Biocon Ltd.'s unit has signed a pact with its partner Viatris Inc. to acquire its biosimilars business for up to $3.34 billion (about Rs 26,079 crore) in stock and cash.

Viatris will receive a cash consideration of $2 billion on closing of the deal and up to $335 million as additional payments expected to be paid in 2024, according to an exchange filing. Upon closing of the transaction, Biocon Biologics Ltd. will issue $1 billion of compulsorily convertible preference shares to Viatris, equivalent to an equity stake of at least 12.9% in the company, on a fully diluted basis.

The cash payment of $2 billion will be funded by $800 million raised through equity infusion in Biocon Biologics and the rest to be funded by debt, additional equity or a combination thereof, the filing said. “Biocon Biologics has received expressions of interest from financial institutions for debt financing and equity commitments from existing shareholders.”

Kiran Mazumdar-Shaw will continue as executive chairperson of Biocon Biologics. Viatris will designate Rajiv Malik, its president, to serve on Biocon Biologics' board.

Biocon Biologics currently has a portfolio of 20 biosimilars. The acquisition of Viatris' biosimilars assets, according to the filing, “strengthens its position in providing affordable access to patients through its portfolio in diabetes, oncology, immunology and other non-communicable diseases”.

Mazumdar-Shaw, in the filing said, this “strategic combination brings together the complementary capabilities and strengths of both partners and prepares us for the next decade of value creation for all our stakeholders”.

In a media meet later in the day, she said:

Biocon Biologics expected to go for an IPO in the next two years.

The deal is set to create one of the largest biosimilars players in the world.

Markets need to understand the transformational nature of the deal.

Opportunities arising out of the deal are likely to be visible from 2023.

Expect the biologics business IPO to be at a very attractive level.

Biocon is very comfortable with the debt taken on.

Debt will be paid back within five years.

Other Key Transaction Highlights

The transaction is expected to close in second half of 2022, subject to closing conditions.

The companies will also enter into a transition services agreement, pursuant to which Viatris will provide certain transition services, including commercialisation services, for an expected two-year period.

Viatris also will pay $50 million to Biocon Biologics to fund certain capital expenditures.

Viatris was formed in November 2020, through the combination of Mylan and Upjohn (a unit of Pfizer earlier). It has a global biosimilars franchise with 150 marketing authorisations in over 85 countries with focus on oncology, immunology, endocrinology, ophthalmology and dermatology.

The deal—value accretive to Biocon—enables it to create fully integrated biosimilars enterprise.

After the deal, Biocon Biologics will realise full revenue and associated profits from its partnered products, a step-up from its existing arrangement with Viatris.

Biocon Biologics will gain Viatris' global biosimilars business whose revenue is estimated to be $1 billion next year, along with its portfolio of in-licensed biosimilar assets.

The deal will expand Biocon Biologics' Ebitda base and strengthen overall financials, enabling investments for sustained long-term growth.

It's likely to accelerate the global reach of Biocon in developed markets and improve its brand presence in the U.S., Europe, Canada, Japan, Australia and New Zealand.

By integrating Viatris' portfolio, Biocon Biologics will have—comprehensive biosimilar insulin portfolio, a growing biosimilars oncology portfolio and a growing presence in autoimmune segment.

Allegro Capital served as the financial adviser to Biocon Biologics, while Goodwin Procter and Shardul Amarchand Mangaldas were the company's legal advisers to this transaction.

