The Indian rupee closed weaker against the US dollar on Friday amid heightened dollar demand by importers looking to settle payments.

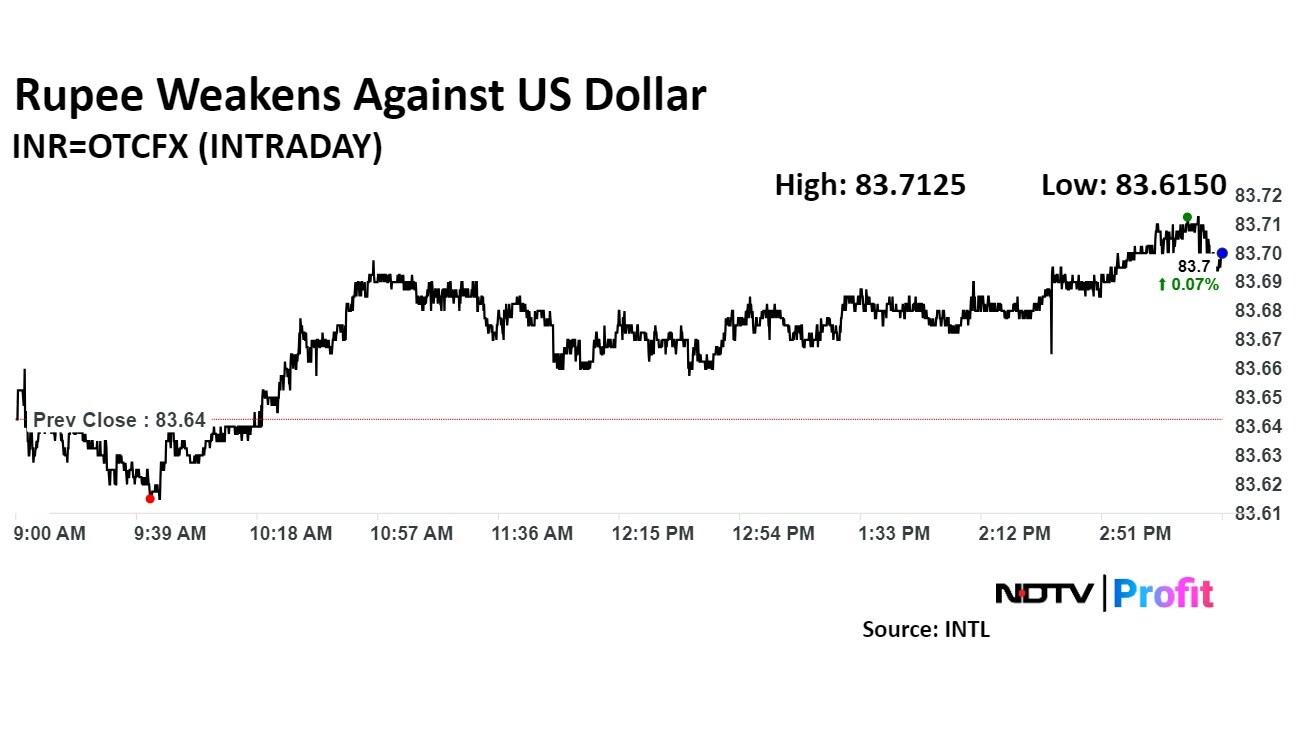

The rupee depreciated by 6 paise to close at 83.70 against the US dollar, according to Bloomberg data.

The drop in rupee comes in spite of a number of supportive factors—most notably, foreign inflows into Indian markets amounting to Rs 84,372 crore in September alone, according to Amit Pabari, managing director at CR Forex Advisors.

With the Nifty and Sensex surging to all-time highs, and a strengthening trend across Asian currencies, including the Chinese Yuan nearing the 7.01 mark, the rupee was expected to perform better, he said. "Despite the positive bias seen since the US Federal Reserve's recent 50-basis-point rate cut, the rupee has struggled to sustain behind the crucial support level of 83.50."

The Reserve Bank of India likely intervened by absorbing excess dollar inflows, a move aimed at curbing excessive rupee appreciation, Pabari said.

Oil prices were up 0.08% to $71.66 amid expectations of increased supply from OPEC members Saudi Arabia and Libya. Meanwhile, the US dollar was down 0.06% at 100.51, easing pressure on commodities like oil.

"The USD/INR is finding solid support around 83.50, with the potential to rise toward the 83.75–83.80 range," Pabari said. "For those who missed earlier selling opportunities, this range may present another chance."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.