(Bloomberg) -- Chinese equities listed in Hong Kong erased Wednesday's initial declines as trading resumed after the Lunar New Year holiday, with investors focusing on what more Beijing can do to stem the rout.

The Hang Seng China Enterprises Index, which tracks Chinese stocks traded in Hong Kong, rose as much as 0.6% after erasing an intraday loss of up to 1.9%. Hong Kong's equity benchmark also nearly erased an early decline. Investors are still trying to assess Chinese authorities' willingness to halt the deepening rout, and evaluating a drop in US markets overnight after a stickier-than-expected inflation reading.

“In the longer term, we still need a more comprehensive easing package to address the macro problems,” Si Fu, a China portfolio strategist at Goldman Sachs Group Inc., said in a Bloomberg Television interview. Investors want “a long term plan to address property and local government debt issues,” and direct stimulus to boost consumption, she added.

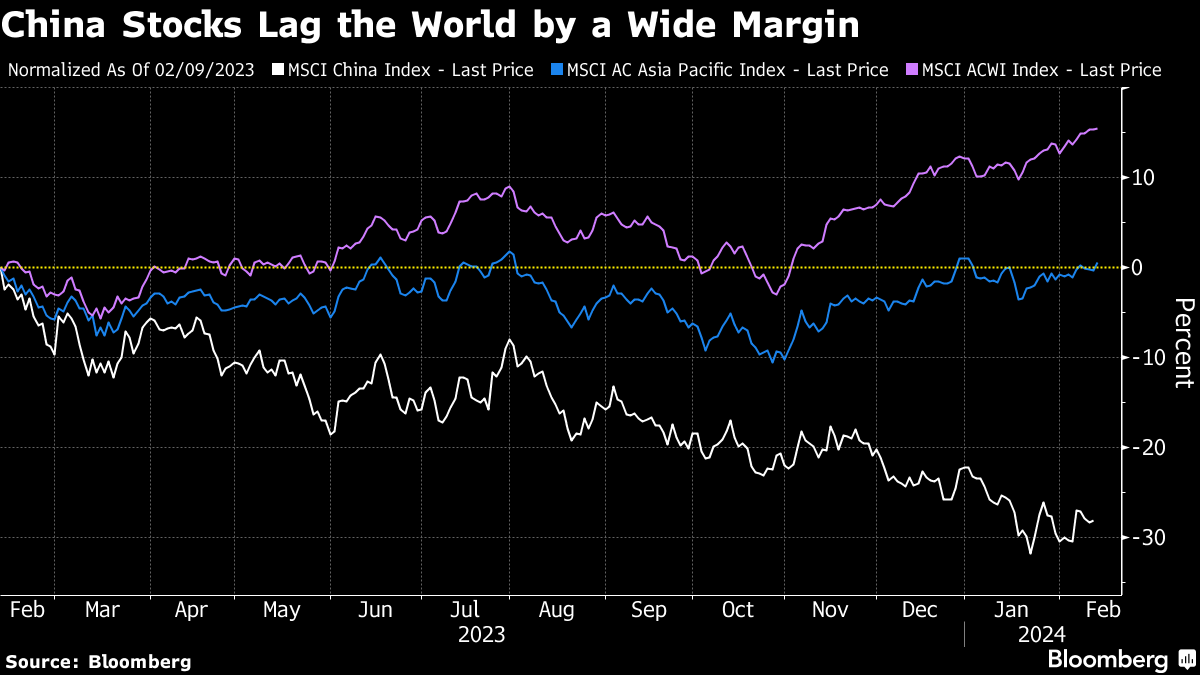

China's efforts, ranging from state-sponsored share purchases to short-selling bans, have had limited impact in reviving the mainland stock market. Structural issues such as deflationary pressure, the property market crisis, and tensions with the West continue to weigh on investors.

The latest Asia fund manager survey from Bank of America showed China allocations dropped to a new low, with investors buying into the idea that the propensity among Chinese households to preserve cash rather than spend or invest is here to stay.

The trading cues that emerged during Hong Kong's Lunar New Year holiday have been mixed.

China's credit growth notched a record high in January and Citigroup Inc. said Macau casinos saw a strong start to the Chinese New Year holidays, with mainland visitors rising 34% in the first three days versus the comparable period in 2019. An index of Macau-related casino stocks rose 2.7%.

On the other hand, MSCI Inc. said it's deleting a slew of battered Chinese stocks from its indexes, while Hong Kong's top housing estates saw zero deals during the Lunar New Year holiday for the first time since records began in 2010. The European Union has proposed new trade restrictions on about two dozen firms accused of supporting Russia's war efforts in Ukraine, three of which are based in China.

From a macro perspective, investors will be watching for further policy signals from Beijing, including a potential reduction in interest rates in announcements scheduled this month and a possible increase in government spending in the National People's Congress's annual sessions in early March.

“We may get an interest rate cut, but the focus will largely be on the fiscal support and potential budget expansion to be announced at the Two sessions policy meeting in early March,” said Marvin Chen, a strategist at Bloomberg Intelligence.

--With assistance from David Ingles.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.