11_07_24.jpg?downsize=773:435)

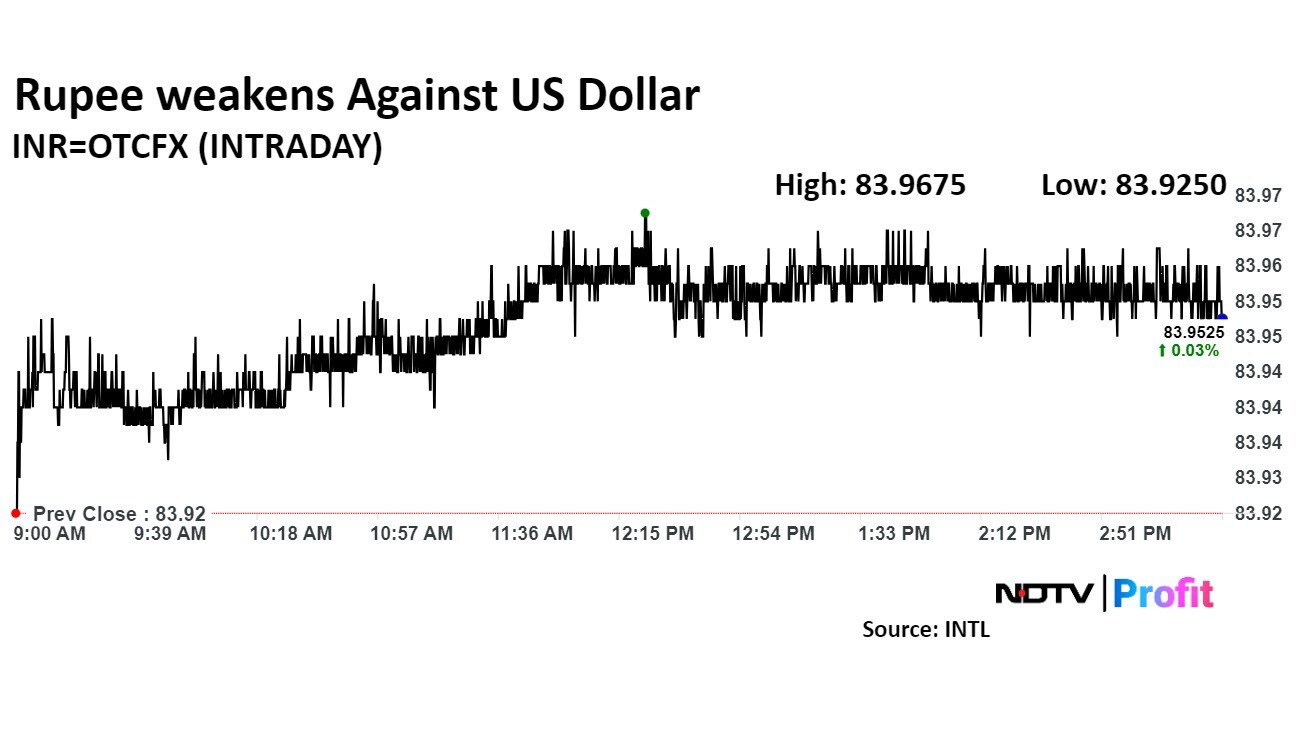

The Indian rupee closed weaker against the US dollar on Wednesday due to month-end dollar demand from importers. However, easing oil prices and continued intervention by the Reserve Bank of India limited the losses.

The local currency depreciated by 4 paise to close at Rs 83.96 and opened at Rs 83.95, according to Bloomberg data. It had closed at Rs 83.92 on Tuesday.

The US dollar index was trading 0.36% higher at 100.91 at 3:40 p.m. IST. Brent crude prices were trading 1.09% lower at $77.83 at 3:41 p.m. IST .

The dollar index, which tracks the performance of the greenback against a basket of 10 leading global currencies, opened flat and was trading 0.17% higher at 100.73 as of 9:24 a.m.

The RBI's interventions not only seem to limit the rupee's downside but also cap its appreciation, said Amit Pabari, managing director at CR Forex Advisors. "This was evident earlier in the week when, despite significant dollar weakness, the rupee remained steady, unlike other emerging market currencies that experienced notable gains."

"Strong fundamentals and consistent dollar inflows are providing additional stability," he said.

International benchmark Brent crude oil was 0.14% up at $79.66 after on Wednesday, recovering from a decline the previous day that had ended a three-day rally, prompted by concerns over a potential halt in Libyan supplies. The disruption in Libya had briefly shifted the oil market, which had been progressively bearish in recent weeks.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.