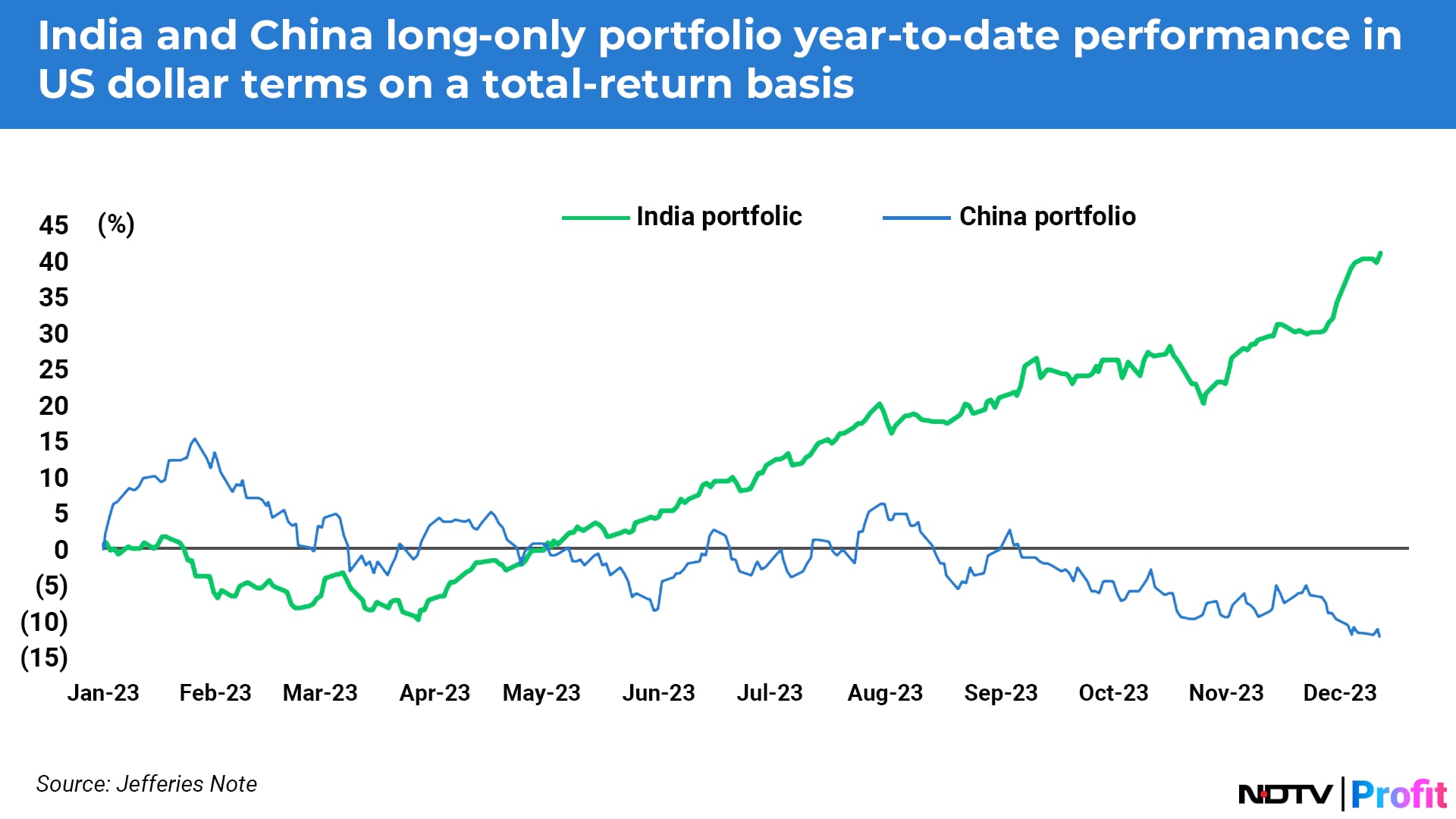

Contrasting performance of Indian and Chinese stocks does not provide confidence to reverse the bets by selling India and buying China, according to Chris Wood of Jefferies Financial Group Inc.

While Wood's India long-only portfolio is up 41.2% year-to-date in dollar terms, China is down 12.1%, according to the latest Greed & Fear note. The best-performing stock in the Indian portfolio is up 309% and the worst performing in China is down 55%.

"Normally, such contrasting performances would be a signal to go the other way in terms of buying China and selling India," Wood wrote.

But Greed & Fear has "no conviction for such a dramatic move", it said. "And nor does anyone else, though a surge of China outperformance can happen at any time if there is a positive surprise on the policy front."