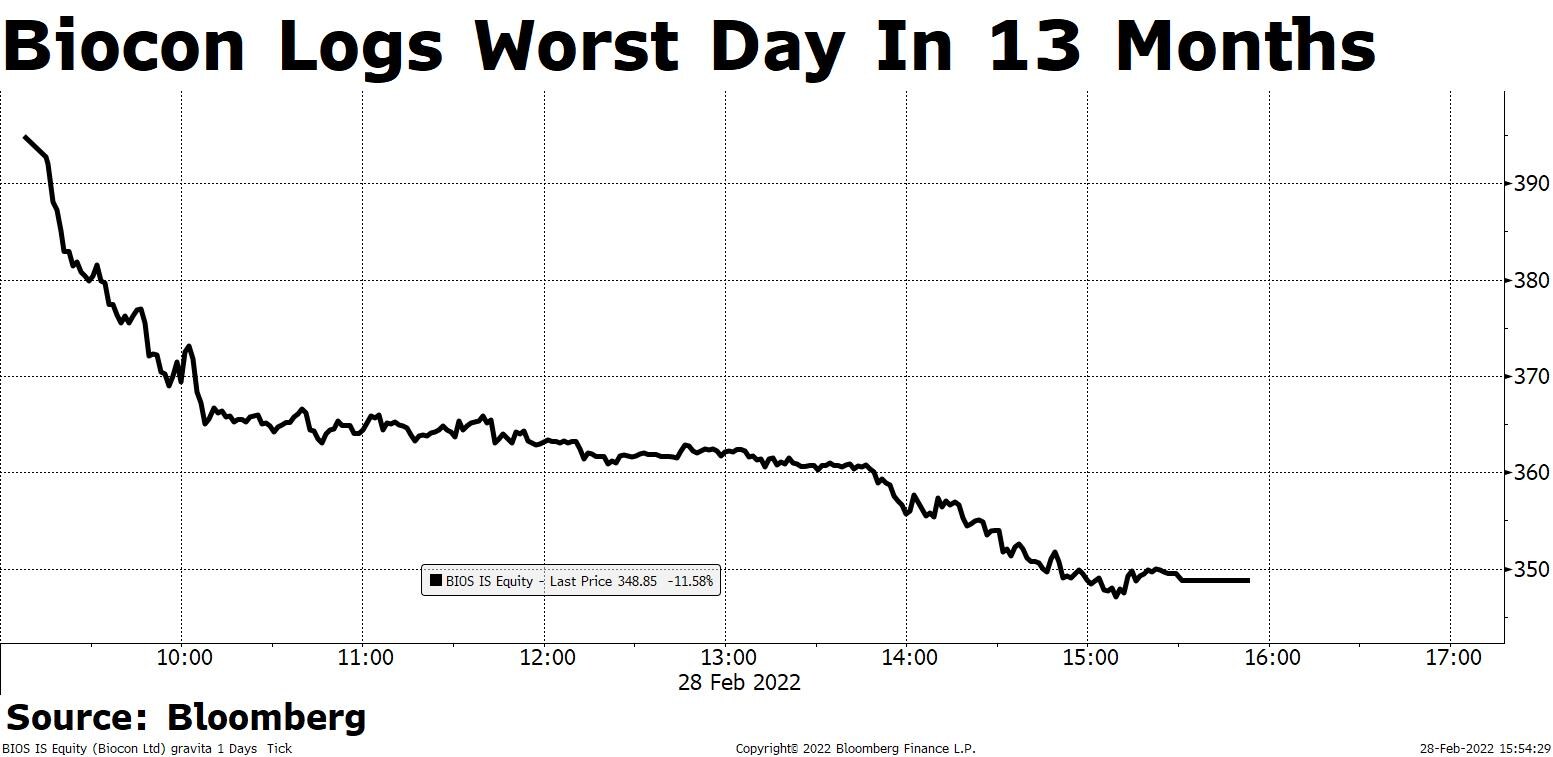

Shares of Biocon fell over 12% intraday, the most in 13 months, on Monday. Trading volume on the stock was over five times the 30-day average volume at close.

The shares fell below the 50-day simple moving average and 200-day simple moving average, indicating potential downward price momentum.

Of the 21 analysts tracking Biocon, 10 maintain a ‘buy', six recommend a ‘hold' and five suggest a ‘sell', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.