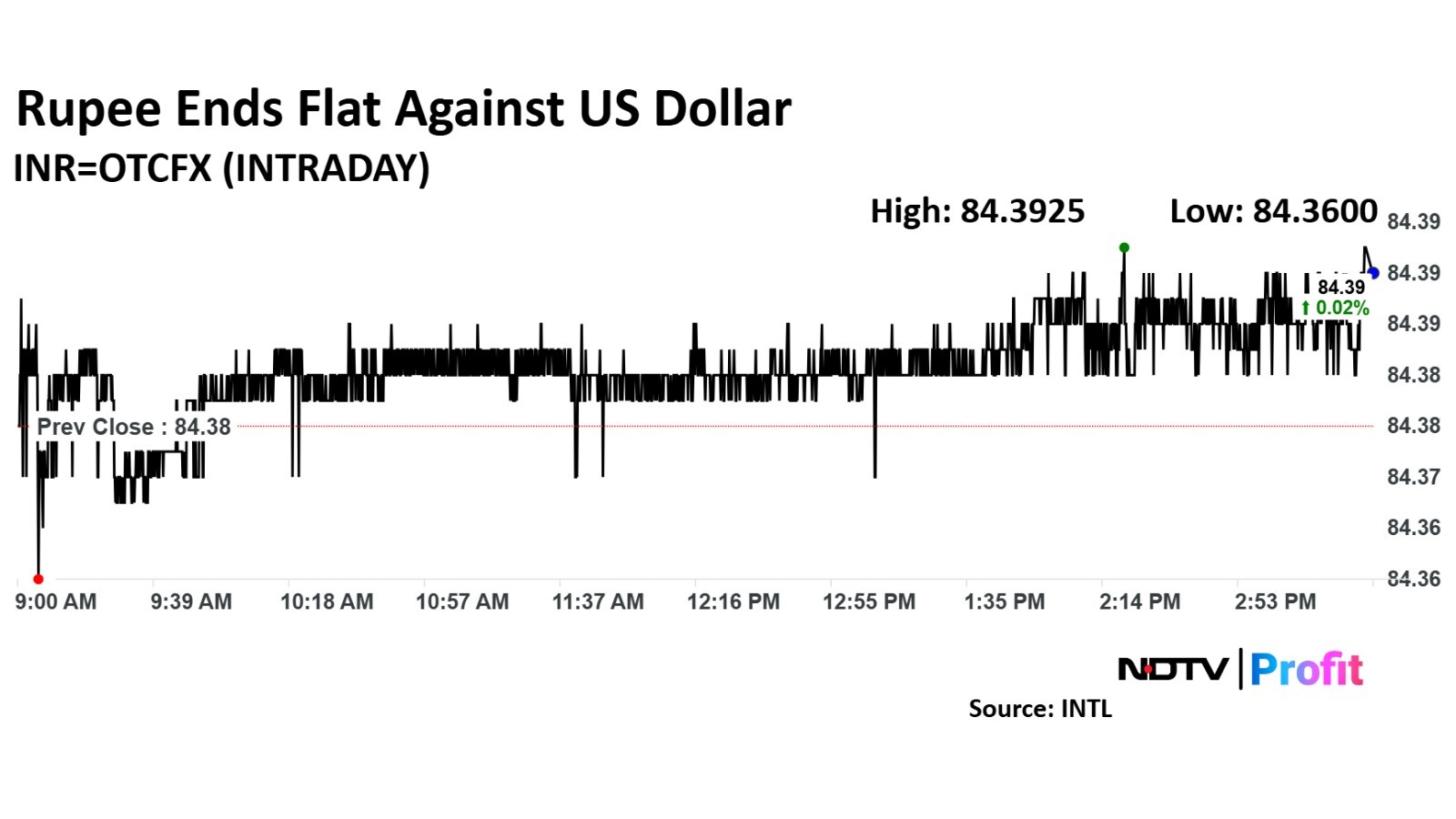

The Indian rupee closed flat against the US dollar on Monday, ending at 84.388.

Anil Kumar Bhansali, Head of Treasury and Executive Director at Finrex Treasury Advisors LLP, commented on the rupee's performance, saying, “The dollar retained its strength, buoyed by the Trump presidency and anticipation of U.S. CPI data.”

He added that the yuan slipped to a three-month high of 7.2128 after China's National People's Congress approved a $1.4 trillion debt package aimed at easing local government debt levels. However, “the measure disappointed investors hoping for more targeted, fiscal support,” Bhansali noted.

He also noted that the yen's decline, with USD/JPY rising to 153.60 following Bank of Japan minutes that revealed a split over interest rate hikes, creating additional uncertainty. "The yen's drop adds to global volatility, while the rupee continues to face pressure from FPI outflows, with foreign investors offloading Rs. 3,404 crore in equities on Friday."

Regarding the rupee's outlook, Bhansali remarked, “With oil companies in the fray and the RBI easing its interventions, the rupee remains vulnerable. Dollar demand is high, and we may see more aggressive buying mid-month.” He also noted that premiums have fallen from a recent high of 2.5% to 2.1%, indicating dollar shortages due to high demand and slower RBI intervention.

Bhansali expects the rupee to trade within a range of 84.30 to 84.50, advising exporters to monitor the situation and importers to buy on dips.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.