(Bloomberg) -- BlackRock Inc., the world's biggest asset manager, is warning investors of the risk UK political parties will promise much greater spending in a bid to win this year's election, potentially sparking a revolt in the bond market.

While neither the Conservative nor Labour parties wants to put forward policies that could unnerve investors, that may change as the election draws near, said Vivek Paul, BlackRock's UK chief investment strategist. Spending proposals are likely to emerge as Prime Minister Rishi Sunak said last week he plans to call a UK election in the second half of the year.

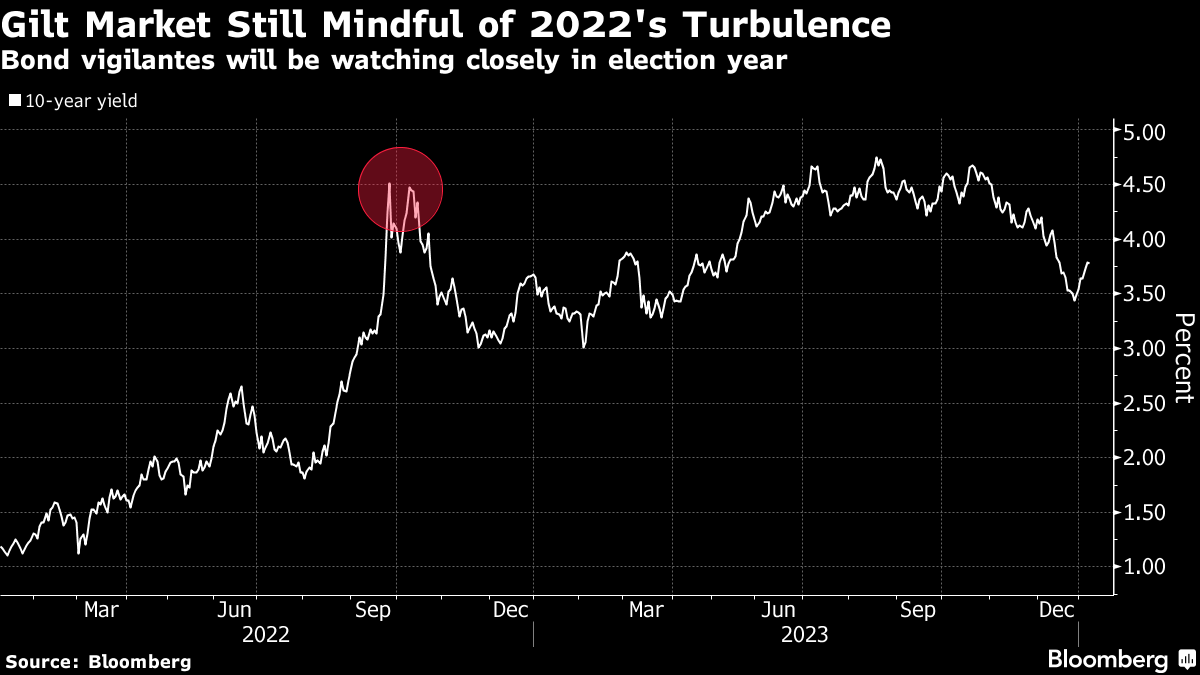

The importance of vigilantes — investors who sell bonds to protest against policies they consider inflationary — shot to the fore in the UK in 2022, when a promise of unfunded tax cuts roiled the country's financial markets, led then-prime minister Liz Truss to exit and forced the Bank of England to intervene. While her successor Sunak switched the government's focus to bringing down inflation, tax cuts are now back on the agenda.

“As inflation falls in the UK and we get closer to the general election date, major UK political parties may be more tempted to promise looser fiscal policy — the more this occurs, the greater the likelihood of the return of the bond vigilantes,” wrote Paul in response to questions from Bloomberg News. “In the lead-up to this year's UK election, we're watching the fiscal policy stance.”

Sunak's Chancellor of the Exchequer Jeremy Hunt has suggested falling debt interest costs may give headroom to deliver tax cuts at a budget in the spring, ahead of an election due by January 2025. Meanwhile Keir Starmer, leader of rival party Labour, has not denied reports he is considering tax cuts but has said the priority was to grow the economy first.

Read more: Hunt Says Lower UK Debt Interest May Give Room for Tax Cuts

With the country's inflation slowing, gilts have rallied in recent months as investors bet on the prospect of Bank of England interest-rate cuts in 2024. That marks a shift after a selloff starting in mid-2022, with the market value of Bloomberg's gilt and inflation-linked gilt indexes losing around £200 billion ($250 billion) in about a month during the turmoil.

“The shadow of the autumn 2022 UK gilt crisis still hangs over the pre-election debate so far,” Paul wrote.

A Markets Live Pulse survey in September showed 80% of 227 respondents said confidence in UK assets still hadn't fully recovered from that turmoil.

Neutral Positioning

BlackRock is now staying neutral on the UK's government bonds. It shifted its tactical gilt recommendation from overweight to neutral in December as “markets are beginning to price in a Bank of England policy rate path which is more in line with our expectations,” wrote Paul. Money markets now expect the BOE to cut rates by around 125 basis points this year.

The firm has made some good recent calls on bonds, including predicting late in 2022 that government bonds would do badly in 2023 while others were positioning for a stellar year. Chief Executive Officer Larry Fink doubled down on that in September, saying 10-year Treasury yields would top 5%, and they did the following month.

It is also neutral on the UK's stocks, even as a growing chorus of investors are becoming more upbeat on the country's assets and currency. While BlackRock sees company valuations as more attractive than US and European peers, it “struggles to identify a catalyst for an overweight to the broad UK market.”

Read more: Traders See Upside for UK Assets Despite Storms and Strikes

“UK economic growth has stagnated over the past year and remains well below its pre-pandemic trend,” Paul said. “The UK is facing some structural challenges: weaker productivity growth and a constrained labor supply.”

Given persistent inflation pressures, Paul warned that central banks, including the BOE, will no longer be able to help boost the economy the way they did before the pandemic.

“Even when rate cuts come, policy rates will still be at levels materially above the norm for the last decade,” he wrote. “That will leave growth materially lower.”

--With assistance from Alice Gledhill.

(Adds survey in 8th paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.