.jpg?downsize=773:435)

Shares of Bharti Airtel Ltd. fell over 3% on Tuesday after the telecom giant reported a 12% sequential drop in its consolidated net profit for the second quarter of the current financial year, missing analysts' expectations.

In an exchange filing on Monday, Airtel disclosed a consolidated net profit of Rs 4,153 crore for the July–September period, down from Rs 4,159 crore in the previous quarter. Analysts tracked by Bloomberg had anticipated a profit of Rs 4,398 crore.

Despite the profit decline, Airtel's revenue rose by 8% to Rs 41,473.3 crore, surpassing the Bloomberg estimate of Rs 41,256 crore. Operating profit increased by 9% to Rs 21,846.2 crore, also exceeding expectations. The company's margin improved to 52.7%, up from 51.6% in the prior quarter.

However, the report included an exceptional loss of Rs 854 crore compared to an exceptional gain of Rs 735 crore in the previous quarter. Average revenue per user climbed to Rs 233, up from Rs 211, reflecting positive customer engagement.

In efforts to enhance network connectivity, Airtel rolled out an additional 5,000 towers and 15,200 mobile broadband stations during the quarter. Furthermore, the company launched India's first AI-powered spam detection solution, which will automatically alert customers about suspected spam calls and messages at no extra cost.

Airtel also announced a partnership with Apple, providing exclusive offers for Apple TV+ and Apple Music to its customers in India, aiming to bolster its service offerings amidst increasing competition.

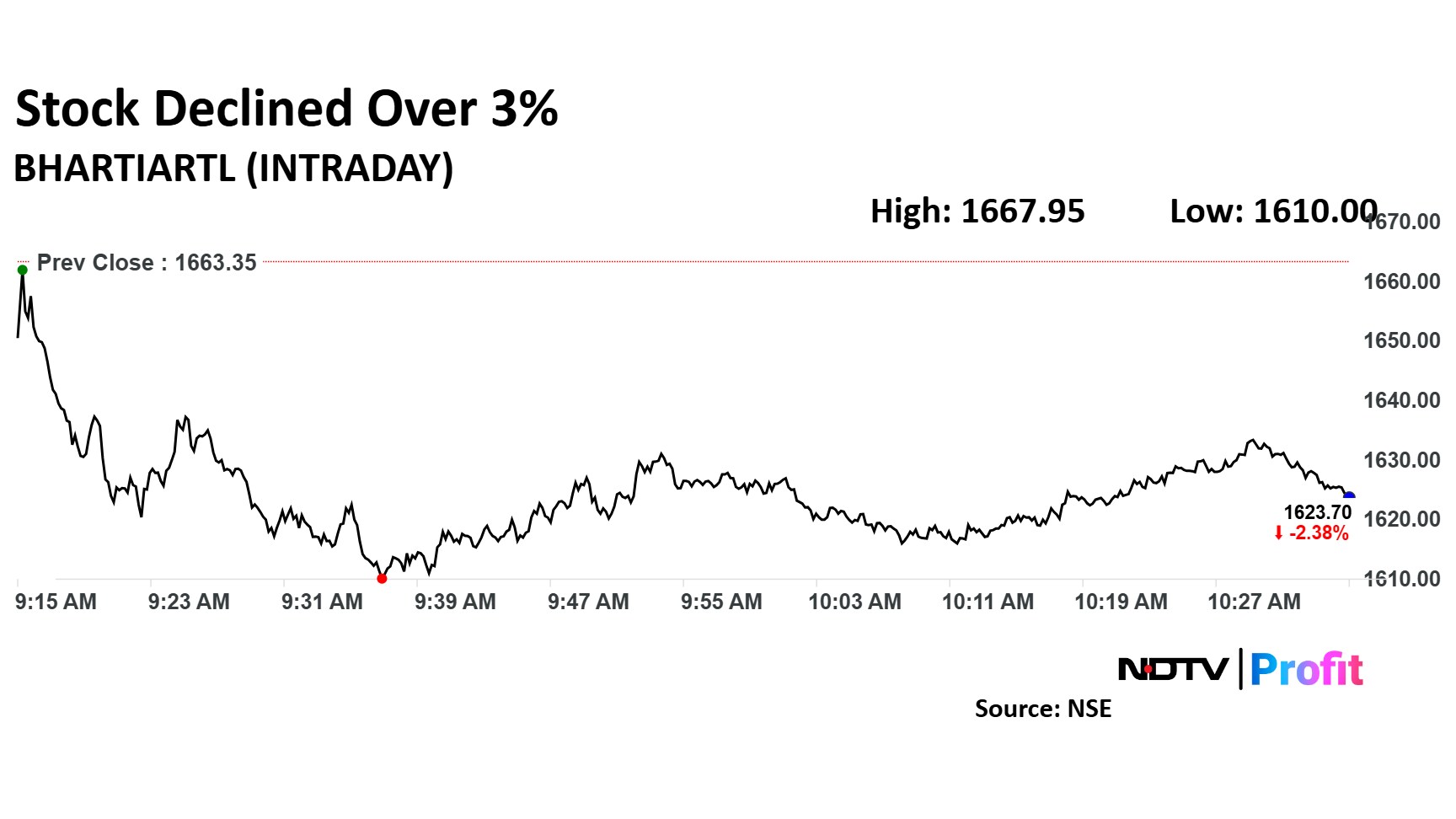

The scrip fell as much as 3.21% to Rs 1,610 apiece. It pared losses to trade 2% lower at Rs 1,630.10 apiece, as of 10:32 a.m. This compares to a 0.62% decline in the NSE Nifty 50 Index.

It has risen 75% in the last 12 months. Total traded volume so far in the day stood at 0.84 times its 30-day average. The relative strength index was at 38.9.

Out of 33 analysts tracking the company, 26 maintain a 'buy' rating, five recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.