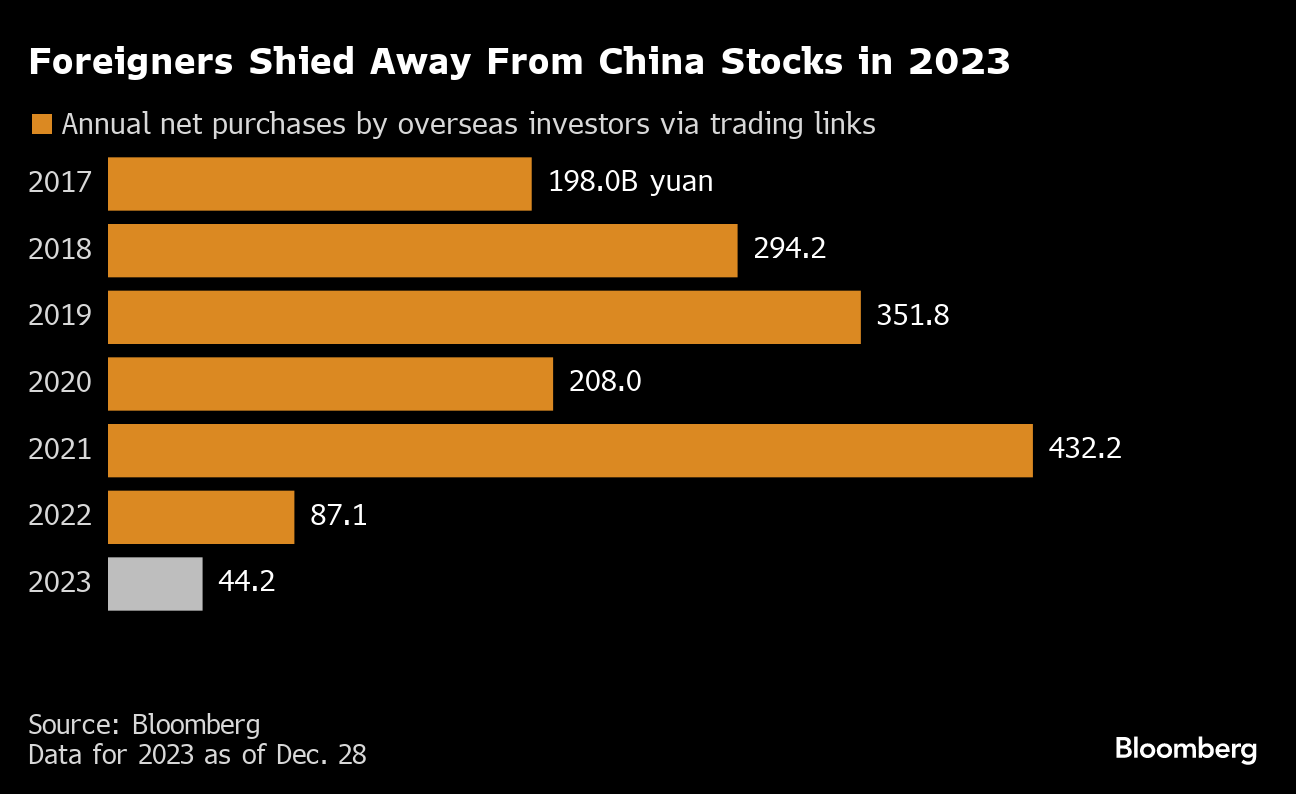

(Bloomberg) -- Overseas investors are set to record their smallest-ever annual purchases of Chinese stocks, discouraged by a plethora of concerns including a fragile economic recovery and geopolitical tensions.

