Coforge Ltd.'s share price rose to hit its lifetime high as it remains JPMorgan's top pick in the sector, given healthy business momentum. The brokerage, which has an 'overweight' rating on the stock, hosted the company's Chief Financial Officer, Saurabh Goel, at the JPM TMT Conference.

The stock has gained around 8% in five consecutive sessions of rise. The brokerage has an unchanged target price of Rs 9,600 for the stock, which implies 11.4% upside.

The company is enjoying strong brood based demand across banking, insurance, travel and the public sector, JPMorgan said. It is proactively going after large transformation deals that provide more visibility and help firm up wallet share with clients, it said.

JPMorgan also likes that the company's furloughs are lower than last year, led by better near term demand. Citing the CFO, it said that the company maintains its target of reaching $2 billion in revenues by fiscal 2027, implying 14% organic annual growth over the next three years, and has a strong handle on margins in the second half of the year.

In addition, the brokerage sees growth momentum and margin expansion for Cigniti, which it recently increased its stake in. "Cigniti's stake to increase to 54% in 3Q as open offer is completed," the brokerage said.

The stock was among the top two contributors to the rise in Nifty IT on Tuesday.

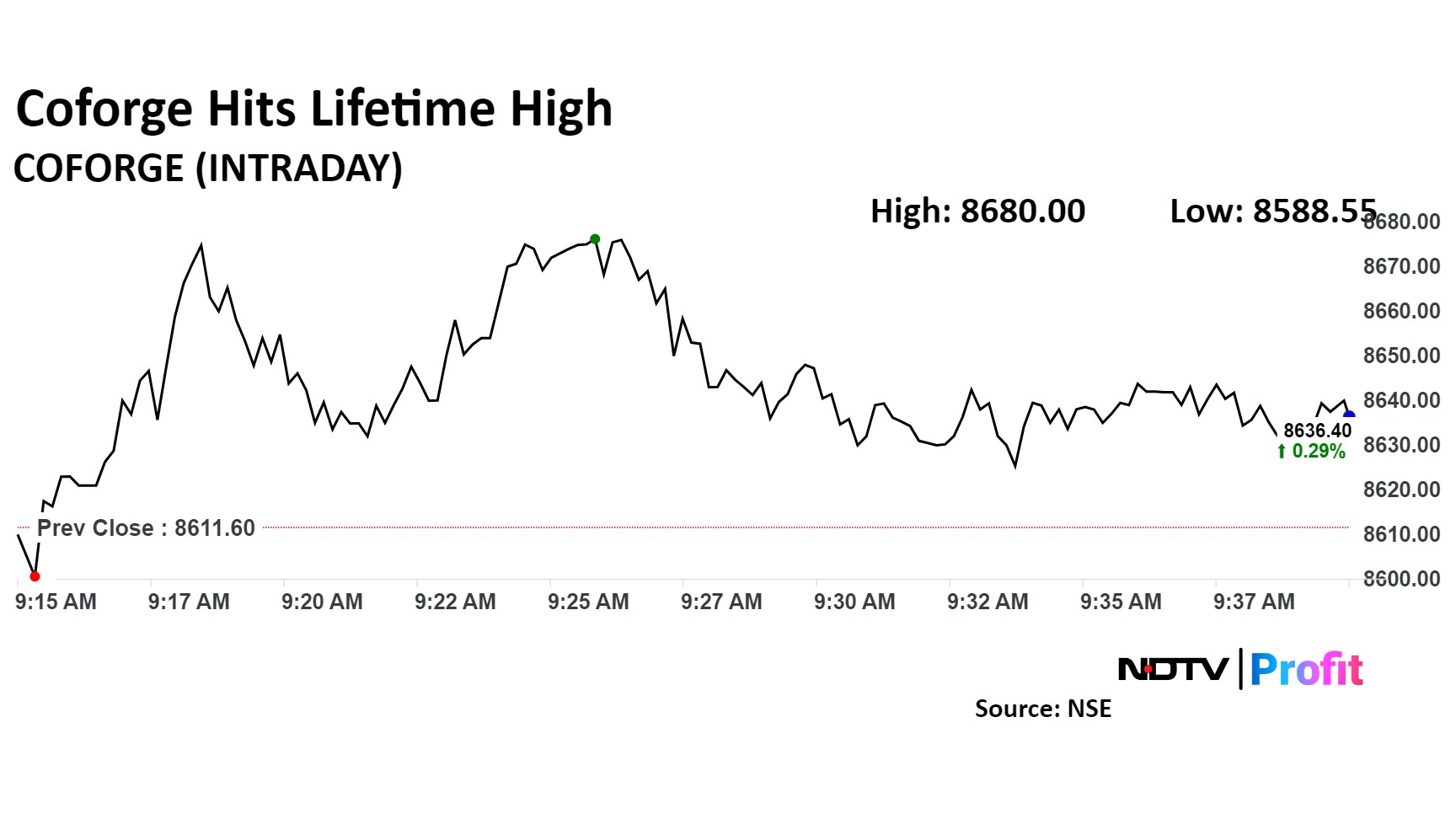

Coforge Share Price Today

The scrip rose as much as 0.8% to Rs 8,680 apiece, the highest level. It pared gains to trade 0.4% higher at Rs 8,638.90 apiece, as of 9:43 a.m., compared to a 0.3% advance in the NSE Nifty 50.

It has risen 37.7% on a year-to-date basis and 50% in the last 12 months. Total traded volume so far in the day stood at 0.13 times its 30-day average. The relative strength index was at 79.09, indicating that the stock may be overbought.

Of the 36 analysts tracking the company, 24 maintain a 'buy' rating, three recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 7.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.