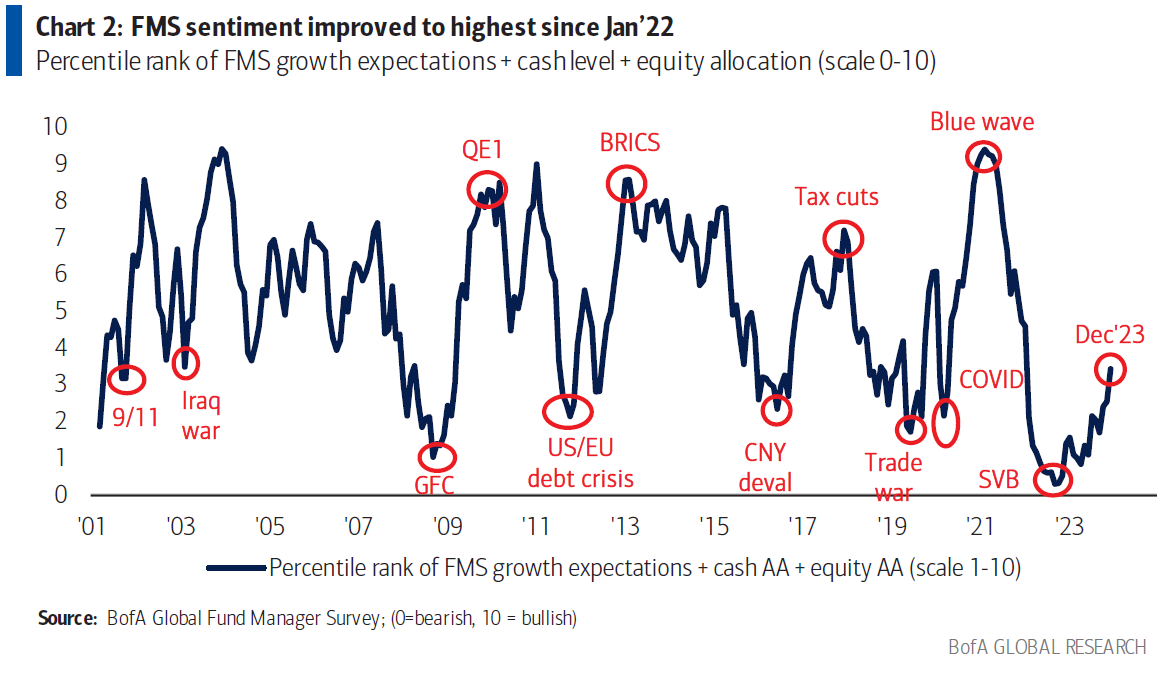

(Bloomberg) -- Investors are the most optimistic since the beginning of 2022 as expectations of policy easing by the Federal Reserve are fueling a rush into stocks, according to a Bank of America Corp. survey.

The sentiment of global fund managers surveyed in December was the most upbeat since January 2022 on a Goldilocks environment — a steady economy that is not running too hot or too cold — as the case for next year, a team of strategists led by Michael Hartnett wrote in Tuesday note.

Against that backdrop, the poll showed investors are the most overweight on stocks since before the Fed started to hike interest rates, with cash allocations cut to a two-year low of 4.5% from 4.7%. Meanwhile, fund managers are the most overweight on bonds in 15 years. They are also the most bearish on commodities relative to bonds since March 2009.

“Policy, not positioning,” is the new tactical driver of asset prices, Hartnett said.

The Fed's last meeting of 2023 fueled expectations of a dovish tilt with the likelihood of interest rate cuts next year. The S&P 500 is approaching a record high while the Nasdaq 100 already breached that level.

But even with the rally, Goldman Sachs Group Inc. said US equity funds received flows of only $95 billion through 2023 while money-market funds got more than a record $1 trillion. Investors are expected to use their cash holdings to fund equity allocations in 2024 as interest rates come down and inflation eases.

A net 91% of the BofA poll participants said hikes from the US central bank are over and expectations of lower rates along with bond yields are at a record high for this century. Bonds and technology are seen as the biggest winners from Fed cuts.

In terms of risks, investors are most wary of a hard landing — or a recession — in 2024. That said, a net 66% is anticipating a soft landing for the global economy over the next 12 months. Hartnett said the best hard landing contrarian trade is long cash and short the group of stocks called the “Magnificent Seven” such as Apple Inc.

The poll was conducted between Dec. 8 to Dec. 14, spanning 219 participants with $611 billion in assets under management. Other findings include:

- The outlook for profits are improving with only a net 26% expecting global earnings to deteriorate

- FMS investors turned overweight on banks for the first time since February while most underweight on energy since December 2020

- The most crowded trade is long magnificent seven, short China equities and long Japan equities

- A record 73% say the Japanese yen is undervalued

- China real estate is now the most likely source for a systemic credit event

--With assistance from Michael Msika.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.