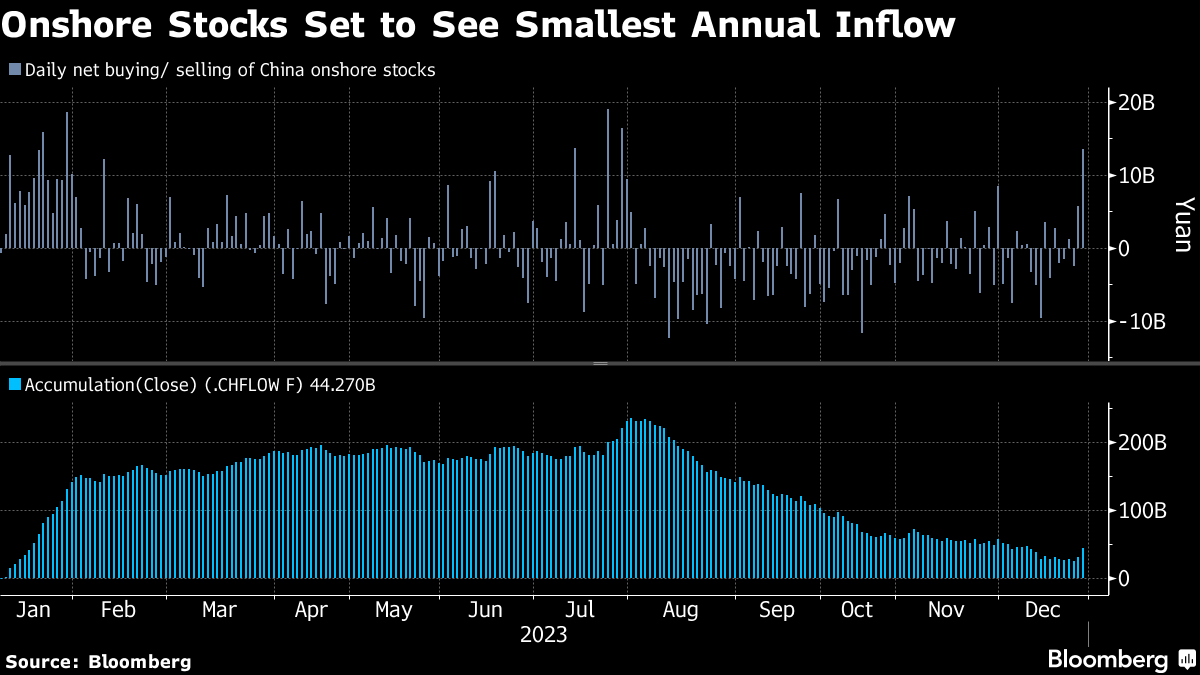

Foreign funds bought just 44 billion yuan ($6.1 billion) of onshore stocks via trading links with Hong Kong on a net basis so far in 2023. That's even after a dramatic surge in purchases Thursday amid year-end positioning adjustments, and marks the least since Bloomberg started compiling annual data for both Shenzhen and Shanghai bourses in 2017. During better times, investors would scoop up that amount in a month.

The year started on a strong note amid hopes of a post-Covid market revival, only to see the rally fizzle as a prolonged housing slump, a lack of strong stimulus and regulatory uncertainties led to a heavy selloff. The CSI 300 benchmark has lost 12% so far this year, among the world's worst-performing major indexes and poised for a third annual decline.

Overseas funds are set to flee Chinese stocks for the fifth month in December, an unprecedented streak. While some fund managers are calling time on the rout, saying it's time to buy the dip, many harbor doubts over the market's longer-term allure. Corporate earnings are no longer growing at a heady pace with concerns over policy support for the private sector, and economic growth is set to moderate amid demographic headwinds.

However, a glimmer of hope emerged Thursday as foreigners added 13.6 billion yuan worth of mainland shares, the most since July. History shows that overseas investors tend to move earlier than others to build positions, Founder Securities analysts including Cao Liulong wrote in a note earlier this month.

“End of depreciation pressure for the yuan, combined with the Fed's pausing of rate hikes and an improving economic outlook as supportive policies are ramped up, are likely to drive overseas investors back into China,” wrote Cao.

The stock connect program with Hong Kong is the dominant channel for overseas investors to trade mainland shares. Daily flows are closely monitored as an important barometer of sentiment, which in turn affects onshore traders, even though foreign purchases account for just 4% of the total shares outstanding of mainland firms.

--With assistance from Mengchen Lu.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.