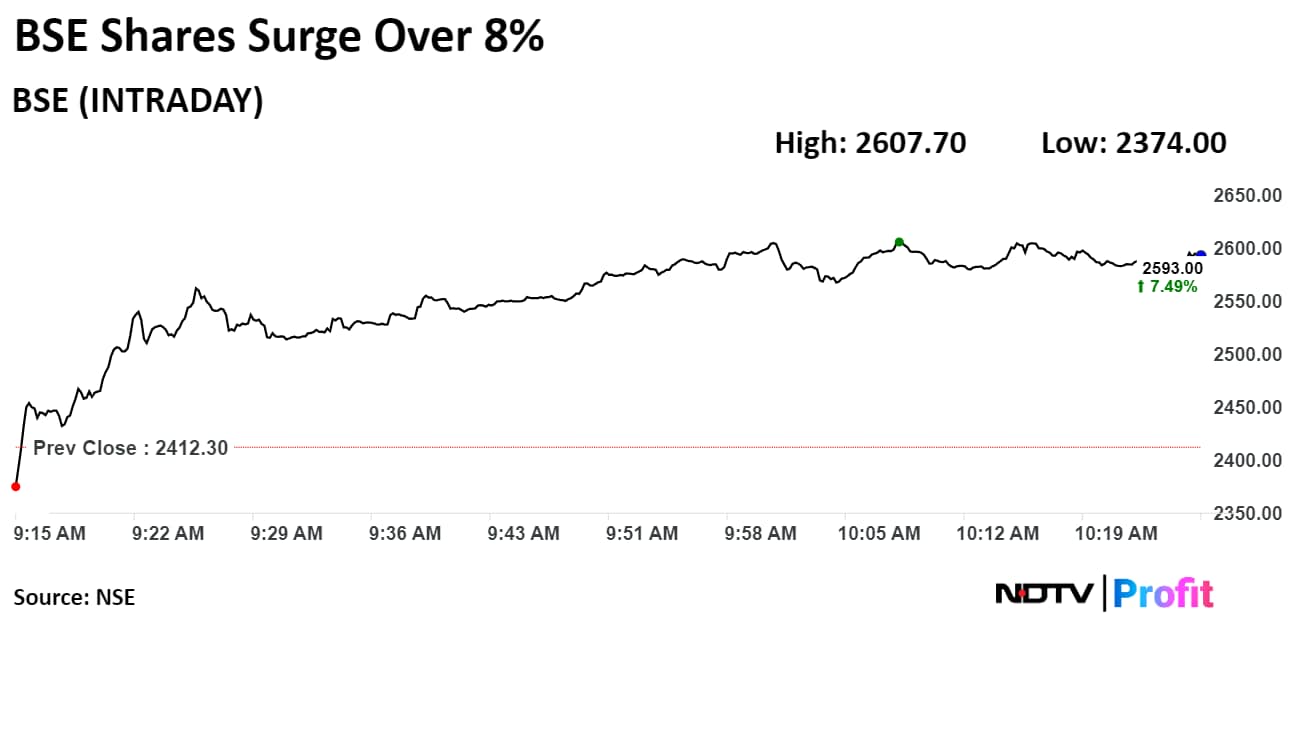

Shares of BSE Ltd. gained over 8% on Wednesday, as the stock exchange could potentially benefit from the latest market regulator proposals in the futures and options segment.

The Securities and Exchange Board of India has proposed new measures to ensure market stability in the booming derivatives market. It has mandated the upfront collection of option premiums from buyers by trading members and clearing members among other measures.

In another potential tweak, SEBI has proposed that the weekly options contracts be provided on a single benchmark index of an exchange.

This could benefit the oldest stock exchange, as the volumes from the higher weekly options contract on the National Stock Exchange could move to the BSE.

Jefferies sees a divergent impact on market players, with the most affected players being the exchanges and brokers with a focus on retail. The removal of the Bankex weekly contract can impact earnings per share by 7-9% over fiscal 2025–2027 for BSE, the note said.

Shares of BSE rose as much as 8.1% during the day to Rs 2,607.7 apiece on the NSE. It was trading 6.77% higher at Rs 2,575.6 apiece, compared to a 0.3% advance in the benchmark Nifty 50 as of 10:26 a.m.

The stock has risen 218% in the last 12 months and 16% on a year-to-date basis. The total traded volume so far in the day stood at 8.2 times its 30-day average. The relative strength index was at 60.

Four out of the eight analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and one suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.