0.9% against the US dollar, best day since late April.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.