Bharti Airtel Ltd.'s effective premiumisation is yielding results and the focused strategy of capital expenditure leading to market share gains, according to brokerages.

The growth in the telecom firm's India mobile business revenue and the earnings before interest, taxes, depreciation and amortisation have been led by improving subscriber mix, according to Morgan Stanley.

The average revenue per user rose higher than the Street's expectations, while Bharti Airtel's net profit increased 37% sequentially to Rs 2,876.4 crore in the quarter ended December, according to an exchange filing on Monday, meeting the consensus estimate of Rs 2,855 crore by analysts polled by Bloomberg.

Airtel Q3 FY24 Earnings Highlights (QoQ)

Revenue up 2.3% to Rs 37,899.5 crore (Bloomberg estimate: Rs 38,338.1 crore).

Operating profit up 1.54% at Rs 19,814.8 crore (Bloomberg estimate: Rs 20,000 crore).

Margin at 52.28% vs 52.67%

Average revenue per user, or ARPU, rose to Rs 208 vs Rs 203.

Here's What Brokerages Say On Airtel Earnings

Citi Research

Citi reiterates 'buy' rating on the stock with a target price of Rs 1,270 apiece.

The sequential growth of 3.3% and 3.7% in India mobile revenue and Ebitda respectively beat estimates by 1.1% and 1.3%

The ARPU rose from Rs 203 to Rs 208 sequentially, above the estimate of Rs 205.

Solid execution and effective premiumisation yielding results.

Focused strategy of capital expenditure leading to market share gains, robust free cashflow generation, and balance sheet deleveraging, with the capex also set to decline from the next fiscal.

Expects a 15% tariff hike in 4G from mid 2024.

Valuations at 9 times 1-year forward EV/Ebitda at premium to its historical mean, these are still at mean levels relative to the broader Indian market.

Morgan Stanley

Equal-weight rating on Airtel with a target price of Rs 1,015 apiece.

Beat in India mobile business revenues and Ebitda led by improving subscriber mix

Capex was stable sequentially and surprised positively.

Consolidated reported net debt came down sequentially to Rs 2,021 billion.

Enterprise business saw moderation in revenue growth at 8.7% year-on-year vs 9.5% YoY in the second quarter and Ebitda margin for the segment was lower at 39.7%.

Revenue growth traction in digital TV services was good. However, the company reported a decline in Ebitda margin at 54.7%, which could be a reflection of investments in the business.

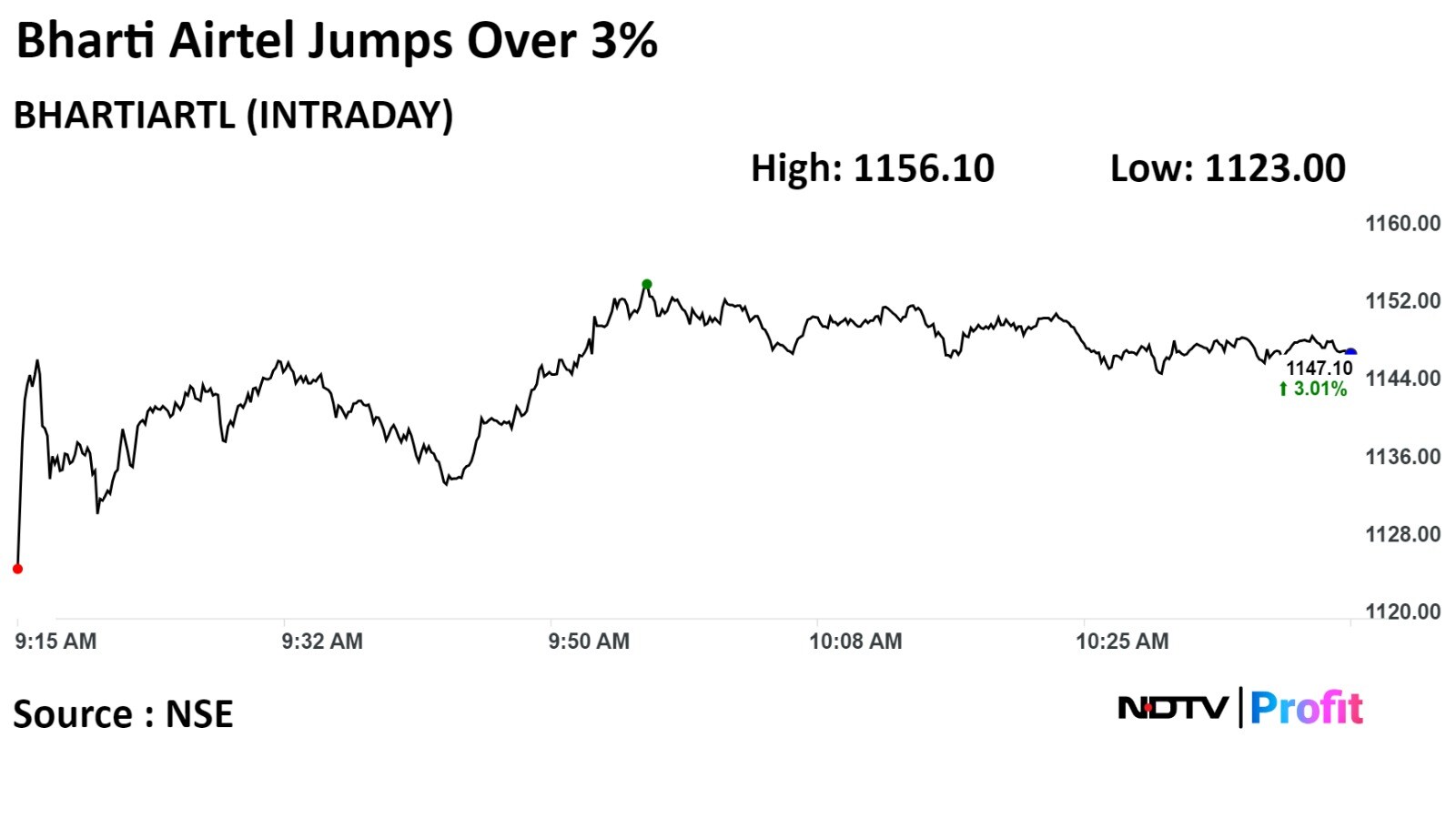

Shares of Bharti Airtel rose as much as 3.82% during the day to Rs 1,156.10 apiece on the NSE. It was trading 3.13% higher at Rs 1,148.35 per share, compared to a 0.17% advance in benchmark Nifty 50 at 10:41 a.m.

Twenty-three out of the 31 analysts tracking Airtel have a 'buy' rating on the stock, seven recommend 'hold' and one suggests a 'sell', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.