Dabur India Ltd.'s share price fell over 7% on Thursday, as most brokerages see the company facing significant challenges in the third quarter of the ongoing financial year. Analysts expect a decline in the company's consolidated revenue to mid-single-digit percentage year-on-year, largely influenced by proactive inventory correction strategy. The unfavourable weather conditions are an additional headwind.

Jefferies noted that the unfavourable weather, including heavy rains and flooding, has affected consumer demand, particularly in the beverages segment. The brokerage expects a decline in operating profits for Dabur, although peers may not experience the same downturn.

Nuvama also highlighted a projected 5% decline in consolidated revenue, attributing it to inventory correction in general trade and subdued urban demand. They emphasise the challenges faced by the beverages portfolio, which suffered from the adverse weather conditions.

Citi echoed these sentiments, stating that their estimates reflect a decline due to weak out-of-home consumption and inventory adjustments. They suggest that Dabur's performance fell short of their expectations, projecting a 5% revenue decline against their earlier estimate of a 6% increase.

Following the recent events, Emkay Global has reduced Dabur's rating from 'buy' to 'add' and has set the target price at Rs 650, implying an upside of 12%, according to Bloomberg.

While the overall sentiment is cautious, the brokerages diverged on their outlook for Dabur's recovery. Jefferies is somewhat optimistic about future growth, suggesting that management expects revenue improvement starting October 2024. International sales may provide a buffer with double-digit growth anticipated in constant currency terms, it said.

However, Nuvama shares a more tempered view, asserting that while the third quarter could see improvement over the second quarter, consistency in growth remains essential for a re-rating of the stock. The brokerage is cautious about near-term pressures on Dabur's stock.

"Hopefully with pipeline correction done and a likely harsh winter in La Nina year helping winter and immunity portfolio, Q3 could be much better versus disappointing performance in Q2," said Abneesh Roy, executive director at Nuvama Institutional Equities.

While the company is set for recovery, the stock could remain under pressure in the short term, according to Emkay. Dabur's recent inventory correction is surprising, indicating a significant buildup that the company has chosen to address with a one-time hit, the brokerage said.

Jefferies also pointed out that Dabur's commitment to sustained marketing investments complicates margin management, suggesting that significant margin expansion may be unrealistic if demand remains disappointing.

Citi supported this view, projecting a decline in Ebitda margin due to reduced sales and operating deleverage, forecasting a 17% year-on-year decline in Ebitda.

This downstocking and pipeline correction, while not uncommon in FMCG, has had a surprisingly strong impact on Dabur compared to its peers, Nuvama said. Citi estimates that the inventory streamlining could have a 10% negative impact on second quarter growth, translating to a notable number of days of inventory held back.

Dabur's approach to managing the excess inventory in general trade is proactive, but reflects a significant challenge, according to Emkay. They stress that the company's strategy to address this build-up is crucial for maintaining distributor confidence and ensuring sustainable growth moving forward.

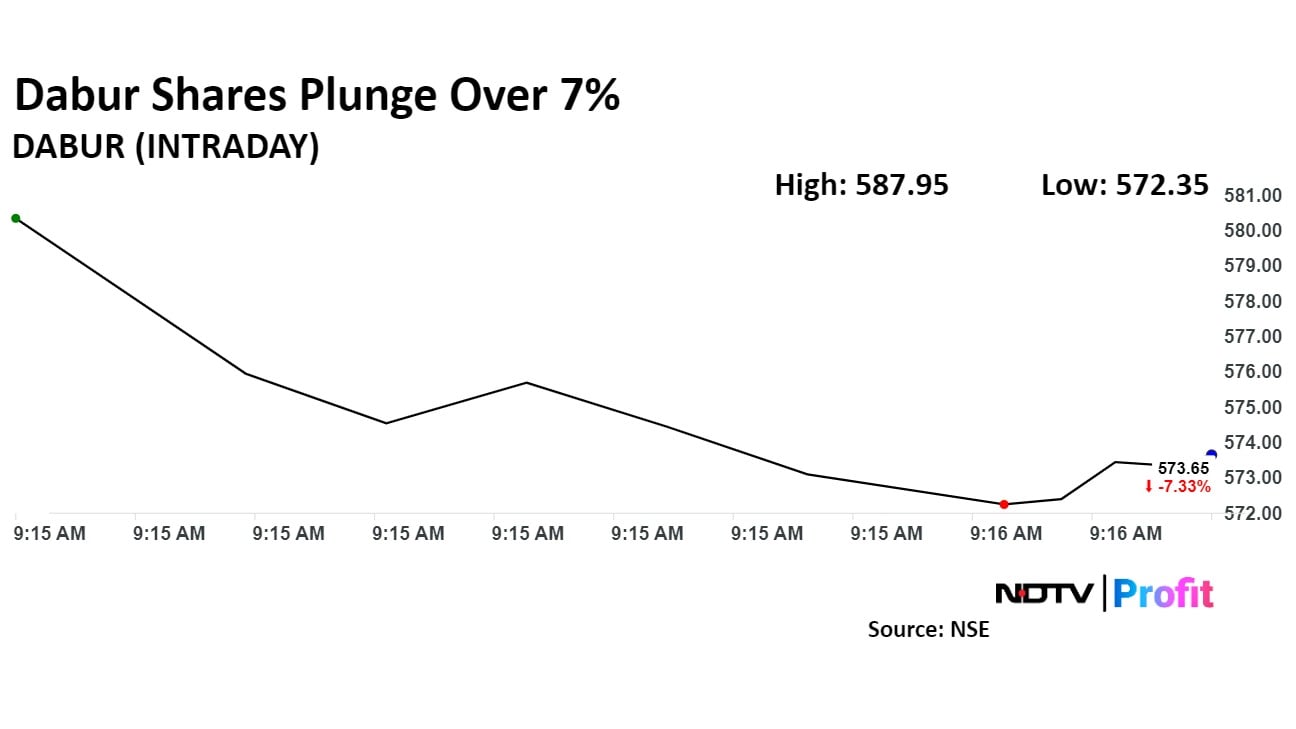

Dabur India Share Price

Shares of Dabur India fell as much as 7.75%, the most since June 4. They pared loss to trade 5.15% lower at Rs 587.10 apiece, as of 09:34 a.m., compared to a 0.98% decline in the NSE Nifty 50.

The stock has risen 5.45% year-to-date. The relative strength index was at 26.37.

Out of 43 analysts tracking the company, 25 maintain a 'buy' rating, 16 recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.