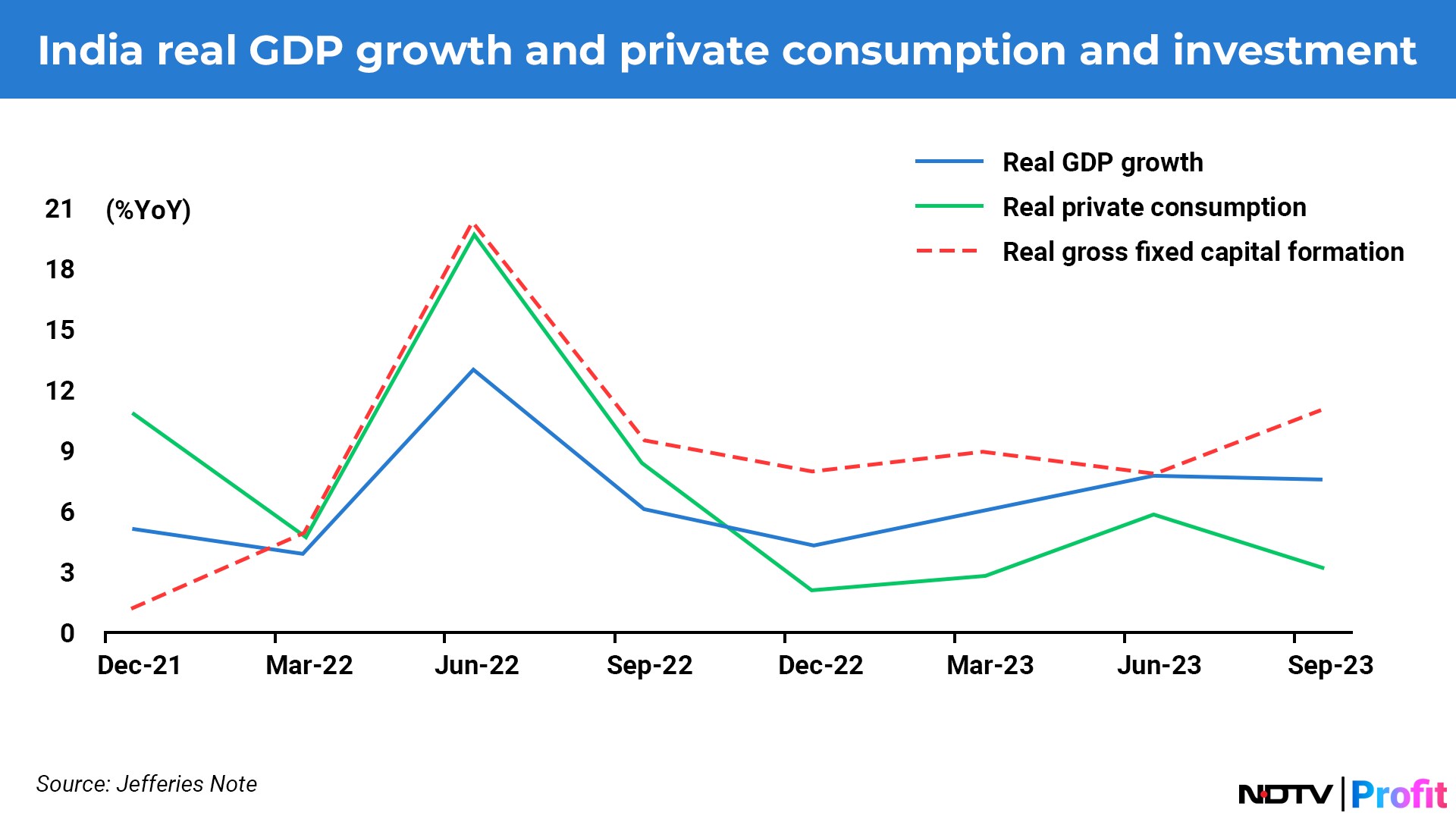

Wood's India confidence stems from "all systems go" situation, referring to the strong macros. The Indian economy is being driven by investment rather than consumption, reversing the pattern of the past decade, Wood said.

