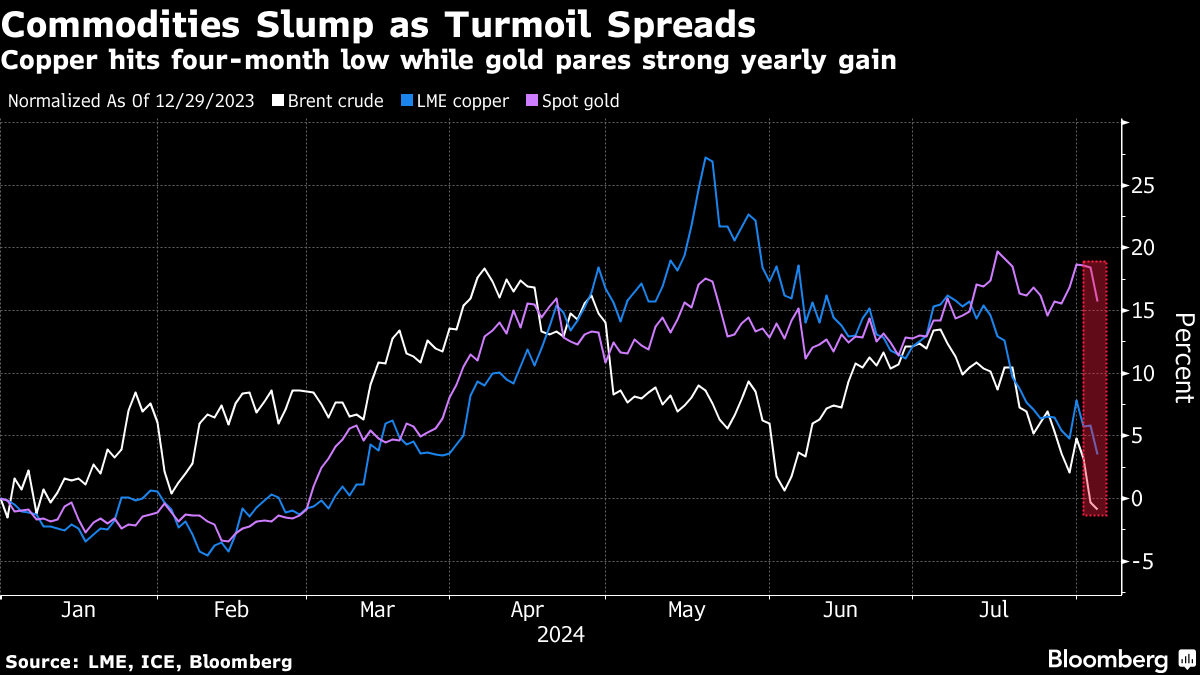

(Bloomberg) -- Commodities from copper and gold to crude oil tumbled, while paring back some of the losses, as global economic malaise dimmed the outlook for industrial demand and sent traders rushing to cash out of profitable positions.

Copper settled down 1.8% on the London Metal Exchange after slumping as much as 3.8%, with aluminum also falling. Benchmark oil futures dropped about 0.5%, after trading down 2.3% at the lowest level in seven months.

Raw material markets were dragged into a massive selloff on Monday as investors reacted to US data signaling a deterioration in the world's biggest economy and speculation that Federal Reserve's long-awaited pivot to more supportive monetary policy may come too late to prevent a major downturn in the US and beyond. The selloff tapered after fresh data showed the US services sector expanded in July.

“It's just widespread panic,” said Phil Streible, chief market strategist at Blue Line Futures. “We've had record amounts of cash sitting on the sidelines,” with “bargain hungers” taking advantage of lower prices, he added.

For commodities linked to industrial cycles, such as copper, a hard-landing scenario would put fresh pressure on bulls who made bold bets on a surge in global demand earlier this year. Prices have already retreated about 20% from a peak seen in May as investors bailed out, and Monday's fresh bout of selling took prices to the lowest in nearly four months. Mounting worries about economic growth across commodities markets have prompted hedge funds to turn predominantly bearish on a basket of key contracts for the first time since 2016.

“Markets like oil and copper appear to be pricing in a recession, which equity and bond markets are doing as well,” said Matthew Schwab, head of investor solutions at Quantix Commodities, a Greenwich, Connecticut-based hedge fund.

Still, some agriculture markets, such as soybeans and cocoa, rose on Monday.

Gold — which is up more than 15% this year and would typically benefit during bouts of economic weakness — was also hit hard earlier as investors closed out trades to cover losses elsewhere. That's a common consequence during large-scale selloffs, and analysts said that the precious metal's status as a haven should soon reassert itself if the turmoil continues.

A slump in the dollar could also boost gold and other commodities priced in the currency by expanding purchasing power for consumers in key markets like China.

“Commodities are getting hit by this risk-off event,” said Ryan Fitzmaurice, a senior commodities strategist at Marex. “But looking out on the horizon, a weaker US dollar and rate cuts could provide support for the asset class.”

If there is more negative US economic data and the Fed is forced to make significant interest rate cuts, that's bullish for gold. Conversely, robust economic signals may delay the pace of any easing by central bankers, which would weigh on the yellow metal, according to Marcus Garvey, head of commodities strategy at Macquarie.

“I guess financial markets like to fix problems in advance by trashing prices on commodities to lessen inflation,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

--With assistance from Yvonne Yue Li and Gerson Freitas Jr..

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.