Bharti Airtel Ltd.'s stock received a target price hike from Jefferies on expectations of a better competitive advantage and likely telecom tariff hikes in the next two years that will boost earnings.

The firm maintained 'buy' rating on the stock and increased the target price from Rs 1,760 to Rs 1,970, implying a potential upside of 20.5% on the previous close.

"Jio's rising focus on growth and VIL's (Vodafone Idea Ltd) continued market share loss may lead to a need for multiple tariff hikes over the next few years," Jefferies said in a note on Friday.

It projects a 10% tariff hike each in the second quarters of fiscal 2026 and 2027 and thereby expects Bharti Airtel to deliver 17% and 19% compounded annual growth in India revenues and operating profit (Ebitda) over the next three years. Further, it expects Bharti Airtel deleveraging by $9.5 billion over the next two years and support stock returns.

Reliance Jio's growth target announced during its annual general meeting last month may require multiple tariff hikes and the telco's recent lead to raise prices indicate step in this direction, Jefferies said.

Moreover, while Vodafone Idea's recent capital raise may help to maintain its market share, recent data shows that its revenue market share has declined further in the first quarter to 15.5%.

By the time the Aditya Birla Group telco completes network investments, it may see further decline in market share and therefore require more tariff hikes to bridge the gap between cashflows and dues payable, Jefferies said.

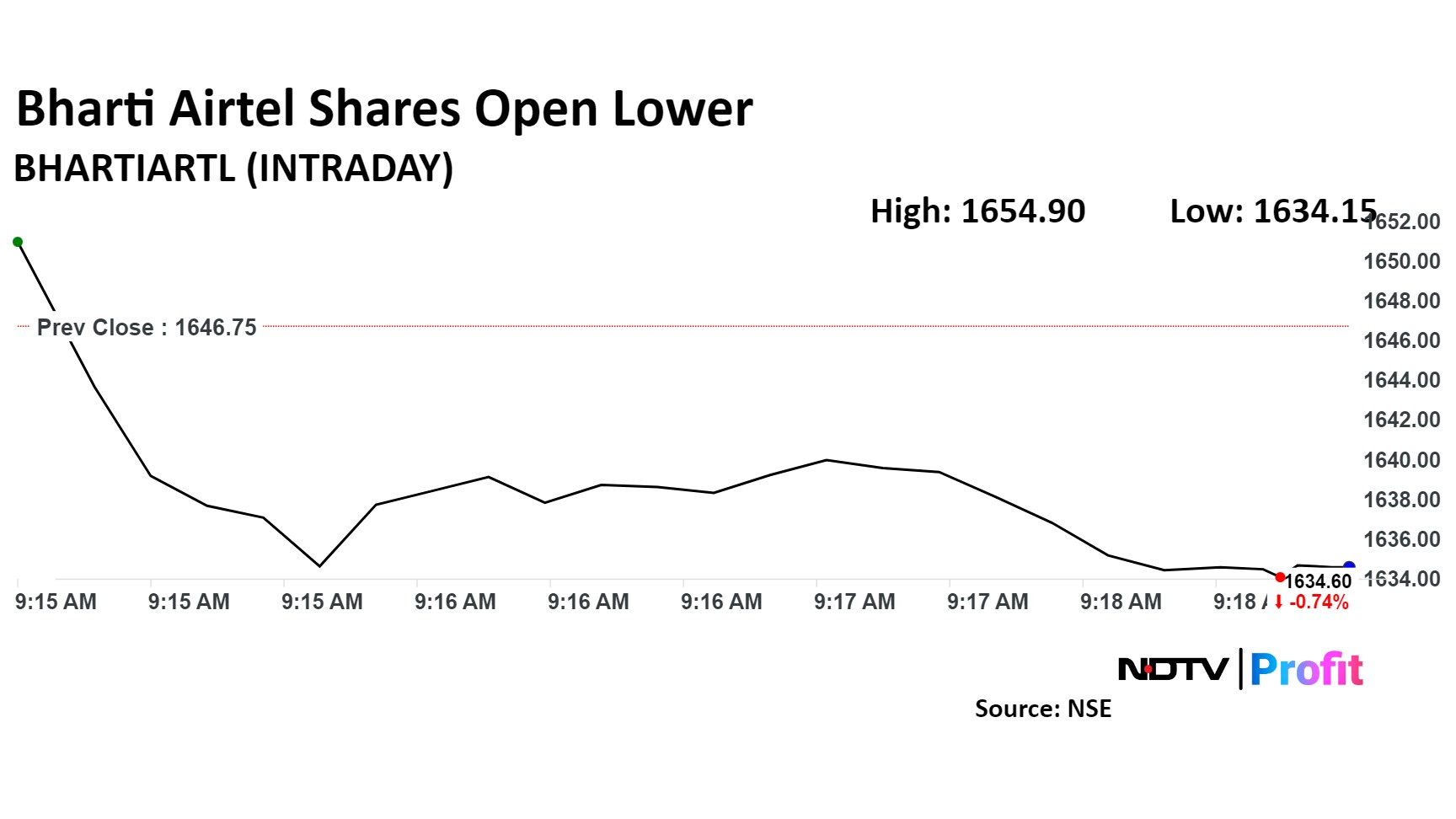

Shares of Bharti Airtel declined 0.8% soon after market open to Rs 1,633.1 apiece. The benchmark NSE Nifty 50 opened 0.16% higher.

It has risen 80% in the last 12 months and 62% on a year-to-date basis. The relative strength index was at 72.

Twenty four out of the 33 analysts tracking Bharti Airtel have a 'buy' rating on the stock, seven recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.