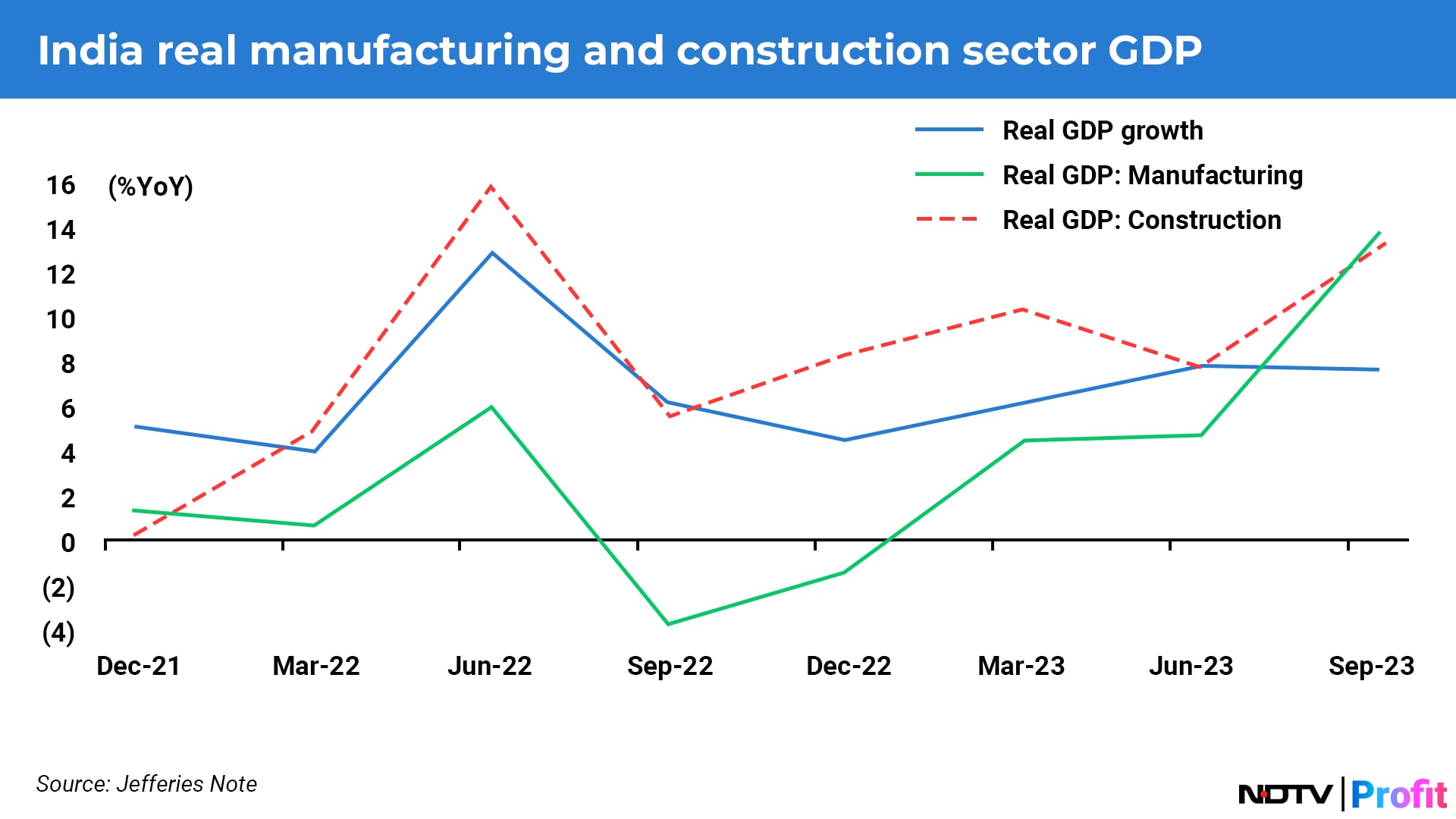

Real private consumption rose 3.1% year-on-year, while real gross fixed capital formation was up 11%. Real gross domestic product from the construction and manufacturing sectors was also up 13.3% and 13.9%, respectively, in the third quarter of calendar year 2023.

The gross fixed capital formation as a share of GDP has now risen by three percentage points from the low, Mahesh Nandurkar, head of India research at Jefferies, has also highlighted. The annualised gross fixed capital formation to the nominal GDP ratio has increased from 26.5% in the fourth quarter of 2020 to 29.4% in the third quarter of 2023.

Nandurkar forecasts that the gross fixed capital formation to the nominal GDP ratio will rise to a near decade high of 30% in the current financial year, up from 27% in fiscal 2021.

The 7.7% real GDP growth in the first half of the fiscal has also caused the Reserve Bank of India to revise up its guidance for growth by 0.5 percentage points to 7%.

Another interesting data point was the 12% growth in October in the index, which measures the production of the eight so-called core industries, according to Jefferies. This is the second largest increase since June 2022 after a 12.5% growth in August.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.